Written by: Jessica N. Abraham

Investors love the upside potential that junior exploration companies can bring to their stock portfolios…especially in emerging and exciting industries with strong long-term fundamentals, like battery metals.

At the same time, junior exploration stocks come with their own set of built-in risks. So, how can you tap into the most upside potential with the least amount of risk? This article explains how to find that balance through the help of:

- an infographic of the mineral discovery lifecycle

- a real-life case study of the TSX Venture Exchange Tier 2 battery metal exploration company Fuse Cobalt Inc. (TSX.V: FUSE) (OTCQB: FUSEF) (FRA: 43W3)

The 2 Sweet Spots of the Mineral Discovery Lifecycle

The first way to de-risk investing in junior battery metal exploration companies is to know the 2 sweet spots of the mineral discovery lifecycle.

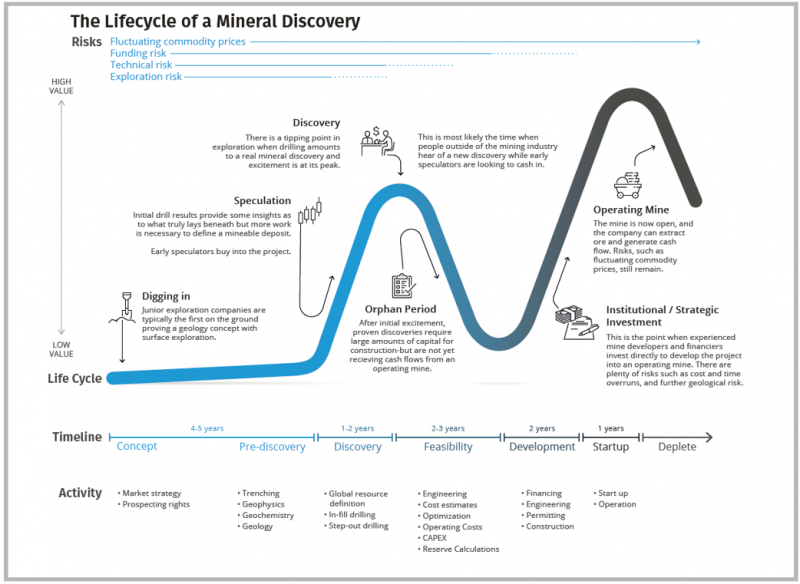

The Lassonde Curve (see below) provides a visual timeline of the risks and potential along the mineral discovery lifecycle.

It’s important to notice that there are risks that run throughout the mineral discovery lifecycle.

It’s also important to realize that those risks are what make it possible for junior mineral exploration companies to have such an alluring upside potential. After all, nothing risked, nothing gained.

So, where do the 2 sweet spots fit with offsetting those risks?

Timing. You want to consider investing in stock under the guidance of your investment advisor before it is too far along either of the 2 large upward movements in the stock price as illustrated by the Lassonde Curve.

That means investing in either of the 2 sweet spots:

- During the “Concept” or “Pre-discovery” phases

- Or early in the “Development” phase

That way, you’re locking in your investment with the most upside potential still in place, which offsets the risks that are always involved.

De-Risking Case Study: Fuse Cobalt Inc.

The second way to de-risk your investing is to select junior battery metal exploration companies that have de-risked themselves by:

- Pulling together a team of proven business builders and resource finders

- Making smart project acquisitions in world-class regions

- Doing the hard work of planning and advancing quality projects

An excellent case study to illustrate such de-risking is TSX Venture Exchange Tier 2 battery metal exploration company Fuse Cobalt Inc. (TSXV: FUSE) (OTCQB:FUSEF) (FRA: 43W3).

Let’s break down 4 of the most important de-risking strategies in general while seeing how Fuse Cobalt has applied those strategies in particular.

De-Risking Strategy #1: Target a Strong Sector with Positive Long-Term Outlook:

One way a junior mining company can de-risk itself is by targeting a sector that is widely regarded by research analysts to have a strong future demand together with solid forecasts for long-term growth. That way, there’s less risk that, somewhere along the junior miner’s mineral discovery lifecycle, demand or prices will drop. Instead, the sector is more likely to grow stronger as time passes.

