Meet Fission 3.0 Corp (TSXV:FUU/OTC:FISOF). This is a cash rich/asset rich junior uranium exploration company, participating in the early stages of a major new bull market for uranium.

Is Fission 3.0 undervalued? Yes.

A much better question: how is this company undervalued?

- Grossly undervalued in terms of its cash/assets vs. market cap.

- A well-managed junior that is undervalued vs uranium peers at all levels of development.

- Nearly the entire uranium sector is mispriced vs. the price of U3O8 itself.

If you see a metric that a particular company is clearly undervalued, that’s a fairly persuasive reason to take a position. If you see three separate metrics that all indicate the company is undervalued, that would seem to be a strong candidate for any investor’s portfolio.

Before investors look at the cash and assets that Fission 3.0 currently sits with (at a market cap currently below CAD$31 million), they need context.

The multi-decade investment opportunity in uranium

A major, new bull market in uranium is in its early stages. A prediction? No, that’s a description of the uranium market today.

The uranium sector is unique in several key respects.

It takes a long time to build a nuclear reactor, the primary source of demand for the world’s supply of U3 O8. It requires enormous investments of money/resources. And for those reasons, nuclear reactors also go through a long “planning stage”.

Of equal importance, the customers for this refined uranium are generally major utilities companies. Fuel for their reactors only accounts for 2 – 6% of expenses.

Translation: even a major rise in the price of uranium would have only a minimal impact on the economics of nuclear energy. And rising prices won’t kill future demand for uranium.

Today, the world is well advanced into what can only be called a Nuclear Renaissance.

Why nuclear energy is on the verge of a renaissance

Simply put, despite the seriousness of the Fukushima nuclear disaster, there is an increasingly strong global consensus that the major backlash against ‘nuclear’ that followed that disaster was a mistake.

Indeed, Japan itself has just announced it is reversing its moratorium on nuclear energy and restarting idled nuclear plants – which has sparked a new rally in the sector.

This emerging global consensus is reflected in a major, multi-decade commitment to return to nuclear power.

Leading the parade in this Nuclear Renaissance is China.

In July 2020, a report emerged that China was planning to build “6-8 nuclear reactors” per year from 2020 through 2025.

By November 2021, a nuclear industry article forecast that China would build 150 new nuclear plants over the next 10 years – equal to 15 reactors per year.

This means growing uranium demand, not for five years or even ten years, but for literally decades.

The first of many extended bull markets for uranium is now underway, following a bear market for uranium that persisted (more or less continuously) for ~10 years.

Fission 3.0 positioned for success in new uranium bull market

Fission 3.0 is well-positioned to capitalize on this multi-decade trend in the uranium market.

