- HIVE (HIVE) is announcing record revenue of US$211M for fiscal 2022

- The figure is up 212 per cent YoY with net income up over 3x

- The company’s milestone year was aided by 545-per-cent growth in BTC hashrate and 225-per-cent growth in ETH hashrate YoY

- HIVE Blockchain Technologies mines for Bitcoin and Ethereum with facilities in Canada, Sweden and Iceland

- HIVE (HIVE) Stock closed up by 7.77 per cent trading at $5.55 per share

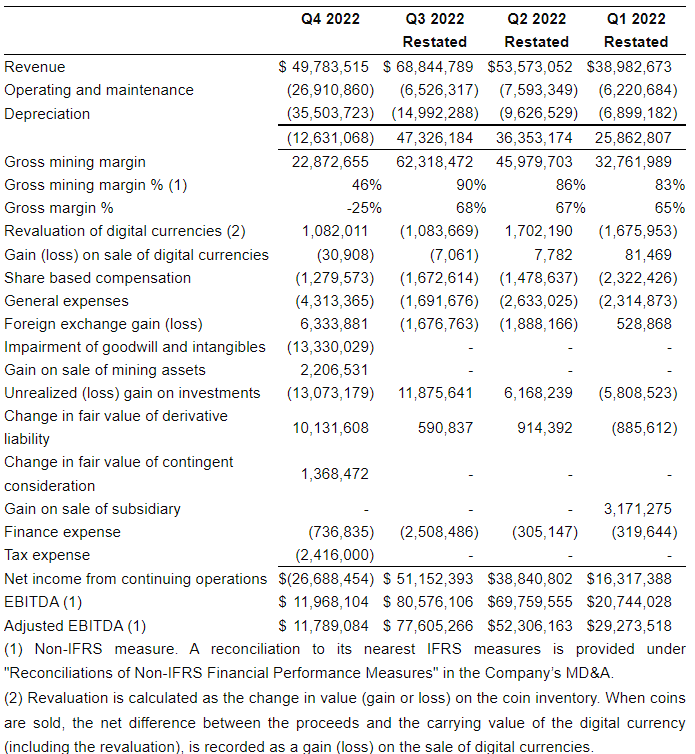

HIVE (HIVE) is announcing record revenue of US$211M for fiscal 2022.

Revenue increased by 212 per cent YoY primarily due to increased production of Ethereum and Bitcoin from mining expansion.

Gross mining margin improvement was primarily due to the acquisition and expansion of HIVE’s New Brunswick Datacentre in April 2021, which resulted in significant increases in Bitcoin hashpower and Bitcoin rewards.

Net income was US$79.6M, or US$1.02 per share, up from US$24.1M, or US$0.35 per share in fiscal 2021, driven primarily by gross mining margin improvement, higher Ethereum and Bitcoin prices, additional hashpower from the New Brunswick facility, gains on the sale of digital currencies, and foreign exchange.

Working capital increased by US$76.5M for the fiscal year with total digital currency assets of US$170M at year end.

Over fiscal 2022, HIVE grew from 310 PH/s of Bitcoin mining and 2,700 GH/s of ETH mining as of March 31, 2021, to a milestone of 2 Exahash and 6,100 GH/s as of March 2022. This represents a 545-per-cent growth in BTC hashrate and a 225-per-cent growth in ETH hashrate YoY.

The company recorded 4,511 Bitcoin equivalents (2,368 Bitcoin and 32,397 Ethereum equivalents) mined in fiscal 2022.

It also paid down its debt by over US$5.5M by fiscal year end.

HIVE Blockchain Technologies mines for Bitcoin and Ethereum with facilities in Canada, Sweden and Iceland.

HIVE (HIVE) closed up by 7.77 per cent trading at $5.55 per share.