Investments in the iron ore sector might not be at the top of everyone’s mind, but the commodity is a lot more versatile and integral to our daily lives than one might think. With the Company’s maiden mineral resource estimate now only weeks away, there is lots to get excited about.

Meet High Tide Resources Corp. (CSE:HTRC), a Canadian-based mining company that is focused on developing advanced-stage iron ore and battery metals projects. As it currently stands, High Tide Resources is earning a 100 per cent interest in the Labrador West Iron Project located near Labrador City, Labrador.

High Tide Resources, which only went public in early 2022, was spun out of a company called Avidian Gold in order to separate the assets by keeping the precious metals in the United States with one company and the base metal projects with the other that are in Eastern Canada.

In an interview with The Market Herald, High Tide Resources’ Director & Interim CEO Steve Roebuck explained that the company’s interest in iron ore is partly because it is one of the most essential commodities and the fact that it is an “often overlooked commodity.”

“[Iron ore] accounts for 93 per cent of all materials mined 2021 on a global basis,” he said. “[Iron ore] is absolutely critical and goes into almost everything we own.”

Roebuck said that what makes iron ore so important — and attractive for investors — is that it’s a commodity that’s in high demand and “isn’t something that will go away.”

Roebuck said what makes iron ore from the southern Labrador Trough a key ingredient in the low-carbon economy is its quality “there are 4 operating iron mines in the area that produce high-quality and low-impurity concentrates and pellets in the 65% to 66% Fe range. These products have a high iron content and are much cleaner than iron from Brazil and Australia and in high demand from steel makers throughout the world but especially North America and Europe but also Korea, Japan and China.”

“I think we are just on the cusp of a major change in the way iron ore and steel are mined and produced. Miners are reducing their carbon footprint by electrifying their fleet of trucks and shovels and how they produce concentrates and pellets, and the steel makers are shifting from BOF to DRI processes, and new technologies, especially green iron and green steel from Europe, are getting traction and attracting serious investment,” stated Roebuck.

Additionally, High Tide has also acquired mineral assets close to existing production infrastructure in world-class and development-friendly jurisdictions. Here, this enables the company to focus on essential commodities required for infrastructure development and renewable energy. As such, this puts High Tide in a strong position to rapidly advance its assets through strategic partnerships and project management.

As 2022 comes to a close, High Tide Resources is gearing up for a busy 2023 at its Labrador project and beyond — making the iron ore space an attractive investment opportunity.

The Labrador West Iron Project

Located in the southern Labrador Trough — which extends from the northern portion of Quebec to just slightly southwest of Labrador City — the belt spans 11,000 square kilometres and is home to billions of tons of iron and world-class miners like Rio Tinto IOC, ArcelorMittal, Tata Steel, Champion Iron and Tacora Resources Roebuck.

What makes the Labrador West Iron Project a special situation is its access and proximity to critical infrastructure like rail, rail to port, low-cost renewable hydro-electric power, roads, modern towns with highly skilled workers and very supportive local and provincial governments.

