- Keyera (TSX:KEY) has said that it will suspend operations at four of its gas plants as its shifts focus to its gathering and processing business

- Minnehik Buck Lake and West Pembina will be halted in the second half of 2020, while Ricinus and Nordegg River will follow suit in 2021

- Volumes at these sites will be re-routed to other Keyera facilities for processing

- The company hopes the decision will improve its long term competitive position

- Keyera (KEY) is currently up 10.69 per cent to C$16.46 per share, with a market cap of $3.61 billion

Keyera (TSX:KEY) has stated it will suspend operations at four gas plants as its shifts focus to its gathering and processing business.

The energy infrastructure company currently operates a portfolio of interconnected assets. Its service-based business consists of natural gas gathering and processing, natural gas liquids processing, transportation, storage and marketing, and iso-octane production and sales.

Keyera also operates a leading condensate system in the Edmonton and Fort Saskatchewan area of Alberta.

According to today’s announcement, the company will indefinitely halt operations at its Minnehik Buck Lake and West Pembina gas plants in the second half of 2020. Come next year, Keyera’s Ricinus and Nordegg River gas plants will follow suit.

The decision is a result of a greater focus on the company’s gathering and processing business.

Under this sector, natural gas is transported from producers’ wells to Keyera’s gathering pipelines, which facilitate delivery to its processing plants. Once there, impurities are removed and economically viable products are separated from the raw gas stream.

Keyera’s pipeline network currently stretches over 4,000 kilometres, drawing from 18 natural gas processing plants.

Once under suspension, resource volumes from the four facilities will be transferred to other gas plants in the Alberta area.

The plan is intended to bolster Keyera’s long-term competitive position by increasing utilisation and efficiency at its existing facilities. The company also hopes to reduce operating costs per unit and provide higher netbacks for producer customers.

In addition, the optimization measures will further Keyera’s environmental efforts by reducing its overall greenhouse gas emissions.

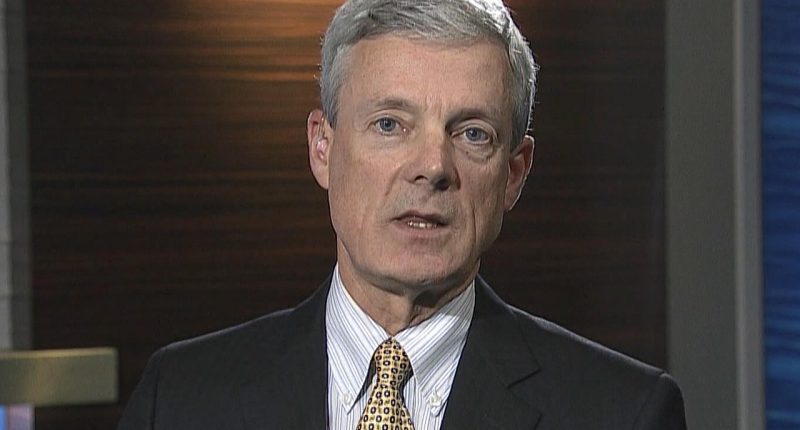

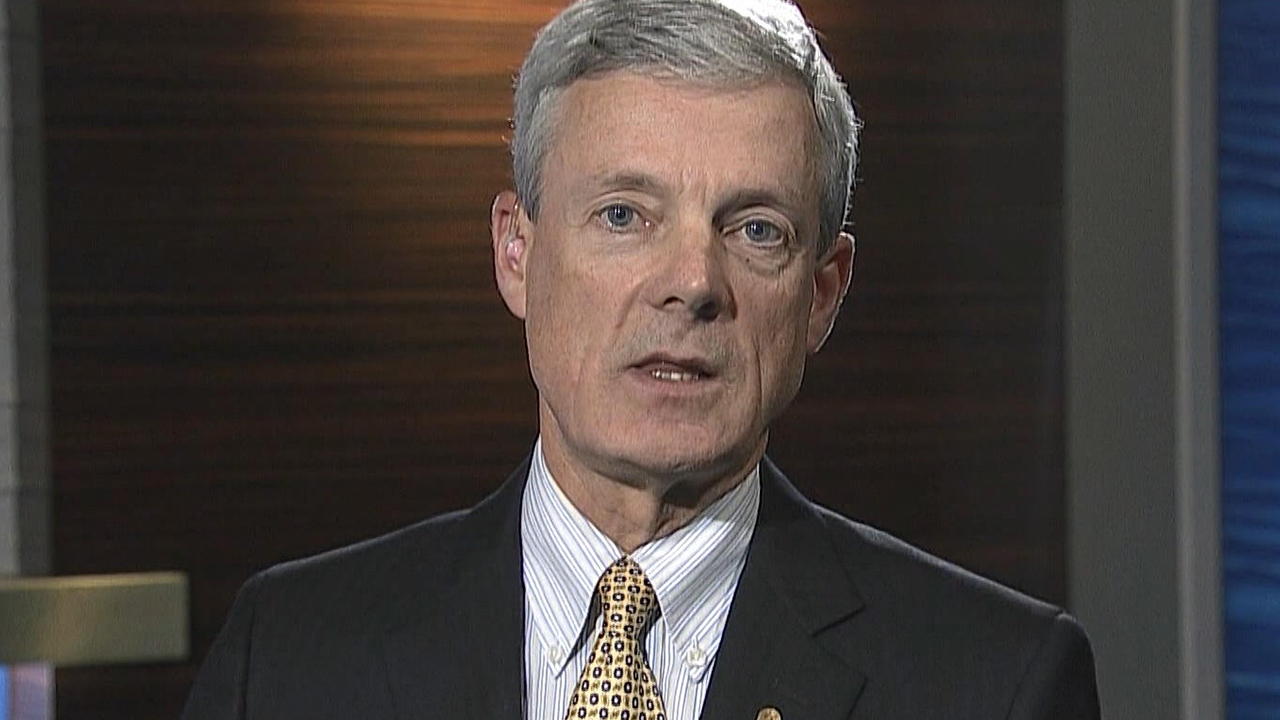

David Smith, CEO of Keyera, said it was a difficult decision to suspend operations at the plants, which have been part of the company’s portfolio for many years.

“However, these optimization efforts will strengthen our gathering and processing business for the long term as they align with our customers’ needs and the current industry environment.

“In the coming weeks we will begin planning a safe and orderly suspension of the gas plants. Our priority is to ensure the health and safety of our employees and support our customers through the process,” he added.

Keyera (KEY) is currently up 10.69 per cent to C$16.46 per share at 11:17am EST.