The way we do business is changing and investors are starting to capitalize on what the fintech industry has to offer. The latest offering in the DealRoom has a unique play in just this order.

Perk Labs (CSE:PERK) has announced a non-brokered private placement for maximum gross proceeds of $500,000.

The company intends to offer 15 per cent unsecured convertible debenture units at a price of US$10,000 per debenture unit.

Each debenture unit will consist of a $10,000 principal amount of 15 per cent unsecured subordinated debentures and 200,000 common share purchase warrants of the company.

Each debenture shall mature on the date three years from the closing of the offering and shall bear interest at an annual rate of 15 per cent per annum, payable quarterly starting on March 30, 2023.

Each warrant will be exercisable to acquire one common share of the company for a period of three years following the closing of the offering at an exercise price of $0.05 per warrant share.

The closing of the private placement is expected to occur on or about December 30, 2022, and is subject to regulatory approval, including approval of the Canadian Securities Exchange.

Proceeds will be used to fund general working capital purposes. In a recent news release, the company’s Chairman, Kirk Herrington, stated that with ongoing consolidation in the financial and restaurant technology industry, the team feels there are many opportunities for discussions with various parties to assess how mutual ambitions to create greater scale in a tough economy can be better realized.

Jonathan Hoyles, Perk’s Chief Executive Officer, added, “We are currently in discussions with several parties with regards to potential transactions and determined the commencement of a strategic process would be helpful in connecting with third parties who could be synergistic with our existing business or in providing new opportunities for the Company and its shareholders.”

Including the raising of growth capital, potential strategic options that the company is exploring include the possibility of a merger, reverse merger, acquisition, or other strategic transactions.

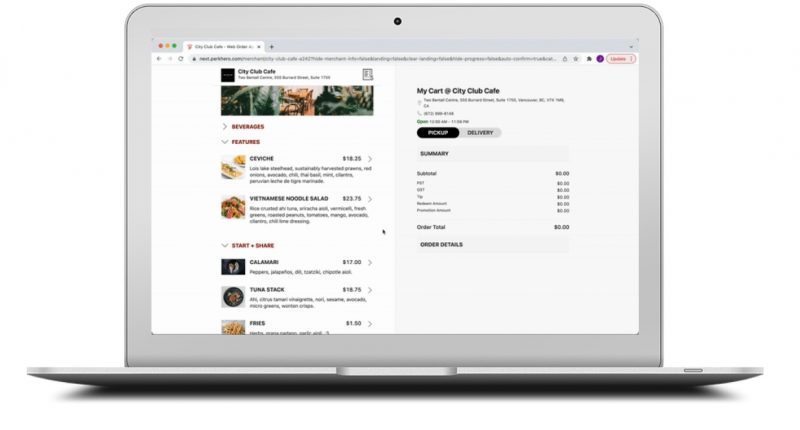

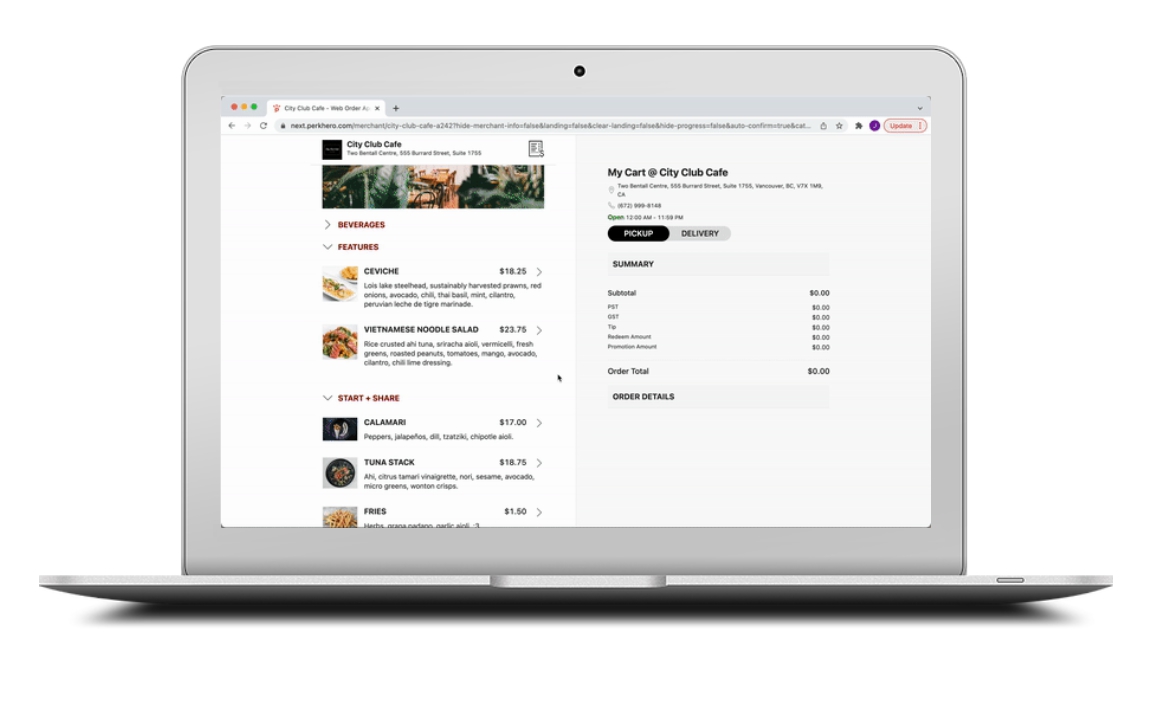

Vancouver, B.C.-based Perk Labs owns Perk Hero, a mobile commerce platform allowing businesses to build digital offerings.

The company’s Perk Hero platform facilitates mobile ordering and payments combined with a digital loyalty program and customer relationship management software. Unlike brick-and-mortar, digital businesses can enjoy recurring SaaS revenue without significant overhead.

The restaurant industry is facing a crisis. COVID-19 restrictions have upended balance sheets, and third-party delivery apps charge upward of 30 per cent commissions. Staff wages can’t keep up with increased rent and food costs and the ongoing labour shortage, 70 per cent of operators admit they do not have enough staff to serve their customers. However, with crisis comes opportunity – customers are used to instant gratification thanks to technology, and it is through technology that Perk Labs can capitalize on via its platform.

To view or participate in the Perk Labs Inc. Deal Room offering, click here.

The Deal Room: your destination to participate in exclusive financings, featuring some of the best companies – and deals – currently available on the market.

FULL DISCLOSURE: The Market Herald is not registered as a broker, dealer, exempt market dealer, or any other registrant in any securities regulatory jurisdiction and will not be performing any registerable activity as defined by the applicable regulatory bodies. This deal room is for informational purposes only and does not constitute an offer to sell or a solicitation to buy the securities referred to herein. Offers to sell, or the solicitations of offers to buy, any security can only be made through official offering documents that contain important information about risks, fees, and expenses. The information contained in this deal room is selective and does not purport to contain all the information relating to Perk Labs Inc. in all cases, parties should conduct their own investigation and due diligence, not rely solely on the data provided herein and are encouraged to consult with a financial adviser, lawyer, accountant, and any other professional that can help to understand and assess the risks associated with any investment opportunity.