Investors looking for a value-based company with projects located in Colombia’s richest gold and silver regions should look no further than this company led by an experienced management team.

Headquartered out of Vancouver, BC, Baroyeca Gold & Silver Inc. (TSXV:BGS, OTC Pink: BRYGF, Forum) is focused on Colombia because of its top-tier ranking when it comes to conducting business in Latin America. In line with this, Colombia is also a global leader for mineral exploration and discovery where roughly 50 million new resource ounces have been discovered in the last 15 years.

In order to move forward with its operations, the company has commenced a non-brokered private placement worth $2 million at $.10 per share with a full warrant at $0.20 per share for two years.

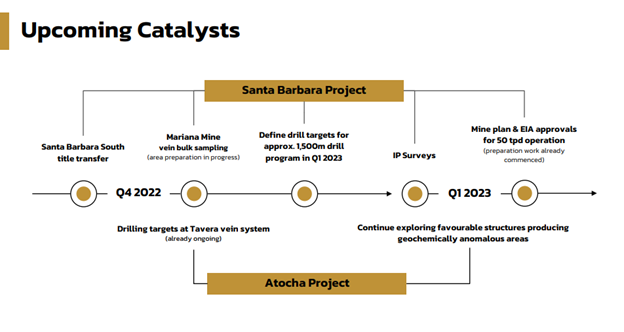

The funds will be used to continue development work at the company’s Santa Barbara gold project, including initiating a 1,500-meter drill program to extend the known high-grade gold mineralization under the Santa Barbara 1 and 2 veins and under the historic Mariana mine works.

The company said it will also be advancing the Atocha silver project and the Zapatoca copper project by mapping and prospecting to develop targets for upcoming drill programs.

Highlights

At Santa Barbara, exploratory drifting continued following vein #1 from the crosscut towards the Southwest. The vein in this interval splits into two parallel veins where the southernmost branch of the vein (Vein A) averages 17.08 g/t Au for a sampled length of 18.8 m and the parallel (Vein B) averages 25.85 g/t Au over a sampled length of 19m for a combined weighed average of 21.42 g/t Au over 0.4m in the entire interval. Channel sampling on Vein #2 average 30.99 g/t Au and 67.51 g/t Ag.

The Atocha project consists of 2,585 hectares of highly prospective ground in northern Tolima, an area that has excellent accessibility, favorable topography and working conditions.

The first holes drilled on Atocha targeted the La Ye vein system and successfully identified and delineated the first mineralized zone. In those initial 13 drill holes, Baroyeca hit a series of high-grade intercepts including 2,233g/t AgEq (2.3 kilos per tonne) over 0.80m, 1,137g/t AgEq over 0.50m and 981g/t AgEq over 0.40m and encountered more than 25 intercepts returning over 200g/t AgEq at La Ye, with a weighted average grade of 570g/t AgEq (7.6 AuEq g/t) over an average intercept width of 0.50 metres.

Drilling to date has tested 1,000m along strike to shallow depths in small step outs, demonstrating the continuity of the silver and gold mineralization and the consistency of high grades across a growing vein system with a second shoot at La Ye West. Drill holes of this Phase 2 program continued delineating the boundaries of the mineralized shoot intersecting multiple sets of stacked veins. Holes returned intersects as high as 0.40m of 986.58 g/t AgEq, 0.25m of 648.88 g/t AgEq, and 447.38 g/t AgEq over 0.65m among other proving the consistency of the Ag-Au mineralization over regional structures.

At Zapatoca, Baroyeca is the first mover in the Santander Jurassic basin making a true discovery of stratiform “Kupferschiefer” copper mineralization, securing over 4,000ha of ground, extending Colombia’s copper potential from the emerging world-class copper district in Cesar to this new area.

Baroyeca Gold & Silver is a Canadian-based company focused on the exploration of precious metals projects in Colombia. In addition, the company is also a member of the Discovery Group, which is an alliance of public companies focused on the advancement of mineral exploration and mining projects that have proven track records of generating shareholder value through responsible, sustainable and innovative development.

To view or participate in the Baroyeca Gold & Silver. Deal Room offering, click here.

Baroyeca’s President, Raul Sanbria, discusses the private placement and plans in this interview.

The Deal Room is your destination to participate in exclusive financings, featuring some of the best companies – and deals – currently available on the market.

FULL DISCLOSURE: The Market Herald is not registered as a broker, dealer, exempt market dealer, or any other registrant in any securities regulatory jurisdiction and will not be performing any registerable activity as defined by the applicable regulatory bodies. This deal room is for informational purposes only and does not constitute an offer to sell or a solicitation to buy the securities referred to herein. Offers to sell, or the solicitations of offers to buy, any security can only be made through official offering documents that contain important information about risks, fees, and expenses. The information contained in this deal room is selective and does not purport to contain all the information relating Baroyeca Gold & Silver. in all cases, parties should conduct their own investigation and due diligence, not rely solely on the data provided herein and are encouraged to consult with a financial adviser, lawyer, accountant, and any other professional that can help to understand and assess the risks associated with any investment opportunity.

FULL DISCLOSURE: This is a paid article produced by The Market Herald Canada