Certain companies are destined to usher their industries into the future through innovation and the continual improvement of their customers’ lives.

The Market Herald Canada’s Leading Edge introduces you to those companies with a focus on how business is evolving toward the interests of society.

Next up: good natured Products (GDNP).

Origins

good natured Products is dedicated to manufacturing sustainable packaging, general merchandise and commercial supplies with less fossil fuel and no chemicals of concern that match or exceed the performance of petroleum-based options.

It offers over 400 products and services through wholesale, direct-to-business and retail channels, with each SKU designed to maximize plant-based materials and minimize its impact on the environment.

Every SKU that comes in contact with food complies with safety and environmental health regulations from design to disposal. All resins, additives, colorants and coatings used are approved for food-grade applications under FDA regulations.

All safety assessments are also in accordance with regulations, including Reduction of Toxins in Packaging, the Clean Air Act, Restriction of Hazardous Substances, and California’s Safe Drinking Water and Toxic Enforcement Act.

good natured currently serves over 1,200 B2B customers in Canada and all 50 U.S. states, with manufacturing facilities in Ontario and Illinois. Its insourced supply chain includes 150,000 sq. ft. of manufacturing floor space with capacity to extrude over 60 million lbs.

The company represents one of the few active solutions to how every conventional petroleum-based plastic ever produced still exists in some form (Greenpeace, 2017). As of April 2022, it has displaced 11.5 million lbs. of petroleum-based plastics and counting.

Differentiator

good natured stands out in the eco-friendly consumer products space by maintaining a realistic approach to bettering the planet. This means it balances usability with sustainability to offer products that live on the cutting edge of environmental stewardship without sacrificing commercial viability. This way, customers can gradually transition to greener options as the company adopts more efficient technologies.

In practice, its use of plant-based materials will fall below 100-per-cent when extra durability and/or colour are required, with certain FDA-approved additives accounting for the reduction. To this end, it offers products made from feedstock-based fibre, bio-based plastics or closed-loop biodegradable polymers, depending on a customer’s ESG commitments.

Backed by flexible and exclusive ingredient and supply chain agreements – including ten manufacturing and sourcing locations in North America – good natured is strategically positioned to grow within the global US$1 trillion packaging market as petroleum-based products cede their dominance to materials more in line with human longevity.

This shift is playing out through bans on chemicals of concern, nonrenewable materials and single-use disposables, and growing ESG awareness spearheaded by public figures such as Larry Fink, BlackRock’s Chairman and CEO, whose landmark 2018 letter argued that financial performance, as well as positive contributions to society, will determine long-term business success moving forward.

The U.S. sustainable CPG market is estimated at US$400 billion annually (Consumer Brands Association, 2019), which amounts to 20 per cent of the country’s overall CPG market. Within this segment, food and beverage packaged goods are a key demand driver expected to grow at 10.7-per-cent annually until 2027 (Emergen Research, 2020).

Let’s now examine the company’s product categories to understand its market entry points in greater detail.

Food containers and packaging

good natured’s food packaging uses a base of either PLA(1) or Bio-PET(2) made from feedstocks of sustainable and rapidly renewable corn starch(4) and sugarcane. Besides being 97 to 99-per-cent plant-based, it is tested according to ASTM D6400(3) to break down within 180 days in an industrial compost facility.

All of its compostable products are also independently certified by the Biodegradable Products Institute and/or the Compost Manufacturing Alliance, including a clearly labelled percentage of plant-based material. Here are some examples:

The company’s compostable containers, plates and bowls are made from bagasse, a sugarcane waste by-product, while its cups are made from Sustainable Forestry Initiative paperboard.

When it comes to clear plant-based food packaging, it boasts up to 50 per cent recycled content, mostly from post-industrial trim from in-house production.

Finally, its microwavable to-go containers are made from CPLA(5), which is able to withstand temperatures of up to 100°C.

Industrial products

good natured is one of only a handful of extruders of certified compostable rigid thermoplastic sheet and the only supplier of Bio-PET thin-gauge roll stock locally made in North America.

Its plant-based extruded sheet is available in two material families and several distinct grades for various applications. Its compostable PLA roll stock works on standard thermoforming equipment with minimal adjustments. Its curbside-recyclable Bio-PET roll stock processes, forms, and performs identically to traditional PET with up to 30-per-cent renewable plant-based content.

The company also manufactures pallet stretch wrap designed for both hand and machine applications with strong puncture resistance and solid pallet stability. The product delivers reliable transparency for quality assurance and easy bar code scanning and can be recycled along with traditional #4 LDPE.

For custom projects, good natured offers polymer engineering services backed by in-house bio-based resin recipes for injection-molded parts or drop-in replacements for PET or recycled PET food packaging.

Home and business

In the home and business category, good natured’s line of bins, totes, crates, bin bags and food storage bags made from renewable sugarcane allows you to get on with your day while doing your part for Mother Nature.

