- Grande Portage Resources (TSXV:GPG) is ready to commence its latest round of drilling at the Herbert high-grade gold project in Alaska.

- The company has enlisted Timberline Drilling for up to 15,000 feet of exploration at the property.

- The upcoming program will focus on the Goat, Main, and Deep Trench veins, testing the mineralisation further east and at depth.

- Drilling will also test the aptly named Elusive vein, which the company only recently identified through LiDAR surveying, as well as the Floyd vein.

Grande Portage Resources (TSXV:GPG) has a resource calculation of almost 1M ozs of gold and previously drilled high grade gold numbers.

The company last drilled in 2018 so, this is a story not many know of yet which should change as the company moves forward in 2020.

Grande Portage Resources is ready to commence its latest round of drilling at the Herbert high-grade gold project in Alaska.

As summer rolls into the region, Grande Portage has begun mobilising crews and preparing drills, ready to start up a new season of exploration. Drilling is expected to start this week.

Located just 25 kilometres from the state capital Juneau, the property lies along the prolific Juneau Gold Belt, which stretches 160 kilometres in length.

To date, mining activity at the belt has produced many millions of ounces of gold. Despite this, the surrounding area remains vastly underexplored and Grande Portage hopes to develop a strong gold-producing site in the historic region.

Drilling was set to commence around mid-July, however Grande Portage expects to begin work ahead of schedule now that the relevant permits have been obtained for the summer season’s work.

As a reminder to investors, past drilling has yielded very encouraging results including numerous multi ounce assays on several veins including those listed below:

- 37.07 g/t Au over 15.27 meters (Deep Trench vein)

- 59.91 g/t Au over 8.08 meters (Deep Trench vein)

- 30.24 g/t Au over 9.08 meters (Goat Creek vein)

- 28.41 g/t Au over 11.58 meters (Deep Trench vein)

- 21.55 g/t Au over 6.46 meters (Main vein)

- 15.76 g/t Au over 2.81 meters (Goat Creek vein)

- 21.22 g/t Au over 2.25 meters (Main vein)

- 13.91 g/t Au over 3.12 meters (Main vein)

The above mentioned are reported as true widths.

The company has enlisted Timberline Drilling for up to 15,000 feet of exploration at the property. Timberline is experienced in the region and already has been drilling this style of rock for many years.

Timberline’s teams are free from COVID-19 restrictions, as case numbers in Alaska remain low compared to the rest of the U.S., an enviable position considering the tight regulations constraining the industry globally.

President and CEO of Grande Portage, Ian Klassen, believes Timberline is a great choice to expand the already established exploration footprint at Herbert.

“We’ve got a first-class experienced drill partner in Timberline and are fortunate to be operating in a supportive jurisdiction which has done an excellent job of controlling the spread of COVID-19,” he said.

The upcoming program will focus on the Goat, Main, and Deep Trench veins, testing the mineralisation further east and deeper than ever before.

The Deep Trench vein has already proven to be a promising exploration target, returning assays up to 59.91 grams per tonne of gold over 8.08 metresand 37.07 grams per tonne of gold over 15.27 metres.

The Goat and Main veins have also returned respectable assays, including 30.24 grams per tonne over 9.08 metres and 21.55 grams per tonne over 6.46 metres.

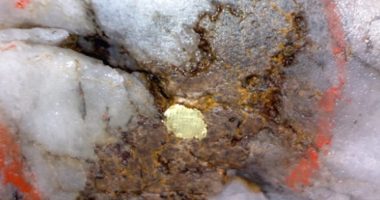

All drilling will be expansion step out drilling. Perhaps most interesting are the plans to test the aptly named Elusive vein, which the company only recently identified through LiDAR surveying. This vein has been followed up on the ground and visible gold can be seen in the quartz at surface. The Elusive vein is the first to be drill tested of the 16 new structures identified from the company’s 2018 LiDAR survey. The company will be eagerly awaiting a chance to examine an untested area of mineralisation, which could potentially expand the site’s known resource.

The most recent estimate calculated the site’s indicated resource at 606,500 ounces of gold with an average grade of 10.03 grams per tonne, with a further 251,700 ounces of inferred resource at a higher grade of 14.15 grams per tonne.

Grande Portage has already fully financed the project, in part through a recent share offer which raised just over C$1,500,000 in net proceeds.

Much like the region itself, Grande Portage has remained resilient through the COVID-19 pandemic and its market performance has reflected the excitement surrounding the Herbert gold project.

The company’s market capitalisation has undergone a startling recovery over the last few months and is currently trading higher than it was before the onset of the pandemic.

Earlier this month, Grande Portage’s share price staged a week-long climb, jumping more than a third and has continued to rise since.

The recovery is, in part, due to gold’s astonishing performance during the pandemic, GPG’s past drilling success and the anticipating of drills turning this summer.

As market volatility has swept the world, investors have sought out traditional safe havens, gold being chief among them. Consequently, companies like Grand Portage have seen renewed interest as the rising gold price improves mining logistics and potential returns.

This effect has been even more noticeable in Canada, where notable gold-bull and billionaire Eric Sprott has recently been reinvesting heavily into Canadian gold mining and exploration companies.

With a strong gold price and a prospective gold project in a mineral-rich region, Grande Portage and its investors will be eagerly awaiting results and revelations from the summer drill program.