- KWG (KWG) will soon begin a magnetotelluric survey on its Black Horse Project in Ontario

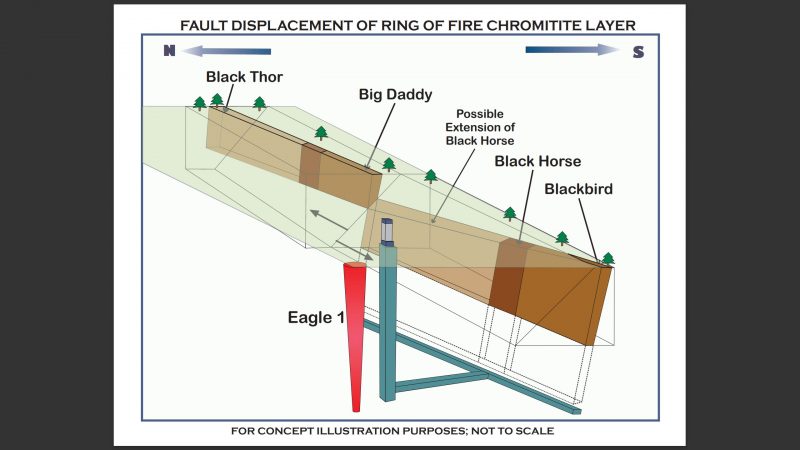

- The company believes the Black Horse resource is a deeper, laterally-faulted and displaced part of the Big Daddy and Black Thor deposits occurring near surface to the north

- It intends to gather data to substantiate an update of the project’s NI 43-101 resource estimate (2015)

- KWG Resources is an exploration-stage company discovering, delineating and developing chromite deposits in the James Bay Lowlands of northern Ontario

- KWG (KWG) is up by 14.29 per cent, trading at $0.04 per share

KWG (KWG) will soon begin a magnetotelluric survey on its Black Horse Project in Ontario.

A magnetotelluric survey maps out geology in 3D by measuring apparent resistivity contrast among rock varieties.

The survey of the chromite project, located in the Ring of Fire, will cover the previously drilled area and the undrilled potential target area toward the south boundary with KWG’s Big Daddy joint venture with Ring of Fire Metals (formerly Noront Resources).

Quantec Geoscience will begin to collect data this week to further define continuity of mineralization for potential drilling.

KWG believes the Black Horse resource is a deeper, laterally-faulted and displaced part of the Big Daddy and Black Thor deposits occurring near surface to the north. The thesis is illustrated by the following diagram:

The company intends to determine if mineral continuity at Black Horse suggests an economic drilling program to update the project’s NI 43-101 resource estimate (2015).

KWG Resources is an exploration-stage company discovering, delineating and developing chromite deposits in the James Bay Lowlands of northern Ontario.

KWG (KWG) is up by 14.29 per cent, trading at $0.04 per share as of 11:31 am EST.