Following the recent closing of a transformational acquisition in one of the most attractive light oil resource plays in North America, Saturn Oil & Gas Inc. (TSXV:SOIL) has just expanded its current production beyond 50 per cent. The company acquired on July 6, 2022 a synergistic set of light oil producing assets in the Viking area of West-central Saskatchewan for cash consideration of approximately $248 million.

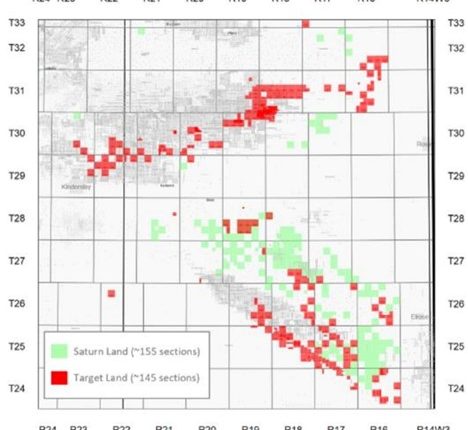

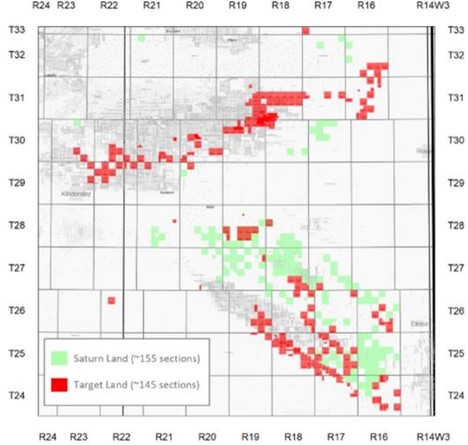

Saturn acquired roughly 4,000 boe/d (about 98 per cent light oil and liquids) of high cash flow netback production. Adding more than 140 net sections of land in the prolific Viking light oil fairway, the acquisition doubles Saturn’s land base in the area. The expanded acreage position provides hundreds of lucrative Viking oil drilling locations, which are expected to pay out in 6 to 8 months and provide 200+% return on investment, assuming a WTI oil price of USD 95/bbl/d.

This transaction is significant for the company as it greatly expands its existing core Viking production area, while also providing an excellent operational fit. Pro forma production is estimated at about 11,400 boe/d, an increase of approximately 52 per cent over Q1 2022 volumes. The move bolsters the company’s existing Viking light oil asset while complementing Saturn’s other core growth area, the Oxbow Asset, targeting Frobisher and Midale formations in Southeast Saskatchewan, building the company’s growing operations in Saskatchewan in size and scale even further.

Highlights:

The Viking acquisition increases Saturn’s 2022 Adjusted funds flow guidance to $2.71 per weighted average basic share over previous guidance of $2.48. With a full 12-month impact of the Viking acquisition, Saturn’s 2023 midpoint forecast of Adjusted funds flow is $223 million which equates to cash flow per basic share of $3.74.

This recently increased guidance indicates deep value potential with Saturn’s share price currently trading below the issue price of the $75 million bought deal closed in June 2022 at $2.75 per subscription receipt.

In periods of high oil prices, like what we are seeing today, there is potential for high cash netback generation with the Viking play, with short investment paybacks. Since the wells only run around 750 metres deep, Saturn Oil budgets wells with a low capex requirement of only $1.2 million. The Viking acquisition came with 186 gross (146 net) sections with high working interest (79 per cent average) in a coveted region of the Viking light oil fairway. The newly acquired acreage contains 138 (gross) booked Viking drilling locations which deliver a 200%+ rate of return based on WTI oil prices of USD 95 /bbl.

Management commentary:

In a media release on this news, Saturn Oil’s Chief Executive Officer, John Jeffrey called this transaction another critical milestone for the company as we execute our strategy of building a scalable portfolio of free cash flow generating assets that support both near and longer-term development, while also diversifying our production exposure across multiple highly economic plays to enhance our sustainability.

“This Viking Acquisition allows Saturn to bring proven expertise in the efficient and responsible development of Viking light oil plays and benefit from additional size and scale to further improve our already low-cost structure and streamlined operations. Upon closing of the Viking Acquisition, we forecast run rate production volumes of approximately 11,400 boe/d (96 per cent crude oil and natural gas liquids), positioning Saturn to generate strong free cash flow which can be directed to debt repayment and future growth opportunities that can enhance shareholder returns.”

Investment summary:

This acquisition by Saturn Oil and Gas is notable as it aims to generate high cash flow at various commodity price levels.

The expansion of the production base and diversification is expected to enable the company to capture operating efficiencies and realize high facility utilization which can result in fixed and variable costs being allocated over larger per unit volumes of production.

News of this transaction and increased production size is likely to generate interest from the investment community. Those in the know today would be wise to deepen their due diligence into SOIL.

For full details on this transaction, and about the company, visit saturnoil.com.

FULL DISCLOSURE: This is a paid article produced by The Market Herald.