With the Covid pandemic now diminishing across most jurisdictions, now is a great time for investors to be looking at other pharma subsectors. Why?

With the recent slump in markets, valuations for biotech stocks, in general, are very compressed. And with all investors beginning to re-focus, there may be some excellent growth opportunities for companies not recently on the radar of investors.

One particularly interesting company for investors interested in biopharma is Cardiol Therapeutics (TSX:CRDL, Forum).

On August 3, 2022, Cardiol Therapeutics announced the first patient enrolled for its Phase II multi-center, international study targeting the treatment of acute myocarditis.

A major study. A lucrative and under-served treatment market. A junior biopharma company bringing a cannabidiol-based treatment to market to address this pharma opportunity.

Does that set-up sound familiar to investors?

It should, since it is a rather close description for GW Pharma, before it became a billion-dollar biopharma company (ultimately bought out by Jazz Pharmaceuticals for $7.2 billion).

Another parallel between Cardiol Therapeutics and GW Pharma?

The “Orphan Drug Designation” GW Pharma obtained for Epidolex® was instrumental in the product’s commercial success.

Cardiol Therapeutics is hoping for a similar opportunity to develop it’s CardiolRx™ formulation as an orphan drug for the treatment of acute myocarditis. More on this later.

The Company’s just-initiated ARCHER study is designed to test the safety and tolerability of CardiolRx™ as well as its impact on myocardial recovery. It is an important milestone in the Company’s plan as they pursues the broader quest to conquer heart failure.

Dennis McNamara, Professor of Medicine at the University of Pittsburgh and Director of the Center for Heart Failure Research at the university framed the news for investors.

“We have long suspected that it is the response to injury that needs to be addressed to improve outcomes in myocarditis. Given its impact limiting these inflammatory mechanisms, we believe cannabidiol has the potential to truly benefit patients with this condition.”

Dr. McNamara is also Chair of the study steering committee for ARCHER. Cardiol is expecting the Phase II ARCHER study to enroll 100 patients, at major cardiac centers in North America, Europe, Latin America and Israel. The primary study endpoints will be evaluated after 12 weeks of double-blind therapy.

Beyond the news of the study commencement itself, the release also provided investors with a further encouraging insight. Cardiol Therapeutics views CardiolRx™ as being a strong candidate for the U.S.’s Orphan Drug Designation program.

The Orphan Drug Designation was legislated to provide additional regulatory support for drug research that targets medical conditions that affect fewer than 200,000 people in the U.S.

In the U.S., myocarditis afflicts ~73,000 people per year.

Given the significant risk of death from the condition, CardiolRx™ would seem like an ideal candidate for Orphan Drug Designation. Among the advantages of Orphan Drug Designation is the potential for accelerated regulatory review.

While U.S. cases of myocarditis total >70,000 annually, the “global burden” of myocarditis is much greater. According to the Myocarditis Foundation, ~1 million people globally are afflicted with this condition.

Myocarditis not only causes potentially fatal cardiac risks for young adults, but also young athletes, children and even infants.

With Cardiol Therapeutics pursuing regulatory approval across multiple jurisdictions, much of this global population of myocarditis sufferers could be opened up to CardiolRx™ once formal approval is obtained.

For investors, what is the market potential here?

A 2022 research report estimated the size of the global treatment market for myocarditis at US$1.592 billion in 2021. The report forecasts the treatment market increasing to US$2.57 billion by 2029, based on a CAGR of 6.15%.