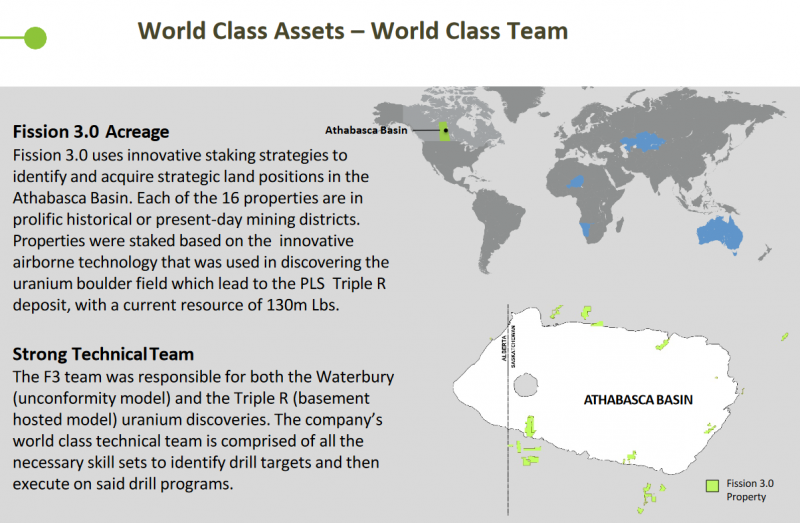

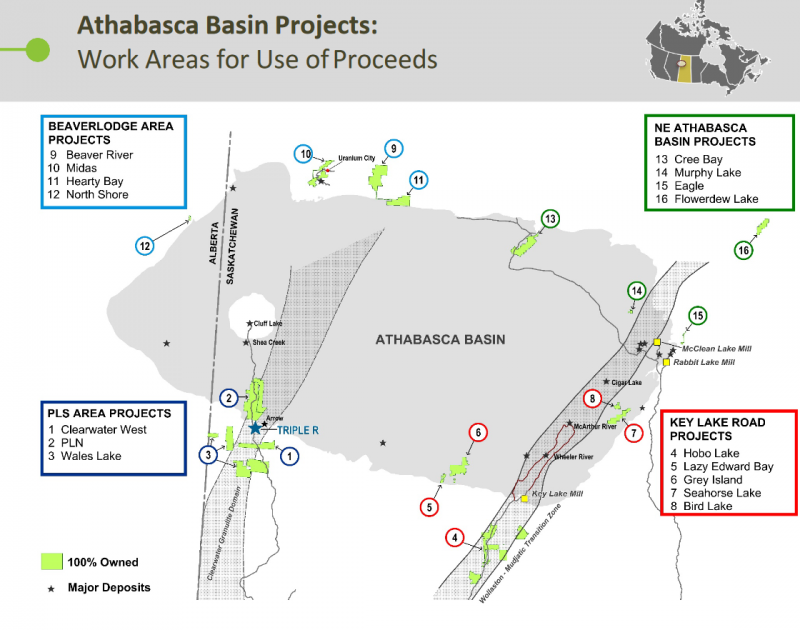

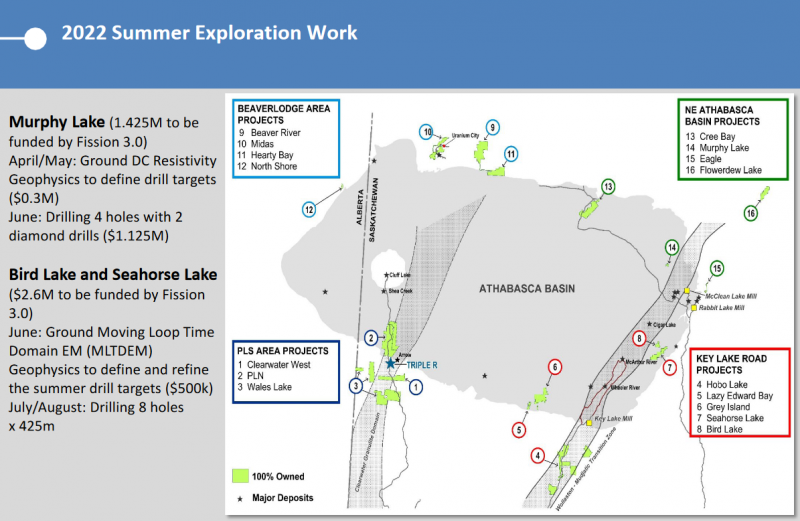

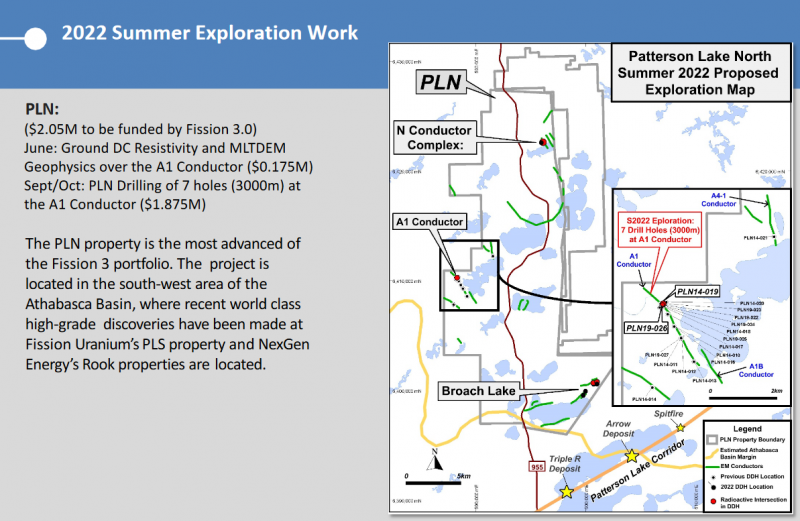

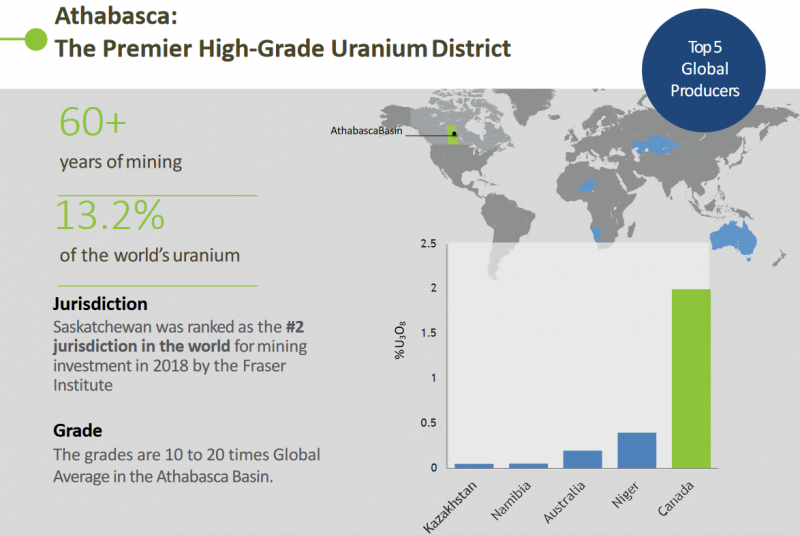

- 16 large land packages in the Western world’s premier uranium district, Canada’s Athabasca Basin

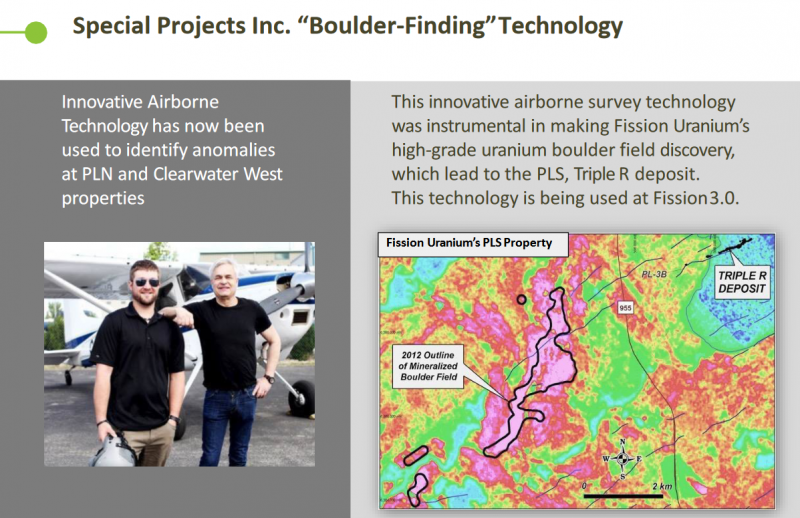

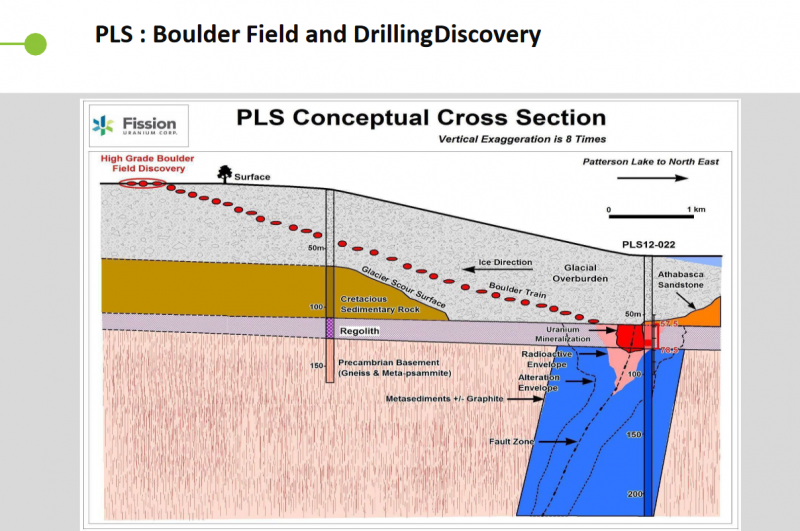

- World-class exploration team already credited with two major uranium discoveries

- “Project generator” business model provides near-term revenue opportunities and accelerates the development of uranium properties

The Company is also cash-rich. As of June 15, 2022, Fission 3.0 sat with a cash position of ~CAD$13 million. With a current market cap of CAD$31 million, that’s not much more than a 2:1 cash-to-market-cap ratio.

Two-to-one cash to market cap for a company with a world-class exploration team, a large portfolio of very prospective properties, and just entering a major new bull market? That’s severely mispriced.

When The Market Herald sat down for a chat with Fission 3.0’s management, our first question was simple.

How could this Company be so cheap when the whole sector should be taking off?

We got a major piece of the puzzle here with one simple phrase: “flow-through shares”. Fission 3.0’s December 2021 CAD$8.6 million private placement contained a large allocation of flow-through shares.