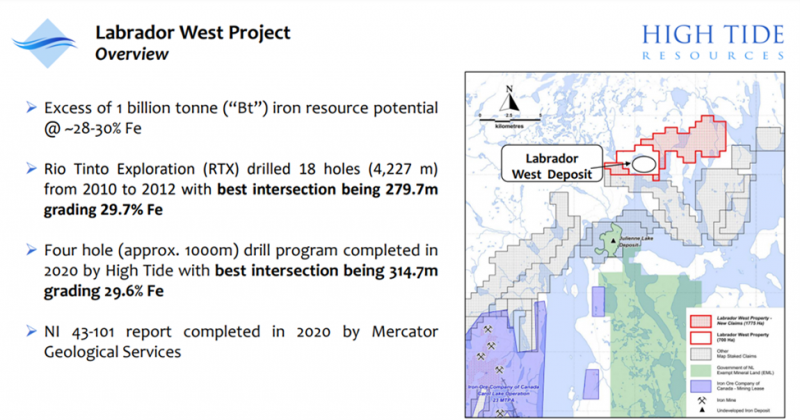

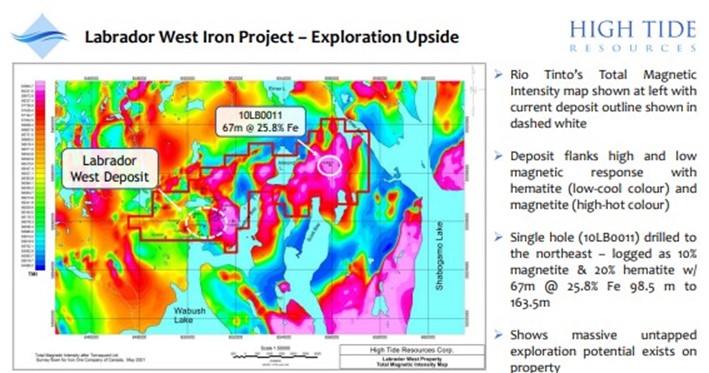

The company acquired the Labrador West Iron Project in August 2019 through an option agreement to acquire 100 per cent of the project from Altius Resources, a wholly-owned subsidiary of Altius Minerals Corporation. The property was previously explored and drilled by Rio Tinto Exploration, who invested over $5M between 2010 and 2012 and then by High Tide in 2020.

The property spans 2,475 hectares and sits 17 kilometres northwest of Iron Ore Company of Canada’s 23 million tonnes per year Carol Lake iron ore mining operation and six kilometres north of the Julienne Lake iron deposit.

In September 2019, the company staked an additional 71 mineral claims, which increased the property to its current size of 2,475 hectares.

In October 2022, High Tide reported its final drill results from the Labrador West Iron Project, which Roebuck said the company began in the late spring/early summer and drilled seven holes.

In total, 2,298 meters of core was drilled with ore-grade iron mineralization intersected in all seven HQ/NQ-diamond drill holes. The company said the 2022 drill program was intended to in-fill between recent and historical drill holes and test for depth and lateral continuity in anticipation of the main resource estimate. To date, roughly 7,500 meters have been drilled on the project.

“We are very pleased to report more significant iron intercepts from the important oxide-facies iron formation drilled at our Labrador West Iron Project. These results, and all previously reported assays along with metallurgical data, are now being used to refine our geological and lithological model and will be incorporated into the upcoming maiden mineral resource estimate.”

Roebuck told The Market Herald Canada that right now is an exciting time for the company and that the soon-to-be-released maiden mineral resource estimate will be a “big milestone” for High Tide Resources — which will give legitimacy to the project and be enticing to investors.

Company highlights

Although the company only went public in early 2022, that hasn’t stopped High Tide Resources from being busy. That being said, because the company was spun out from Avidian Gold, High Tide already had some legs that have enabled it to continue progressing on its projects.

At its Clearcut Lithium project in Quebec, High Tide Resources reported in October that it had completed a high-resolution heliborne magnetic and spectrum survey. The project, which spans 14,400 hectares, is located in the emerging Cadillac-Pontiac lithium camp just southwest of Val d’Or, Quebec.

In other words, High Tide Resources is just getting started with the Clearcut Lithium project, which is made up of 249 claims that are accessible by a network of logging roads that helps boost efficiency and reduce exploration costs.

“The Clearcut Lithium project in Quebec represents an exceptional opportunity for both High Tide and Avidian shareholders. Given the recent activity in the domestic and global lithium markets, with record high prices and very strong demand from the electric vehicle and battery storage markets, the company is well positioned to benefit from this massive increase in demand,” Roebuck said in a release.

The management team

Steve Roebuck, Director & Interim CEO

Steve Roebuck received his Bachelor of Science degree from Concordia University in 1994 and is a registered Professional Geoscientist with the Association of Professional Engineers and Geoscientists of Newfoundland and Labrador (PEGNL). Roebuck has an extensive background with open pit and underground production experience, having worked for Royal Oak Mines and BHP Billiton in the Northwest Territories and exploration experience working for Placer Dome, Aur Resources and Advanced Explorations Inc (iron ore) in Quebec and Nunavut. Roebuck has also taken on executive roles, having been President of Scorpio Gold and is currently President and CEO of Avidian Gold.

