Certain companies are destined to usher their industries into the future through innovation and the continual improvement of their customers’ lives.

The Market Herald Canada’s Leading Edge introduces you to those companies with a focus on how business is evolving toward the interests of society.

Next up: PyroGenesis (PYR).

Origins

Montreal-based PyroGenesis was founded in 1991 to pursue the design, development, manufacturing and commercialization of advanced plasma processes.

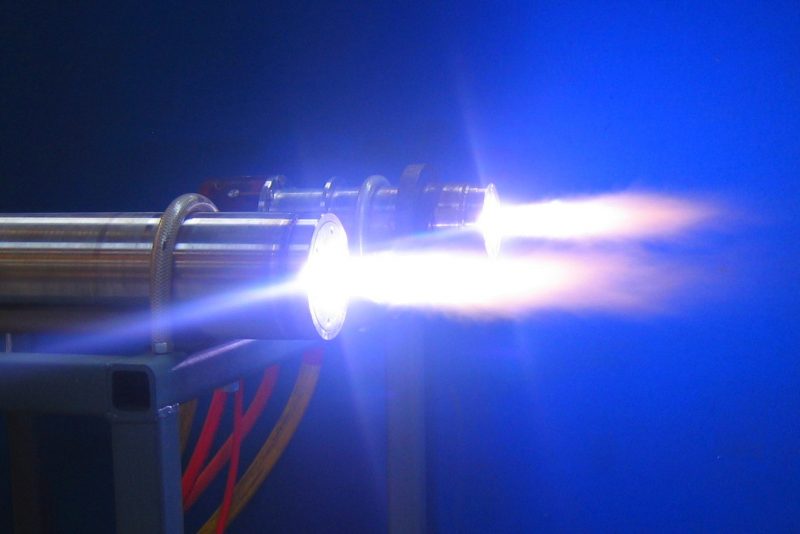

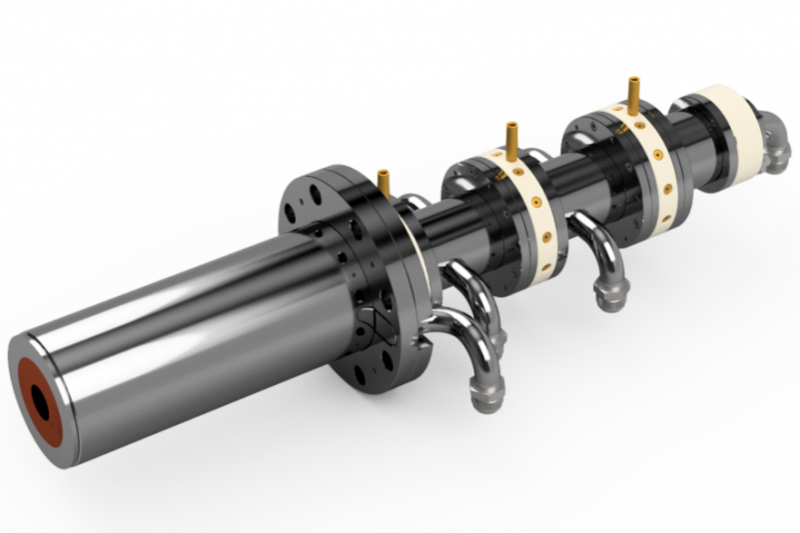

‘Plasma’ here refers to electric plasma torches, which the company offers five of to tackle a wide-ranging selection of industrial problems, including refrigerant destruction, waste disposal and waste recycling. The company also offers a handful of proprietary systems geared toward industrial emissions reduction, with the sector accounting for more than 30 per cent on a global scale.

PyroGenesis’ business is broken up into the following divisions:

Plasma-atomized metal powders

PyroGenesis Additive, a division of PyroGenesis Canada, produces plasma-atomized spherical metallic powders, which are highly in demand in the additive manufacturing, aerospace, biomedical, thermal spray, and metal injection molding industries.

PyroGenesis Additive can control particle size distribution and produce any size cut to meet customer needs, thus significantly reducing end-user costs.