Flow-through shares are popular with investors because of the tax advantage they offer. But once that advantage is realized, the incentive to continue holding diminishes.

Fission 3.0 has been temporarily pulled down as significant blocks of these flow-through shares were recently liquidated. In a bull market, that’s a buying opportunity.

We continued to kick the tires in our chat with management.

World-class exploration team? This core group is credited with two major uranium discoveries: the Waterbury “J Zone” and the “Triple R” deposit at Patterson Lake South.

Many veteran mining exploration teams go through their whole career without a major discovery.

Do it once, and the mining world takes notice. Do it twice and you earn the right to label yourself a “world-class team”.

How did this $31 million junior end up with such a large portfolio of strategically located uranium properties just as a new bull market in uranium is commencing?

Here, Chairman and CEO Dev Randhawa was willing to take a little credit.

“In a bear market you look to buy, in our world that means staking…and looking closely for companies or individuals who have dropped their claims. We staked in the historically successful north east where the earliest discoveries and mines were developed giving us proximity to the mills.”

With a wealth of these prospective properties, Fission 3.0 also has the luxury of being a project generator. The Company can develop its favorites and farm-out other properties – that are good enough to have significant appeal to other uranium exploration companies.

The obvious example here is Fission 3.0’s deal with Traction Uranium Company (CSE:TRAC).

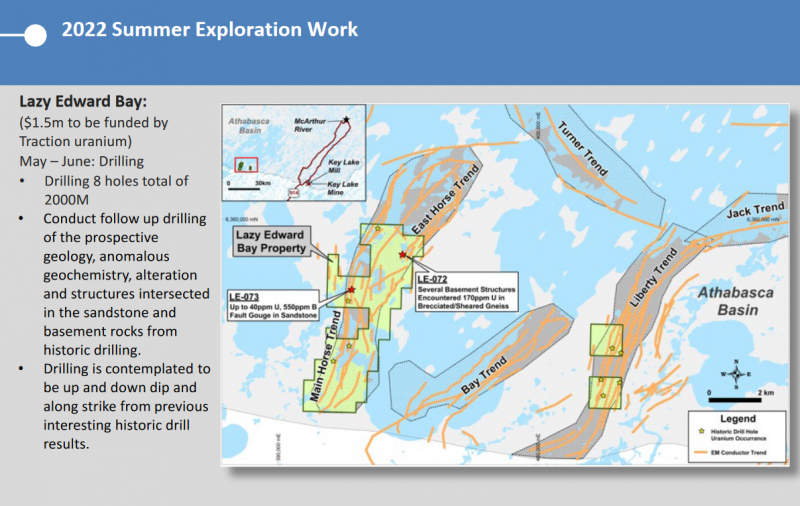

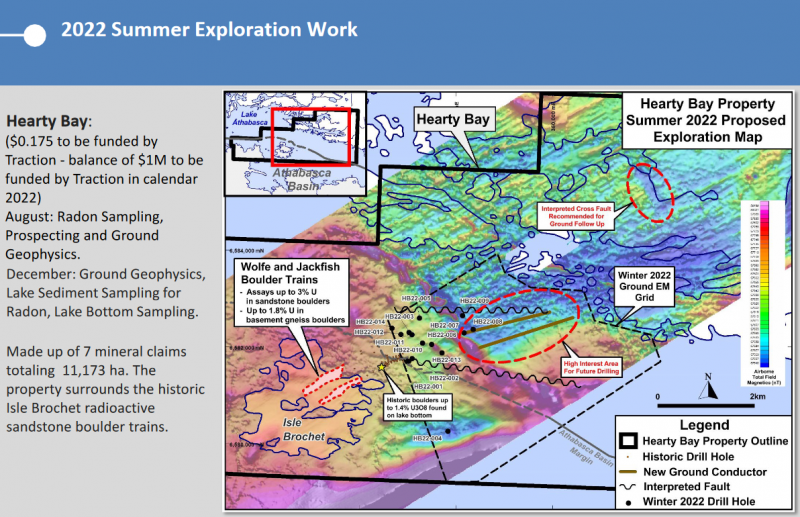

On December 10, 2021, Fission 3.0 announced an option agreement with Traction Uranium for the Lazy Edward and Hearty Bay Projects. Traction can earn a 50% interest in both projects subject to fulfilling certain terms, and can expand that interest to 70% with additional spending.

