- Imperial Mining (IPG) closed the first tranche of a non-brokered private placement for gross proceeds of $441,778

- The company issued 3,670,708 flow-through shares at $0.11 per share and 422,223 units at $0.09 per unit

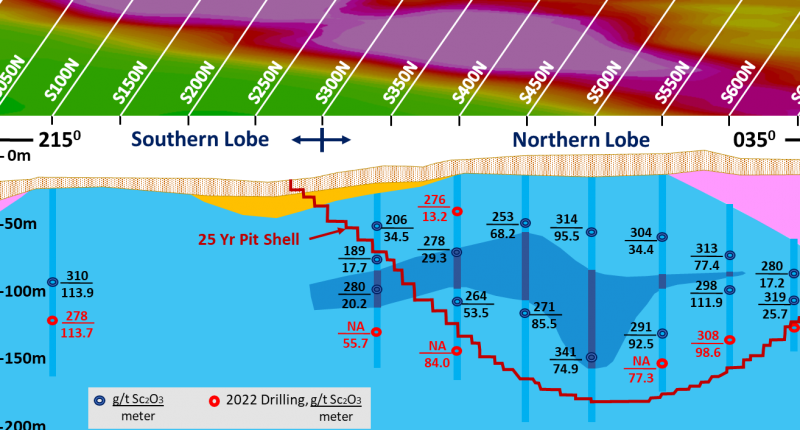

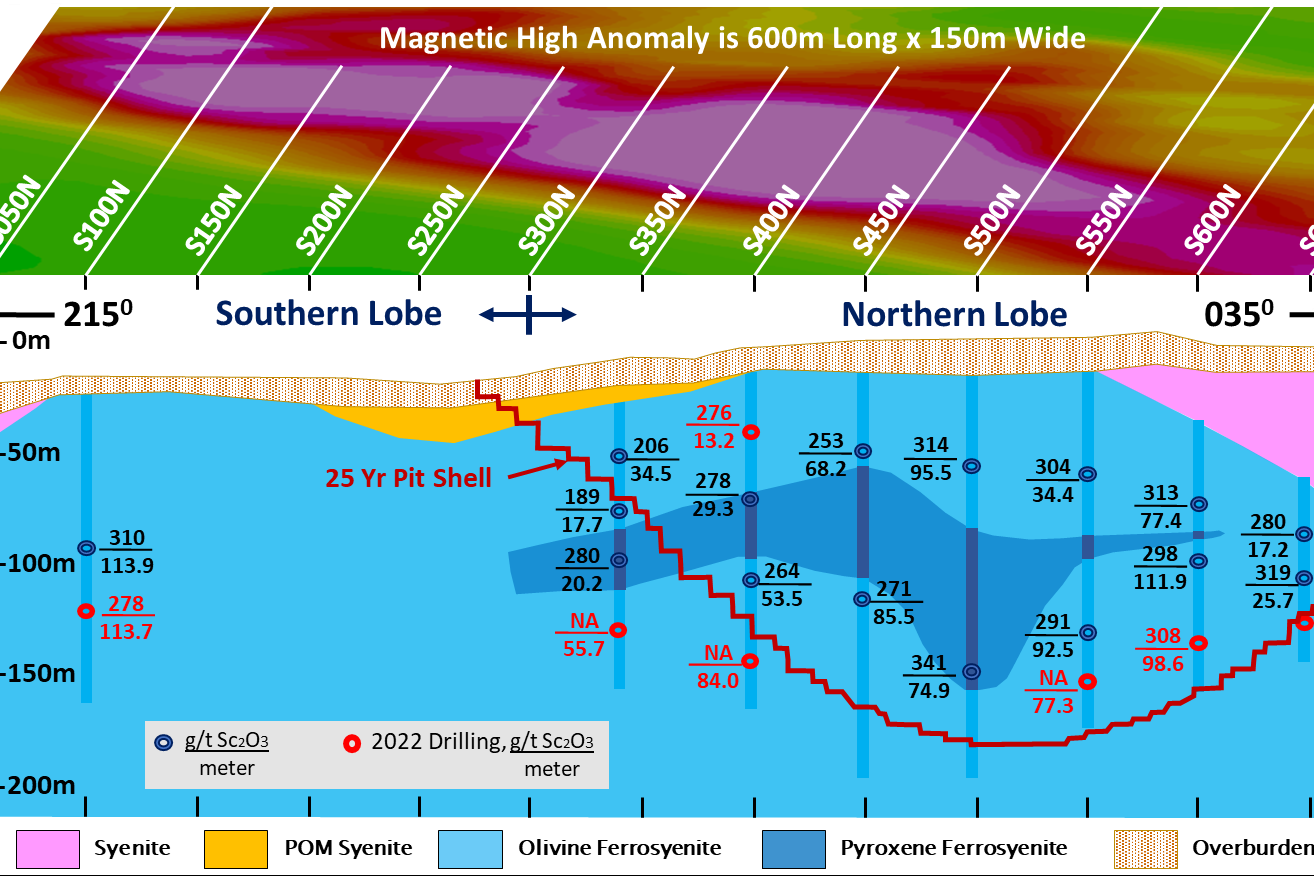

- The corporation will use the proceeds of the offering to complete exploration drilling on the Southern Lobe of the Crater Lake scandium-rare earth zone in Québec

- Imperial is a Canadian mineral exploration and development company advancing its technology metals projects in Québec

- Imperial Mining Group (IPG) opened trading at C$0.09

Imperial Mining (IPG) closed the first tranche of a private placement for gross proceeds of $441,778.

Under the first tranche, the company issued 3,670,708 flow-through shares at $0.11 per share and 422,223 units at $0.09 per unit. Each unit consists of one common share and half of a share purchase warrant. Each whole warrant entitles the holder to acquire one additional share for a period of 24 months from the closing date.

The corporation will use the proceeds of the offering to complete exploration drilling on the Southern Lobe of the Crater Lake scandium-rare earth zone in Québec, complete optimization work on the process flow sheet and other corporate purposes.

The corporation paid cash finders’ fees totalling $20,240 and issued 184,000 warrants.

All securities issued are subject to a statutory hold period of four months.

Imperial is a Canadian mineral exploration, and development company focused on the advancement of its technology metals projects in Québec.

Imperial Mining Group (IPG) opened trading at C$0.09.

Imperial Mining (IPG) closed today the first tranche of a non-brokered private placement of flow-through shares and units for gross proceeds of $441,778.

Under the first tranche, the company issued 3,670,708 flow-through shares at $0.11 per share and 422,223 units at $0.09 per unit. Each unit consists of one common share and half of a share purchase warrant. Each whole warrant entitles the holder to acquire one additional share for a period of 24 months from the closing date.

The corporation will use the proceeds of the offering to complete exploration drilling on the Southern Lobe of the Crater Lake scandium-rare earth zone in Québec, complete optimization work on the process flow sheet and other corporate purposes.

The corporation paid cash finders’ fees totalling $20,240 and issued 184,000 warrants.

All securities issued are subject to a statutory hold period of four months.

Imperial is a Canadian mineral exploration, and development company focused on the advancement of its technology metals projects in Québec.

Imperial Mining Group (IPG) opened trading at C$0.09.