DROSRITE

PyroGenesis’ DROSRITE system enables a salt-free, cost-effective process to maximize aluminum, zinc and copper recovery from dross, a waste generated in the metallurgical industry.

The patent-pending process avoids metal losses, including 98 per cent aluminum recovery, which is 20 per cent higher than rotary salt furnaces. It also reduces a smelter’s carbon footprint through 100-per-cent recyclable non-hazardous residues, which are accretive to return on investment.

Waste management

The company has created a line of five systems to handle waste management regardless of scale.

- Plasma Resource Recovery System: A solution that harnesses plasma to convert 1-10 metric tons per day of industrial, municipal and defense sector waste to clean energy (electricity, steam, hot water, liquid fuels) and marketable construction materials

- Plasma Arc Waste Destruction System: The world’s most compact, high-temperature, plasma-based waste treatment system for remote communities and camps. The land-based system operates at 200 kg/hour for up to 24 hours and generates excess heat for buildings or greenhouses. A ship-based version is also available

- Steam Plasma Arc (SPARC) System: A patented process for the complete destruction of ozone-depleting substances and other environmentally noxious chemicals – CFC, HCFC, HFC, PFC – which are fully cracked and eliminated using high-temperature steam plasma at a rate of 50 kg/hour

- Plasma Arc Chemical Warfare Agent Destruction System: This innovation facilitates the destruction of chemical warfare agents with over 99.9999 per cent efficiency without hazardous by-products. The system can handle up to 2 barrels per day with set up and disassembly in only 2 hours

- Plasma Arc Gasification and Vitrification System (PAGV): The PAGV converts incinerator ash, asbestos and other hazardous inorganic material to an inert slag that functions as construction material for asphalt, flooring and even jewelry. The system is available in capacities of 1 to 250 metric tons per day

In-house innovation

True to the series’ name, PyroGenesis also houses a division specifically for leading-edge processes on the frontier of clean energy innovation.

These processes include the patent-pending PUREVAP reactor, in partnership with HPQ Silicon (TSXV:HPQ), which utilizes a plasma arc within a vacuum furnace to produce high-purity, metallurgical-grade silicon and solar-grade silicon from quartz. The one-step process entails lower costs and carbon emissions compared to current practices.

Silicon is a strategic material for global decarbonization, given its uses in semiconductors, computer chips, solar power cells and electric batteries. That said, the element does not exist in its pure state, while environmentally damaging and capital-intensive production methods are hindering reliable supply. PyroGenesis’ PUREVAP reactor aims to address precisely that need.

Additionally, the company’s Plasma Fired Steam Generator uses contaminated water to generate steam for steam-assisted gravity drainage in the oil and gas industry. The portable system reduces the need for steam pipelines and uses only electrical power, as is the case for all PyroGenesis torches.

The company is also progressing with a patent-pending process that converts methane into hydrogen with zero carbon emissions. Compare this to steam methane reforming, the conventional hydrogen production method, which releases almost 10 kg of carbon dioxide for every 1 kg of hydrogen produced.

PyroGenesis puts its products into practice through engineering and manufacturing consulting, contract research, and turnkey process equipment packages, with an enviable list of clients to date such as the U.S. Navy, a major international iron ore producer, a global aerospace company, a European chemical and energy conglomerate, and a major Canadian refrigerator recycler.

The company’s enduring focus on technological development has led it into promising ventures at the forefront of emissions reduction, global electrification and environmental stewardship, which, given their massive potential scale, offer investors a tangible opportunity at exponential long-term returns.

Differentiator

PyroGenesis’ value proposition lies in its diversified solutions, whose global applicability coincides with the ongoing rise in ESG awareness. To paint a picture of the company’s addressable market, let’s consider some third-party projections relating to its target industries.

Plasma-atomized metal powders

According to Polaris Market Research, the global metal powder market was valued at US$6.27 billion in 2021 and is expected to grow at a CAGR of 7 per cent until 2030.

Waste management

According to Fortune Business Insights, the global industrial waste management market reached US$961.96 billion in 2021. It’s expected to grow from US$1,004.38 billion in 2022 to US$1,473.95 billion by 2029 at a CAGR of 5.6 per cent.