How Fuse Cobalt has used this strategy to de-risk itself:

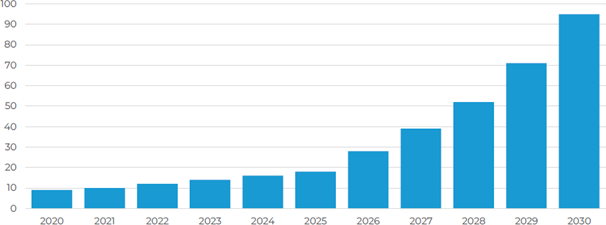

- They’re focused on the established yet rapidly emerging battery metals market, which is being driven by the exponential growth of the electric vehicle (EV) market. The global battery metals supply chains involved need to expand by 10x to meet projected critical minerals needs by 2030.1

- Fuse Cobalt is also focused on the clean energy metal cobalt, a key metal increasingly needed for EV batteries and the green revolution. According to the International Energy Agency (IEA), the mining industry needs to build 17 more cobalt mines by 2030 to meet global net carbon emissions goals.

Surging Cobalt Demand for Lithium-Ion Batteries

De-Risking Strategy #2: Avoid Geopolitical Conflict:

Another way a junior mining company can de-risk itself is by steering clear of regions mired in conflict and, instead, working in well-regarded and ethical international mining jurisdictions. That way, there’s less risk of getting sidetracked by governments taking over assets (i.e., nationalization), workers going on strike, economic meltdowns, and so on.

How Fuse Cobalt has used this strategy to de-risk itself:

- They’ve avoided troublesome cobalt mining districts, such as The Democratic Republic of Congo (DRC), which has about 70% of the world’s cobalt supply but which also represents political instability and instances of unethical mining practices.2

- They’ve targeted the mining-friendly, politically stable, world-class mining jurisdiction of Ontario, Canada, which was ranked #12 out of 77 for “Investment Attractiveness” by Fraser Institute’s 2021 mining survey.3

De-Risking Strategy #3: Leverage Existing Infrastructure, Labor & Industry Investment:

Another way a junior mining company can de-risk itself is by acquiring projects that are close to what’s needed for any mining project: roads, power, equipment, field service companies, experienced industry workers, and ongoing investment in the region’s mining sector. That way, the junior mining company can reduce its capital expenditures (CAPEX) and operating expenditures (OPEX), lower its overall exploration costs, and ride the momentum of the area’s collective development.

2 https://www.ft.com/content/77011f71-6619-4c49-ac80-d1de033e4b74

3 https://www.fraserinstitute.org/sites/default/files/annual-survey-of-mining-companies-2021.pdf

How Fuse Cobalt has used this strategy to de-risk itself:

- They’ve acquired 100% ownership in 2 cobalt projects that are close to power and water, both of which were previously owned by mining giant Glencore

- Both projects are just outside of a town in Ontario named Cobalt, which has a skilled labour force readily available

- The projects are also less than a half-mile from the only cobalt refinery in North America, which has received recent investments of $5 million CAD from the Canadian Federal government, $5 million CAD from Ontario’s provincial government,4 and a total loan commitment of $45 million CAD from mining and commodities trading giant Glencore to refurbish and reopen the refinery5

De-Risking Strategy #4: Assemble the Best Possible Leadership & Advisory Team:

Another way a junior miner can de-risk itself is by only trusting the business building of the company and the advancement of its projects to proven industry experts. That way, there’s a greater chance of success at raising capital when needed, getting the necessary permits in a timely manner, procuring top-quality exploration equipment and drill teams, and successfully executing exploration programs. There’s also less risk of making mistakes due to lack of experience, leading to lost opportunities and exploration timeline delays.

How Fuse Cobalt has used this strategy to de-risk itself:

- They’ve assembled an experienced and proven group to run the company [learn more here]

- They’ve secured a well-seasoned team of advisors, including the recent appointment of:

- Matthew Halliday, P. Geo, cobalt exploration expert with over 15 years of experience in mineral exploration and development6

- Frank J. Basa, P. Eng, cobalt exploration and mineral extraction expert with over 37 years of experience, decades of cobalt mineral exploration experience in the immediate area, while being a trusted individual within the local First Nations community7

Summary

In summary, investors can tap into the most upside potential of junior battery metal mining companies while reducing their risk by:

- investing in companies that are in either of the 2 sweet spots of the mineral discovery lifecycle (i.e., during the “Concept” or “Pre-discovery” phases or early in the “Development” phase)

- investing in junior battery metal exploration companies that have de-risked themselves using the 4 strategies outlined above, as demonstrated by Fuse Cobalt Inc. (TSX.V: FUSE) (OTCQB: FUSEF) (FRA: 43W3)

Now it’s time to do your due diligence: speak to your financial advisor and find those junior miners that fulfill those de-risking requirements.

5 https://www.mining.com/glencore-commits-45-million-to-restart-first-cobalt-refinery-in-canada/

Prepared by Jessica N. Abraham on behalf of Fuse Cobalt Inc., a Stockhouse Publishing client.