Donna R. McLean BA, CFO

Donna McLean has over 25 years of experience specializing in the areas of financial reporting, controls, and administration. Has held the positions of CFO and Controller for several mineral exploration companies, including Unigold, Intrepid Mines, Metalla Royalty & Streaming, Firestone Ventures, and Aurania Resources.

Stephen Altmann MBA, Chairman and Director

Stephen Altmann has over 30 years of experience and is currently a managing director of an investment banking advisory firm in Toronto, Ontario. Here, Altmann provides strategic advice and financial analysis to mining companies all around the world.

Dr. Joseph Poveromo, Director

Dr. Joseph Poveromo received his Bachelor of Science in Chemical Engineering from RPI in 1968 and his MSc. (1971) and Ph.D. (1974) in Chemical Engineering from SUNY (Buffalo). He is President of Raw Materials & Ironmaking Global Consulting. Joe is an internationally recognized steel industry authority on the technical and economic aspects of ironmaking (blast furnace and direct reduction), ironmaking raw materials (iron ore, coke) including sintering and pelletizing processes, iron ore mining, processing & properties, steelmaking metallics (merchant pig iron, DRI, HBI). Joe has extensive experience working in the Labrador Trough, having worked for 15 years with ArcelorMittal Canada (the former Quebec Cartier Mining Company) as Director of Technology-International. During his time with Bethlehem Steel, he served on the Technical Committee of IOC (Iron Ore Company of Canada). More recently, he has advised on a number of iron ore operations and projects in the region.

Carol Seymour BSc, P. Geo, Director

Carol Seymour received a Bachelor of Science degree with Honors from the Memorial University of Newfoundland in 2003. Since this time, she has been working as a geologist with Canadian junior mineral exploration companies, where she has gained valuable work experience both in Canada and internationally in the mineral exploration field. Seymour is a registered Professional Geoscientist with the Association of Professional Engineers and Geoscientists of Newfoundland and Labrador (PEGNL) and currently works as a senior geologist with Altius Resources Inc. Through her role with Altius and internships at the Iron Ore Company of Canada, Seymour has gained extensive experience working throughout the Labrador Trough on various iron ore exploration projects and was the project geologist for Altius’ Kami and Julienne Lake iron ore projects.

Serge Pelletier BSc, Independent Director

Serge Pelletier is a veteran mining engineer who graduated from the Montana School of Mines in 1994. Upon graduation, Serge joined BHP World Minerals at its New Mexico Operations. Following two years in New Mexico, Serge and his family moved around the world for BHP; Mali, Australia, Canada (NWT), South Africa, Canada (Saskatoon), US (Houston) before retiring in 2016 as the Manager of North America Closed Sites.

In 2018, he took over the Reconstruction Office in Lac-Megantic, Quebec, to help rebuild the town after the train derailment disaster of 2013. During his career, Serge was involved in large mature mines, small operations, corporate offices, and exploration projects. During his tenure with BHP, Serge worked extensively in community relations with multiple stakeholders, including municipal, provincial, state, and federal governments, including First Nations.

The investment corner

As of the time of this writing, High Tide Resources has a market capitalization of just under C$8 million, a share price of $0.11, and 72.4M shares outstanding.

With the global iron ore market estimated to reach 2.7 billion tons by 2026, growing at a compound annual growth rate of 3.7 per cent during the forecast period, companies like High Tide Resources will be ones to watch for going into 2023 and well beyond that.

Thanks to its experienced management team and board of directors, High Tide Resources sets itself apart from the rest in the space, and with its ideal location in the heart of Labrador, the company and its investors have a lot to gain.

For more information, please visit hightideresources.com

FULL DISCLOSURE: This is a paid article by The Market Herald.