Silicon

According to Allied Market Research, the global silicon metal market was valued at US$6.3 billion in 2019, with growth projected to reach US$8.9 billion by 2027 at a CAGR of 5.5 per cent.

Aluminum

Aluminum is the world’s second-most used metal after steel, with Fortune Business Insights predicting that the global aluminum market will grow from US$168.84 billion in 2022 to US$255.91 billion in 2029 at a CAGR of 6.1 per cent.

Hydrogen

Finally, according to Grand View Research, the global hydrogen generation market reached US$129.85 billion in 2021 and will grow at a CAGR of 6.4 per cent from 2022 to 2030.

Some quick math brings our rough outline of PyroGenesis’ addressable market to around US$1.2 trillion, an astounding number that would grant the company mega-cap status should all of its innovations experience mass adoption. While this rosy outcome should not be taken at face value, given the future’s inherent uncertainty, it does point to the vastness of the company’s ambitions, which would result in unparalleled success should only a fraction of them come to pass.

Potential investors should then balance the company’s ultimate goal – to become a global leader in keeping industrial emissions on the path to net zero – with the developmental stage of its silicon and hydrogen technologies, as well as the current state of its revenue-producing metallic powder, DROSS and waste management divisions as revealed by financial results.

Finances

The blue-sky nature of PyroGenesis’ product lineup must outshine its loss-making ways to merit a place in your portfolio.

While the company managed to produce C$41.77 million in net income in 2020, it has only registered positive net income in one of the last five quarters, with the lone gain coming it at a paltry C$620,000 in the quarter ending September 2021.

Additionally, it generated positive operating cash flow in only one out of the last five quarters, achieving a C$590,000 gain in the quarter ended September 2022, including C$490,000 in free cash flow.

This level of unpredictability is part and parcel with venture-stage, growth-driven companies whose globally relevant products and noteworthy clients have yet to result in wider recognition. PyroGenesis’ products in the marketplace are not yet able to fund ongoing research while maintaining profitability. The company has pockets of profitability, which are encouraging, but also indicative of the reality that more pain will have to be endured in the short term before its emissions-reduction capabilities translate into non-dilutive growth.

To put this pain into context, PYR stock is down 89 per cent from its 2021 high, with 40 per cent of that loss occurring over the past year, despite no internal catastrophe to merit such a precipitous fall. While market-wide, inflation-induced pessimism is largely to blame, recent shareholders will need convictions of steel to hold on or average down.

Prospective investors will need similarly optimistic projections for PyroGenesis’ technology and its 46-per-cent insider ownership, given how ESG considerations are now table stakes in the corporate world and the source of exponential competition growth. That said, there is a margin of safety in the current entry point price – an over 10-year low – which is attractive when considered alongside the shareholder value implied by the company’s cross-industry relevance and the fact that investors since that low are sitting on approximately even money.

On the horizon

One reason PyroGenesis has yet to achieve mainstream investor recognition is that it’s a boring company, a concept certain investors will recognize as a sign of value dislocations due to choppy volume and/or lack of analyst coverage.

Part of this boredom is due to PyroGenesis’ growing reputation as the go-to for process improvements with the waste of heavy industry, where the level of excitement doesn’t compare to more headline-friendly tech like AI and electric vehicles.

Additionally, the company’s just over C$200 million market cap is too small to command much institutional capital since a sizeable allocation would entail management responsibilities most firms are not willing to undertake.

The likely catalyst to unleashing herd mentality, and with it shareholder value, is consistent evidence of cash generation stemming from entrenched market share. On the path to this scenario, interested investors should be alert to:

- The revelation of client names upon reaching the commercialization stage of existing agreements

- Enhanced revenue runways through validation of company technology in new industries

- The economical scaling of research in silicon, hydrogen and other divisional innovations as they arise

As an active driver toward a greener world, PyroGenesis‘ success is positively correlated with the health of the planet, a relationship that should serve to line its coffers as more consumers demand industrial sustainability. With investor pessimism at a high, the time is now to conduct thorough due diligence in line with your financial plan.