- Li-FT Power (LIFT) has signed an option agreement with a private company over 14 mineral leases

- The option agreement grants Li-FT the sole and exclusive right to acquire a 100-per-cent interest in the property

- To exercise the option, Li-FT must make cash payments totalling $3,000,000 and incur exploration expenditures on the property over a two-year period

- Li-FT is a mineral exploration company engaged in the acquisition, exploration, and development of lithium pegmatite projects located in Canada

- Li-FT Power Ltd. (LIFT) opened trading at C$9.97

Li-FT Power (LIFT) has signed an option agreement with a private company over 14 mineral leases.

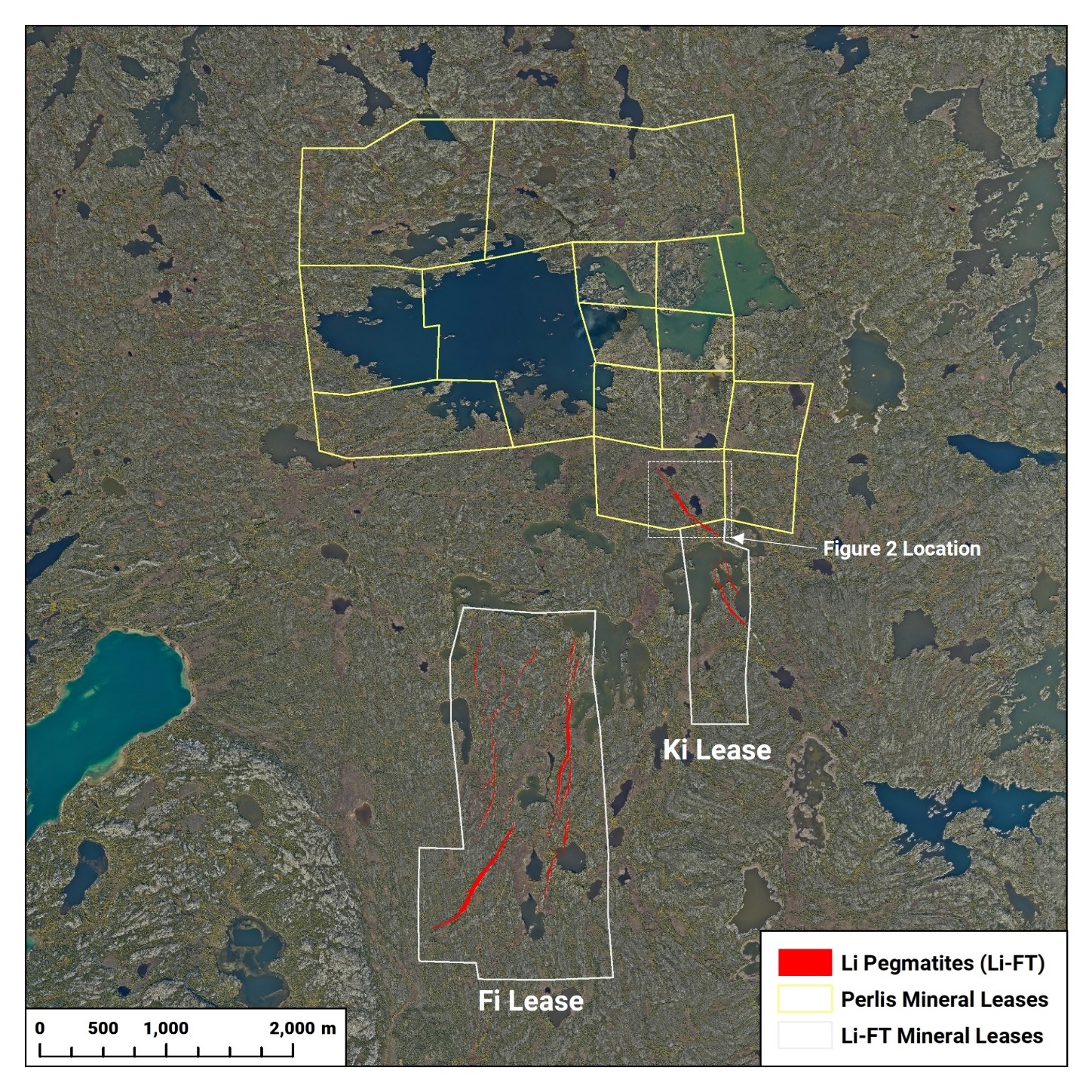

The private company holds a 100-per-cent interest in 13 mineral leases, which span 991 hectares and comprise the Thompson-Lundmark Project, as well as one lease, which covers 115 hectares to the north of the property.

The option agreement grants Li-FT the sole and exclusive right to acquire a 100-per-cent interest in the property.

To exercise the option, Li-FT must make cash payments totalling $3,000,000 and incur exploration expenditures on the property over a two-year period.

The Thompson-Lundmark Property is contiguous with Li-FT’s Ki mineral lease that hosts the Ki lithium pegmatite occurrence, part of Li-FT’s Yellowknife Lithium Project (YLP), in the Northwest Territories.

The lithium pegmatite dykes exposed on the Thompson-Lundmark Property have widths on surface up to 25 metres and are on strike with Li-FT’s Ki lithium pegmatite that has reported an intersect of 13 metres at 1.80 per cent Li2O in a single diamond drill hole from the 1970s.

Outcrops of the Ki pegmatite within the Ki lease have been described to contain 15 to 20% spodumene content approximately 40 metres from the property boundary.

The dykes add 600 meters of strike length to the Ki pegmatite system for a total of 1.5 kilometres which will be one of the targets for systematic follow-up drilling commencing in the next months.

“Securing the Thompson-Lundmark Property is an accretive transaction for Li-FT and increases the strike length of the Ki pegmatite system to 1,500 metres,” said Francis MacDonald, CEO of Li-FT.

“With maximum widths of 25 metres, we believe the Ki pegmatite has the potential to host a significant stand-alone lithium resource, but its proximity to the Fi Main and Fi Southwest dykes is favourable to establishing a centre of mass for the road-accessible group of lithium pegmatites within our Yellowknife Lithium Project,” he added.

Upon the exercise of the option, the company will grant a 1.5-per-cent net smelter returns royalty on the property to Perlis.

Li-FT is a mineral exploration company engaged in the acquisition, exploration, and development of lithium pegmatite projects located in Canada.

Li-FT Power Ltd. (LIFT) opened trading at C$9.97.