- Inventus Mining Corp. (IVS) has closed a non-brokered private placement for gross proceeds of $1,200,000

- The company issued 24,000,000 units priced at $0.05 per unit

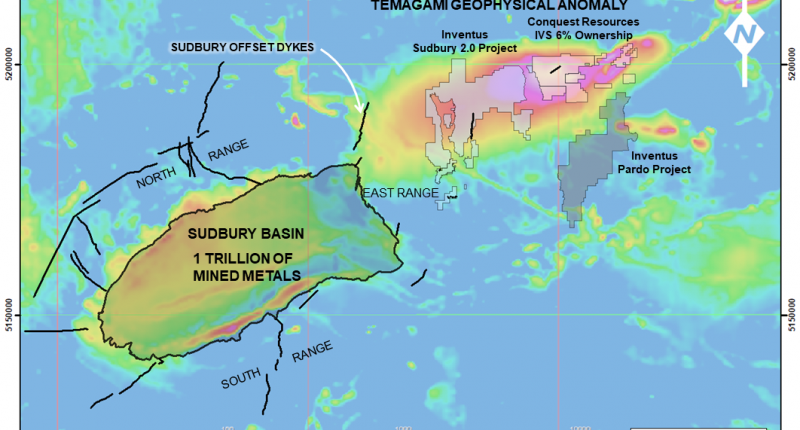

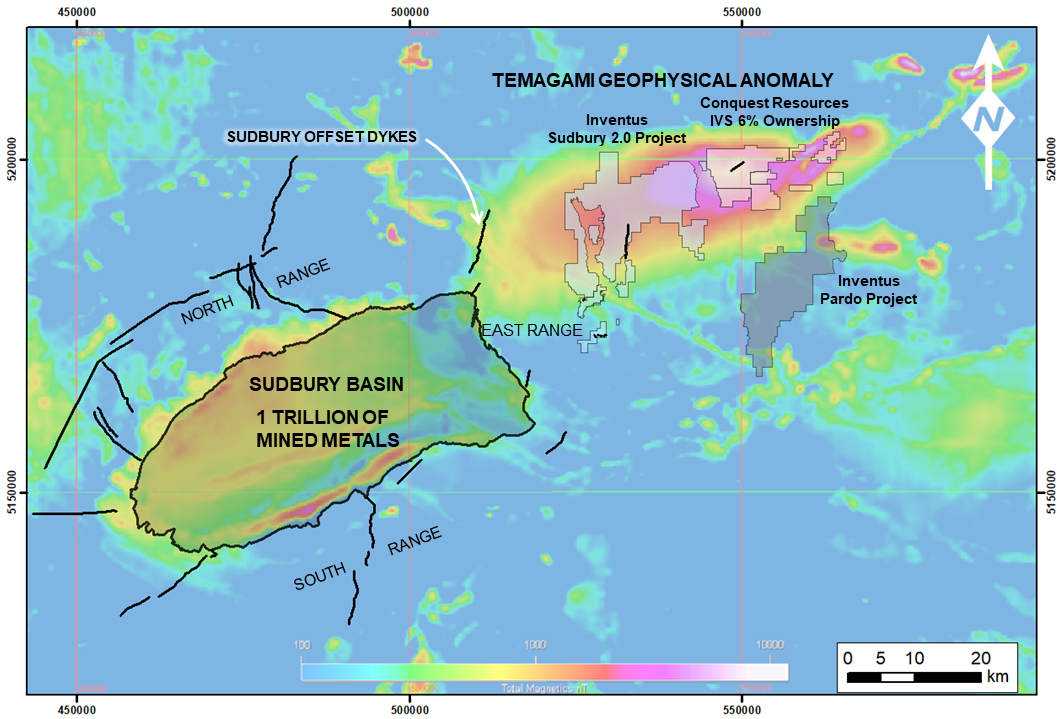

- Proceeds will be used primarily to advance the Pardo and Sudbury 2.0 projects

- Inventus is a mineral exploration and development company

- Inventus Mining Corp. (IVS) opened trading at C$0.07

Inventus Mining Corp. (IVS) has closed a non-brokered private placement for gross proceeds of $1,200,000.

The company issued 24,000,000 units priced at $0.05 per unit. Each unit includes one common share and one-half of one common share purchase warrant. Each whole share purchase warrant entitles the holder to acquire one additional common share for $0.10 for a period of two years after the closing of the offering.

The warrants are subject to an acceleration clause.

The offering is subject to the receipt of all required regulatory approvals.

All securities issued are subject to a statutory four-month hold period.

Proceeds will be used to advance the Pardo and Sudbury 2.0 projects, reduce accounts payable, and for general corporate purposes.

Inventus paid a cash commission of $11,640 and issued 310,400 finders’ warrants.

Inventus is a mineral exploration and development company focused on the mining district of Sudbury, Ontario. The company’s principal assets include a 100 per cent interest in the Pardo Paleoplacer Gold Project and the Sudbury 2.0 Critical Mineral Project located northeast of Sudbury.

Inventus Mining Corp. (IVS) opened trading at C$0.07.