Highlights:

- A minimum of CAD$1.3 million in cash payments to Fission 3.0 (CAD$2 million for 70% earn-ins)

- A minimum of CAD$7.5 million in exploration spending (an additional CAD$7.5 million in spending for 70% earn-ins)

- 15% of Traction’s issued/outstanding shares transferred to Fission 3.0 (6,046,952 shares)

That’s a very robust options agreement for a junior exploration company – in any sector. It’s a reflection of the quality of Fission 3.0’s uranium assets and management’s ability to close deals that add value for shareholders.

Another indication? Fission 3.0’s own commitment to in-house exploration.

In speaking with management, The Market Herald learned that Fission 3.0 has a drilling budget of CAD$12 – 13 million over the next 12 months.

That equates to ~40% of the market cap of this Company in new exploration spending. With Fission 3.0 already looking substantially undervalued, how much additional shareholder value will be generated over the next 12 months with that level of activity?

Fission 3.0 undervalued versus uranium peers

Fission 3.0 doesn’t only look undervalued in absolute terms. It also looks undervalued versus various other uranium investments.

Fission 3.0 a best-buy in uranium?

At the beginning of May 2021, the price of uranium had broken out of the long bear market to a new price level of ~$34 per pound (U3O8). Uranium stocks also surged at that time as bull market conditions began.

Today, near-term futures contracts for U3O8 are trading at approximately $49 per pound, more than 40% above the May 2021 price level, but well below 2022 highs.

Larger-cap players have retreated by 15-37% from their 52-week high, including Sprott Physical Uranium Trust, which is essentially a pure play on the commodity.

Look at the junior uranium companies, however. Pushed down 65-75% from previous highs.

With the sector now looking like it’s turning higher again and Fission 3.0 having been much more heavily discounted than larger peers, it’s upside potential would appear to be commensurately greater.

As already explained, in the uranium sector we have rare clarity: what looks like a multi-decade window of heavy/increasing demand for uranium. A rare opportunity to ride these juniors through extended bull market conditions.

Uranium stocks undervalued versus the commodity

Look again at Sprott Physical Uranium Trust in the table above, the pure play on U3O8.

It’s sitting more than 500% above its May 2021 price level, and only 23% off its 52-week high – reflecting very strong investor sentiment in these bull market conditions for uranium.

Large-cap industry leader, Cameco Corp is only off roughly 15% from its 52-week high. But look at the other uranium mining stocks.

Advanced-stage development companies, Denison Mines and NexGen Energy have both slipped more than 30%. As noted, Fission 3.0 and Azincourt Energy are off 65-75%.

Does this make sense? No.

In bull market conditions, mining companies are expected to leverage (i.e. outperform) the commodity itself. The market has (irrationally) discounted these uranium mining stocks versus U3O8 itself, despite the strongly bullish sentiment currently present in this sector.

Opportunity knocks.

Cashing in on the price-disconnect for Fission 3.0

As previously outlined, Fission 3.0 Corp is a seriously undervalued stock in terms of its cash and assets versus its current, compressed market cap.

The Company also looks like a bargain when stacked up against other uranium investment assets. And uranium mining stocks have been excessively and irrationally discounted by the mindless trading algorithms that dominate global markets today.

We now see this irrational algorithm pricing on a regular basis in markets. It can be frustrating for shareholders who often have to wait for extended periods for (rational) price discovery to return to their stock.

How do these disconnects end? More often than not, with a violent upward correction. Are there any other reasons for investors to suspect that a “violent upward correction” may be on the way for Fission 3.0?

Yes. It’s all about Fission 3.0’s strategic positioning in the less-explored portions of the Athabasca Basin. Dev Randhawa sheds some light here for investors.

“We have also staked three large areas the in the south western part of the basin surrounding the most recent discoveries made there. Looking at Fission Uranium’s Patterson Lake South Triple R deposit and less than 5 kilometers away, Nexgen’s Arrow deposits both of which are WORLD CLASS, one can presume that the south east will be the next area of focus and development in the Basin.”

It began with the Company’s foresight to recognize this emerging bull market when it was still on the distant horizon. It required conviction to stake out and maintain these holdings during vicious bear-market conditions.

Now Fission 3.0 Corp is priced for investment success.

Despite the difficult overall market conditions at present, uranium is currently one of a handful of metals markets with rabidly bullish fundamentals. Unlike those other metals markets, the bullish set-up for uranium looks like a guarantee – not just for years but for decades to come.

This makes Fission 3.0 not only a short-term bargain but a hot prospect as a long-term investment.

Appendix: Fission 3.0’s innovative exploration techniques and near-term exploration plans

FULL DISCLOSURE: This is a paid article of The Market Herald.