- Gran Columbia Gold Corp (TSX:GCM) provided COVID-19 update

- A business continuity plan was enacted, with most head office functions to be maintained remotely

- Gran Colombia is working with suppliers to ensure they have mitigation plans in place to minimise risk

- The company has increase its equity stake in Caldas Gold (TSXV:CGC) to 74.4 per cent

- Gran Columbia Gold (GCM) is trading for C$3.73 per share up 4.19 per cent with a market cap of $236.4 million

Gran Colombia Gold Corp (TSX:GCM) has announced that COVID-19 has not affected production and the company does not expect it will.

The Canada based Colombian gold and silver miner has activated their business continuity program to ensure head office functions are maintained during the pandemic.

Travel restrictions are also in place.

This is in line with a host of other companies’ announcements today, as resources companies around the world start to shut down access to sites to prevent the spread of infection.

Gran Colombia are adamant that COVID-19 has not had a significant negative impact on, or disruption of, the Company’s supply chain.

The company is however working with its suppliers to ensure their mitigation plans are also in place, to ensure the continuity of critical supplies during the crisis.

Serafino Iacono Executive Chairman of Gran Colombia said the health and well-being of his employees was of the utmost importance.

“These are unprecedented times.

“As that markets have experienced tremendous upheaval over the last week, we have also received many inbound enquiries from our concerned investors,” he said.

Gran Colombia has also acquired an aggregate of 1,295,100 shares of Caldas Gold (TSX:GCM) at a price of C$1.89 per share in the open market from February 28 to March 16.

This purchase has cost the company some $2.4 million, as the company increase their share stake in the Canadian Gold miner to 37,545,200.

“We have been making purchases of common shares in Caldas Gold Corp to support our position in the Marmato Project” he said.

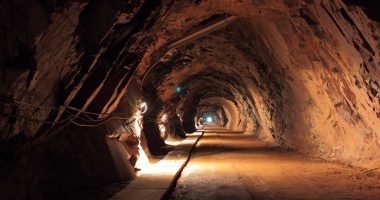

The Marmato Project is a large underground mining operation in central Colombia.

Caldas are currently completing a pre-feasibility accessing the viability of a major expansion and modernisation of the mine.

Gran Columbia Gold Corp (GCM) are currently trading at $3.66 per share up 2.2 per cent at market close.