Its recycling bins are 90-per-cent plant-based and include different sizes customized to everything from desktop to curbside use.

Its bin bags come in at 56-per-cent plant-based with an easy close-and-carry drawstring and three-way leak resistance, puncture resistance and tear resistance.

Additionally, its line of freezer and sandwich bags are 69-per-cent plant-based and resealable for maximum convenience.

Through these diversified offerings, good natured facilitates the decision to make sustainability a priority without hindering your bottom line. While prices are higher compared to popular brands like Glad or Ziploc, they are reasonable given the sector’s high fragmentation – the largest company in the space has a US$23 billion market cap with only a 3-per-cent market share. The company is also constantly looking for more economical feedstocks from fringe crops, agricultural waste and micro-organisms to remain competitive in the marketplace.

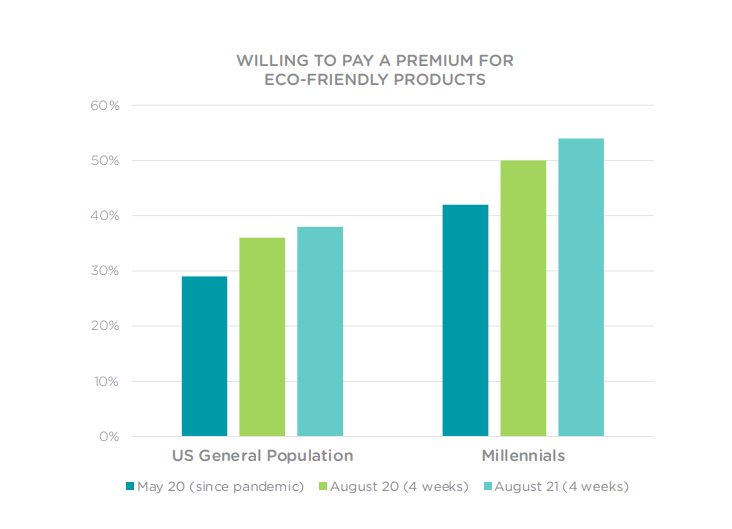

It is also worth noting that a growing percentage of consumers are willing to pay a premium to satisfy their environmental values (Meta for Business, 2022), which is likely to serve as a bridge toward good natured expanding its materials portfolio into cheaper options that meet its high-quality standards.

In the meantime, the company continues to build brand equity by offering clients peace of mind about their environmental impact:

- Unlike traditional petroleum-based plastic packaging, good natured’s products will not leach hazardous chemicals if they end up in a landfill

- It conducts freezer and drop tests to ensure optimum durability compared to petroleum-based products

- In some instances, it has even reduced the thickness of certain products to save on weight and resources while simultaneously improving durability

- The company’s focus on limited energy use can also offer reductions in CO2 emissions, which can be confirmed through life-cycle assessments of a customer’s processes and transportation network

The future is undoubtedly bright for good natured as biopolymer and plant-based plastics development turn to novel methods, including CO2 re-capture and conversion, to gradually kick hydrocarbons to the curb.

We’ll now analyze how the company’s lofty aspirations have unfolded from a financial perspective.

Finances

Firstly, good natured is a venture-backed by considerable skin in the game. Insider ownership stood at 23 per cent as of June 30, 2022, a source of confidence that its two-pronged growth strategy will continue unabated as it has since inception.

Management, seasoned with ample Fortune 500 experience, has achieved organic growth through its relentless pursuit of new customers, cross selling and hundreds of new product launches, while inorganic growth through acquisitions boasts 6 M&A transactions to date.