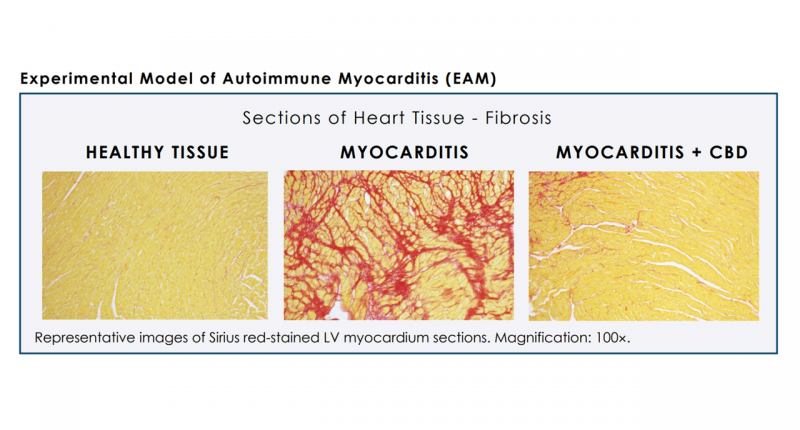

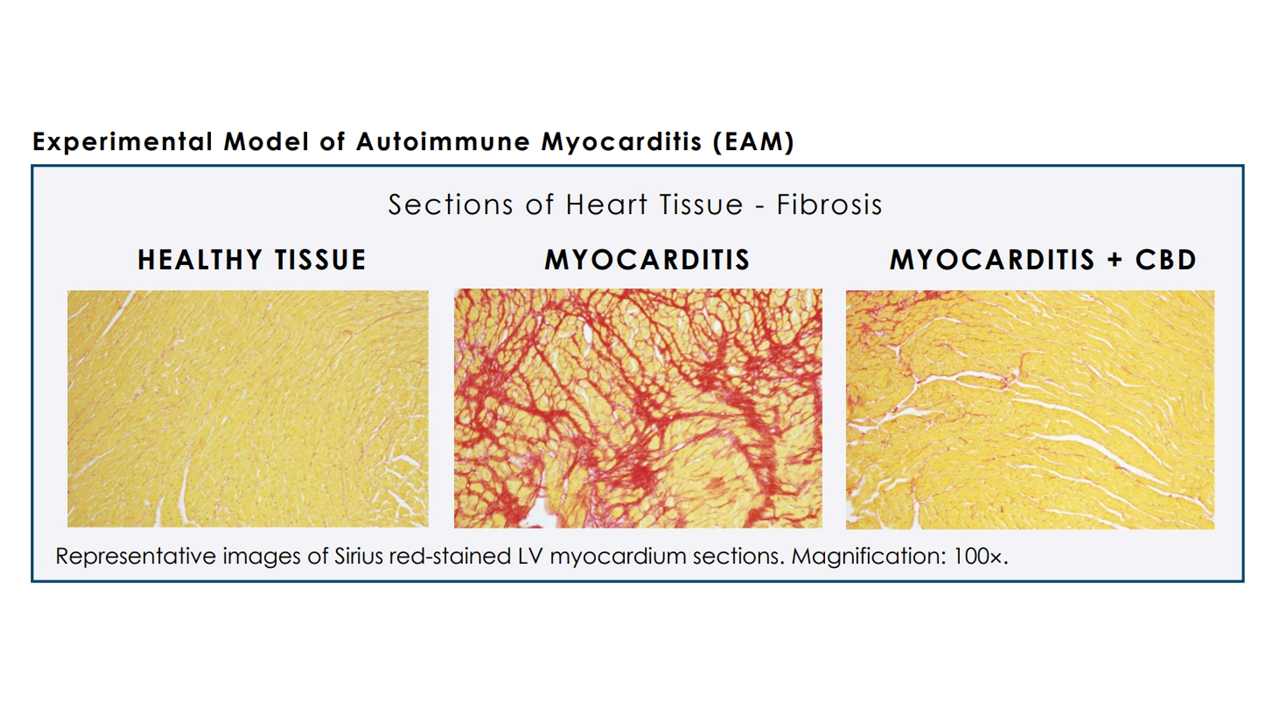

Further down the road, Cardiol Therapeutics also indicated in the release that additional research is already underway on a cannabidiol formulation aimed at “the treatment of inflammation and fibrosis associated with the development and progression of heart failure.”

For investors, now is the time to turn this new medical crisis into an investment opportunity. Cardiol Therapeutics offers an advanced R&D option that is targeting the anti-inflammatory properties of cannabidiol-based medicines for cardiac disease.

FULL DISCLOSURE: This is a paid article by The Market Herald.