- good natured Products (GDNP) has announced unaudited preliminary results for Q2 2022

- It expects to roughly double revenue YoY with a gross margin of 24-26 per cent within its targeted range

- CEO Paul Antoniadis sat down with Dave Jackson to discuss the results

- good natured Products offers a broad assortment of plant-based products made from rapidly renewable resources instead of fossil fuels

- good natured Products Inc. (GDNP) opened trading at C$0.405

good natured Products (GDNP) has announced unaudited preliminary results for Q2 2022.

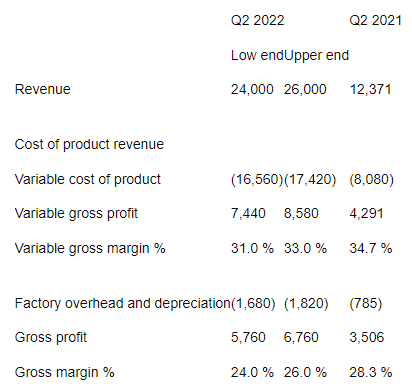

It anticipates the following figures:

- Revenue between $24M and $26M, up approximately 95-110 per cent YoY

- Variable gross margin between 31-33 per cent compared to 34.7 per cent for Q2 2021

- Gross margin between 24-26 per cent compared to 28.3 per cent for Q2 2021

Revenue growth was driven by strong organic growth from new customers, increases in average selling price per unit and contributions from the Ex-Tech Plastics acquisition finalized in May 2021.

CEO Paul Antoniadis sat down with Dave Jackson to discuss the results.

“I’m very pleased with the strong results that our good natured team delivered in the second quarter. Overall, customer demand for our sustainable, earth-friendly products continues to be robust, and we remain highly focused on servicing our customers with strong operational execution.”

good natured Products offers a broad assortment of plant-based products made from rapidly renewable resources instead of fossil fuels.

good natured Products Inc. (GDNP) opened trading at C$0.405.