- KWG (KWG) has completed its magnetotelluric survey over its Ring of Fire chromite Black Horse Project

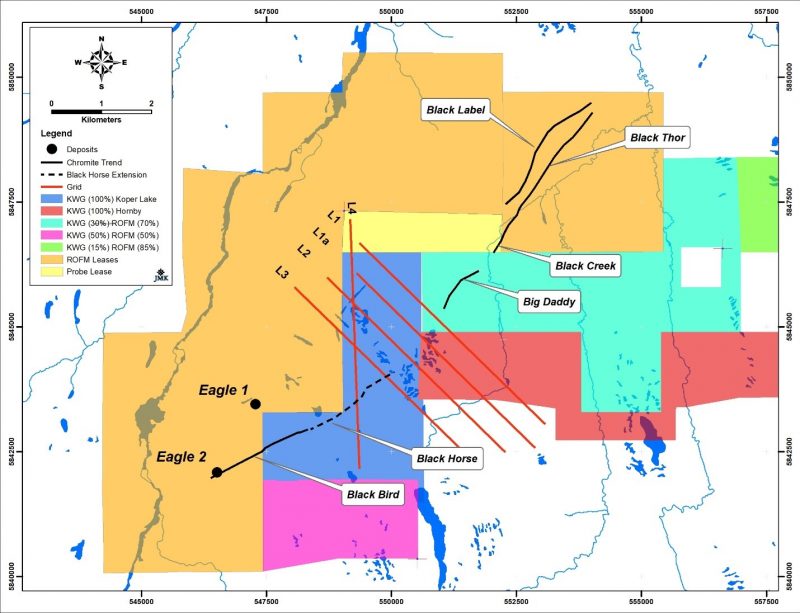

- Both targets were defined by coincidental gravity and magnetic anomalies supported by multiple drilling intercepts of secondary chromite within the shear zone known as Franks Fault

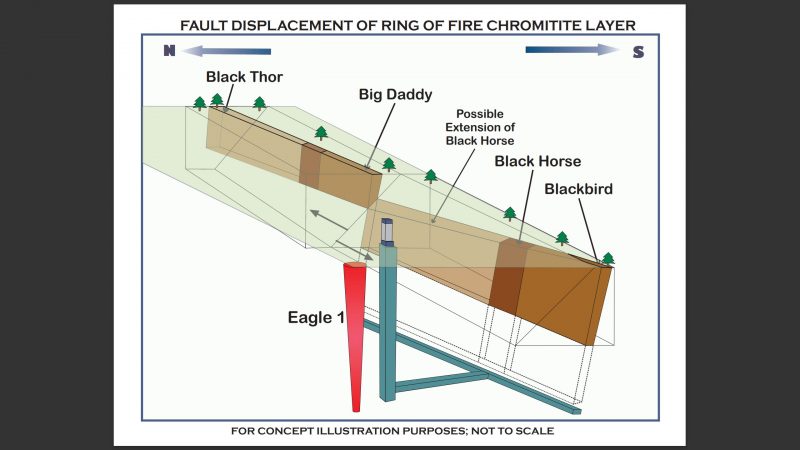

- KWG believes the Black Horse resource is a deeper, laterally-faulted and displaced part of the Big Daddy and Black Thor deposits occurring near surface to the north

- KWG Resources (KWG) was trading steady at $0.03 per share as of 10:05 am ET

KWG (KWG) has completed its magnetotelluric survey over its Ring of Fire chromite Black Horse Project.

Both targets were defined by coincidental gravity and magnetic anomalies supported by multiple drilling intercepts of secondary chromite within the shear zone known as Franks Fault.

KWG believes the Black Horse resource is a deeper, laterally-faulted and displaced part of the Big Daddy and Black Thor deposits occurring near surface to the north.

Quantec Geoscience Ltd. delivered preliminary interpreted resistivity cross sections and is expected to deliver a final report on the magnetotelluric survey in March. The magnetotelluric data will be merged in 3D with all other data, and this will form the basis of the design of a drilling campaign to test the identified target areas.

KWG Resources is an exploration-stage company discovering, delineating, and developing chromite deposits in the James Bay Lowlands of northern Ontario.

KWG Resources (KWG) was trading steady at $0.03 per share as of 10:05 am ET.