The mindless, algorithm-driven selloff in markets has exposed a lot of overvalued market darlings. It’s also taken many strong and well-run public companies to incredibly attractive valuations.

A good example of the latter group of companies is Vertex Resource Group (TSXV:VTX).

What has this Company done lately?

In its just-announced third quarter results for 2022, Vertex Resource Group reported:

- 40% gain in revenue, both q-o-q and y-o-y

- 36% gain in adjusted EBITDA q-o-q (24% gain y-o-y)

- 32% gain in Gross Profit q-o-q (26% gain y-o-y)

These are not merely excellent operating results. Vertex Resources is also clearly turning the corner on its balance sheet.

Net income for the first 9 months of 2022 has increased (y-o-y) from CAD$0.3 million to CAD$3.7 million. That’s a jump of more than 1100%.

Free cash flow has increased y-o-y from CAD$17.6 million to CAD$21.6 million. That’s an increase of ~23%.

Some investors seeing these quarterly results may be experiencing a sense of déjà vu. That’s understandable.

In Q2, Vertex also reported record revenue and record adjusted EBITDA Year-over-year, net income jumped 700% in the second quarter.

The Company preceded that with an announcement of record revenue in its first quarter of 2022. String together three consecutive quarters of record revenue and that will quickly get the attention of savvy investors.

Vertex Resource Group “has been a leading North American provider of environmental and industrial services” since 1962. The Company provides these services for clients in oil & gas, oilsands, agriculture, forestry and mining. Vertex also serves many industrial clients.

Today, the focus on better environmental management has never been greater. And after a long commodities trough, many, including Wells Fargo, are seeing a new “super cycle” emerging in many commodity markets

The new commodity super cycle bull

Vertex Resource Group is extremely well-positioned for the global economy of 2022. The Company is taking advantage of this positioning with very strong execution.

An integral part of this execution has been key acquisitions. On April 25, 2022, Vertex completed its acquisition of Cordy Oilfield Services. On September 30, 2022, Vertex announced acquiring Young EnergyServe Inc.

Cordy Oilfield Services provides construction and environmental services in western Canada. Highly complimentary to Vertex’s business model.

Young EnergyServe provides “turnkey turnaround solutions, cutting-edge robotic tank cleaning services, and various other industrial services throughout Canada.” This adds a new dimension to the Vertex business model.

The synergies from the Cordy acquisition will already be starting to show up in the Company’s results. The operational gains from the acquisition of Young won’t begin to be realized until the following quarter.

Not surprisingly, the “outlook” that Vertex provided to investors in its Q3 results is for more blue sky.

2022 continues to exceed our expectations with excellent third quarter results being driven by operational efficiencies, realized synergies from our previous acquisitions including the acquisition of Cordy Oilfield Services Inc. during the second quarter of 2022, strong, stable commodity pricing, as well as the gradual return to pre-COVID activity levels across other industries. Our outlook for the 4th quarter of 2022 and 2023 is that North American economies will continue to benefit from favourable commodity prices in energy, utilities, agriculture, and forestry. In addition, we have major capital projects from multiple midstream, utilities/telecommunications, municipal infrastructure, and energy transition projects in 2022 and 2023.

Fueling continued top-line and bottom-line growth for Vertex, the Company’s working capital has risen to CAD$13.7 million, nearly double what Vertex reported the previous quarter.

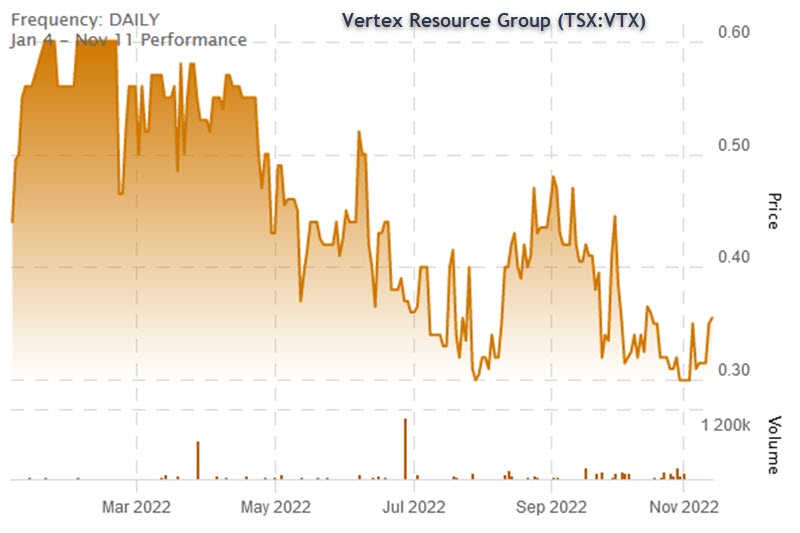

Now take a look at the year-to-date chart for Vertex Resource Group.

The Company has reported record after record after record in its quarterly results for 2022. Its outlook is for more of the same.

Buy low, sell high. That’s how investors make money. The tricky part is recognizing which (good) companies are genuinely trading “low”.

That’s not just a buying opportunity for investors. This is a steal.

DISCLOSURE: This is a paid article of The Market Herald.