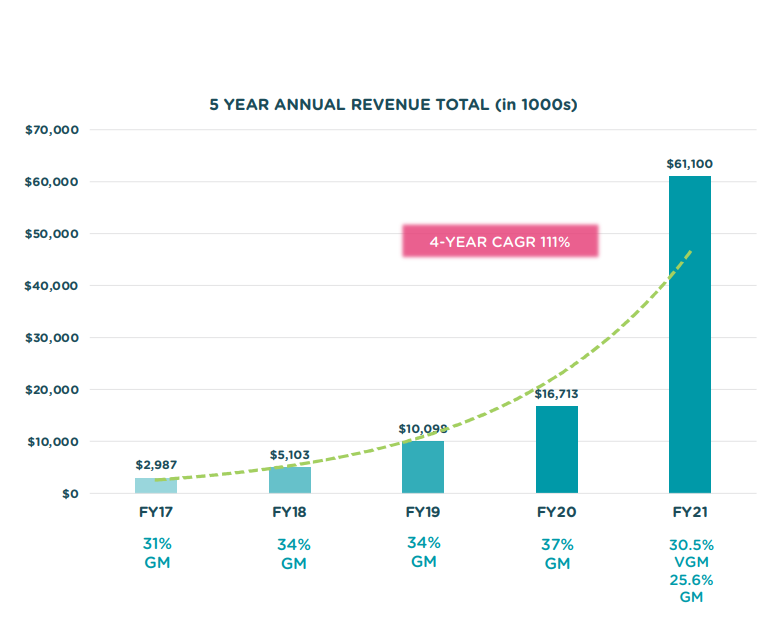

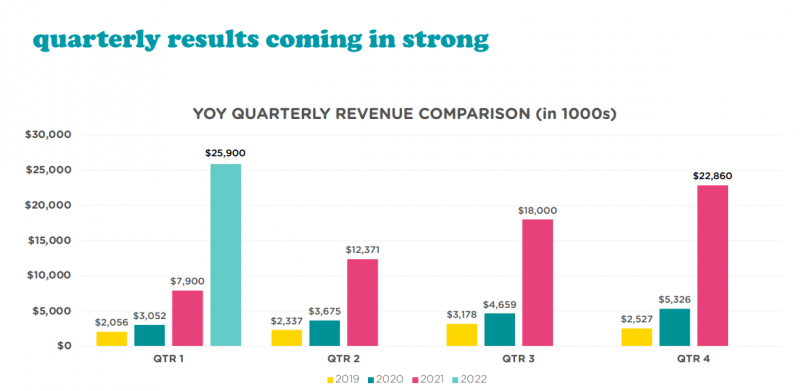

This flurry of activity has resulted in over 50-per-cent YOY e-commerce growth and a 4-year revenue CAGR of 111 per cent right as regulatory pressure and demand for sustainable products is finding its footing.

Through a quarterly lens, consumer adoption appears to be expanding at an exponential and sustainable pace, despite COVID’s hindrance to supply chains. The company remains true to the commitment to environmentalism on which its reputation is based. Revenue for 2021 was up an astounding 266 per cent YOY, with Q1 2022 revenue coming in at one-third of 2021’s total.

A selection of recent acquisitions demonstrates good natured’s balance between financial value and mandate compliance when it comes to enhancing its offerings, customer base and supply chain efficiency.

While investors commonly criticize ESG’s values-based approach for leaving returns on the table, good natured is on track to buck that trend by meeting or exceeding the expectations set by the petroleum-based establishment. Backed by a strong cash position of US$12.374 million as of Q1 2022, when it also became free cash flow positive, and a debt-to-equity ratio that has fallen from 563.6 to 221.1 per cent over the past five years, the company’s ultimate goal of meaningful environmental and social impact is fueling momentum on its path to profitability. We’ll sketch out the next steps on that path in the final section.

On the horizon

With the tailwind of sustainability on its side, good natured Products is ramping up product, customer and M&A development with an eye on making it easier and more affordable to minimize waste and improve the lives of future generations.

Its most recent customer, a large U.S. food producer, recently committed to a three-year contract under which the company will supply packaging designs using Bio-PET-based material and recycled content. Valued at US$13 million for the first year, the contract represents the company’s largest organic commercial agreement to date.

Its most recent innovation, GoodGuard, is a dual-sided tamper-evident container to be available in both compostable PLA and curbside-recyclable Bio-PET. The product’s timely emergence comes after California’s 2020 bill requiring restaurants to use tamper-evident packaging for third-party food delivery services. good natured anticipates more states to follow, creating a propitious environment for its novel solution.

Finally, the company’s most recent acquisition, Houston-based FormTex Plastics, produces custom plastic packaging for the medical, food, electronic, industrial and retail markets. The addition of FormTex’s seven thermoforming machines will enhance good natured’s packaging business with expected material upside in terms of revenue, profitability, cost synergies (up to US$0.3 million in year one) and supply chain improvements.

With revenue expected to keep climbing and its negligible 1 per cent institutional ownership likely to increase, good natured represents a compelling investment opportunity marked by rapid expansion and customers willing to pay up for the clean conscience its products provide.

Considering that wider market awareness began only three years ago, when the company’s growth transformed its green mandate from idealism to reality, it has made a commendable start on its path to becoming a leading North American Earth-friendly products company.

Endnotes

1. PLA, or polylactic acid, is a biodegradable thermoplastic made from renewable resources. The majority of compostable packaging uses PLA as it’s the most cost-effective option.

2. Bio-PET is a PET #1 plastic material with up to 30 per cent plant-based content and up to 50 per cent recycled content. It is identical to PET in every other way, such that it can be recycled and re-used through any curbside program that accepts PET #1.

3. Certified compostability requires precise temperature control and mixing for optimum biodegradability, which expedites the material’s journey back to reusability compared to burying the waste in your backyard.

4. Bioplastic: a material with at least some renewable plant-based content that can be recycled and mixed together with traditional petroleum plastics classified from #1 to #6. For context, current bioplastics production relies on less than 1 per cent of the annual global corn supply, compared to the 33 per cent of food that gets wasted every year.

5. CPLA, or crystallized polylactic acid, is a heat-resistant version of good natured’s PLA material. It is made from annually renewable plant-based material with no BPA, phthalates or other chemicals of concern.