- Kaizen Discovery (KZD) reported positive results from the recently completed 92 km2 induced polarization and resistivity survey at its Pinaya Copper-Gold Project

- The company found seven chargeability anomalies that could potentially indicate sulphide mineralization and identified them for drill testing

- Four anomalies that are lying to the west of the fault bounding the current Pinaya mineral resource were noted to possibly be porphyry sources of the Pinaya mineralization

- Kaizen Discovery Inc. (KZD) is trading steady at $0.13 per share at 12:45 p.m. ET

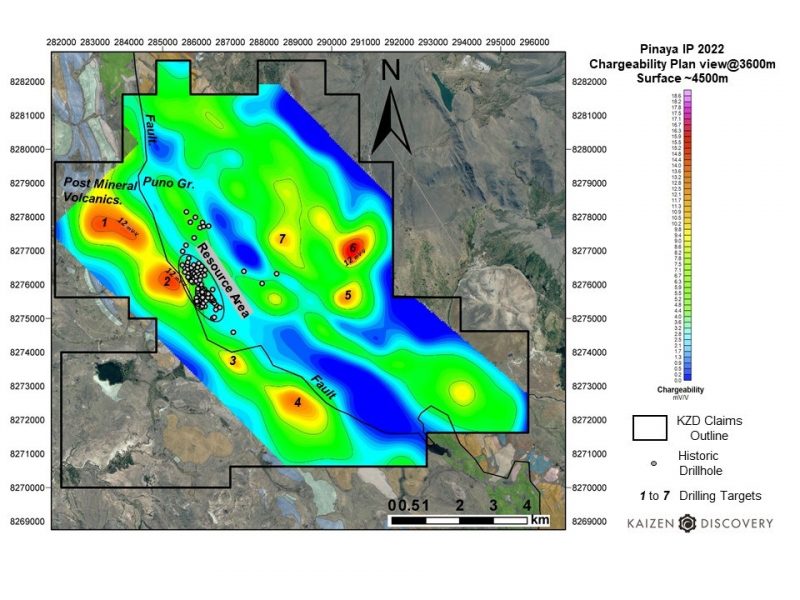

Kaizen Discovery (KZD) reported positive results from the recently completed 92 km2 induced polarization and resistivity survey at its Pinaya Copper-Gold Project.

The company found seven chargeability anomalies that could potentially indicate sulphide mineralization and identified them for drill testing.

Four anomalies that are lying to the west of the fault bounding the current Pinaya mineral resource were noted to possibly be porphyry sources of the Pinaya mineralization.

Three anomalies lying several kilometres to the east may also represent a separate copper-gold system.

The company has applied for diamond drill permits and, once received, will begin drilling all seven chargeability targets.

“We are encouraged by the positive results received from this IP-resistivity survey, which confirmed the potential to identify significant new zones of porphyry copper-gold mineralization at Pinaya,” Kaizen’s interim President and CEO, Eric Finlayson, said.

Kaizen is a publicly traded Canadian mineral exploration and development company with exploration projects in Peru and Canada. Its wholly owned Pinaya Copper-Gold Project is located in the Andahuaylas-Yauri Porphyry-Skarn Belt in southeastern Peru. This belt contains some of the world’s largest recent copper mine developments.

Kaizen Discovery Inc. (KZD) is trading steady at $0.13 per share at 12:45 p.m. ET.