“Gold rush.”

Even if you’re not a mining investor, the two words conjure up visions of prospectors panning for alluvial gold. Many made their fortunes doing so.

In Australia, a gold rush began in the 1850s, in the state of Victoria. It spread to other states across the country, then petered-out almost as suddenly as it began early in the next century.

Today, there is a new gold rush in Australia. But it’s not prospectors dredging rivers. Mining companies from around the world are flocking to Australia, looking for gold.

One junior gold exploration company that has taken a particularly strategic and cost-effective approach to capitalizing on Australia’s new gold rush is Roo Gold Inc. (CSE:ROO / OTC:JNCCF). More on this later.

The easy-to-access alluvial gold in Australia is gone. So mining companies are bringing with them modern mining exploration technology, scratching beneath the surface of these gold-rich districts – to find all of the gold that was missed in the first gold rush.

There is a lot of gold to be found.

In recent years, Australia has risen to become the world’s 2nd largest gold-producing nation, behind only China – and nearly double the annual production of #3 producer, Russia.

Australia produces close to 10,000 tonnes of gold per year, representing ~10% of the global supply of gold.

It takes more than merely an abundance of gold-rich ore to reach this level of production.

Australia is a global leader in the production of a number of metals. On top of its resource riches, this is a very mining-friendly jurisdiction that boasts an abundance of supportive infrastructure.

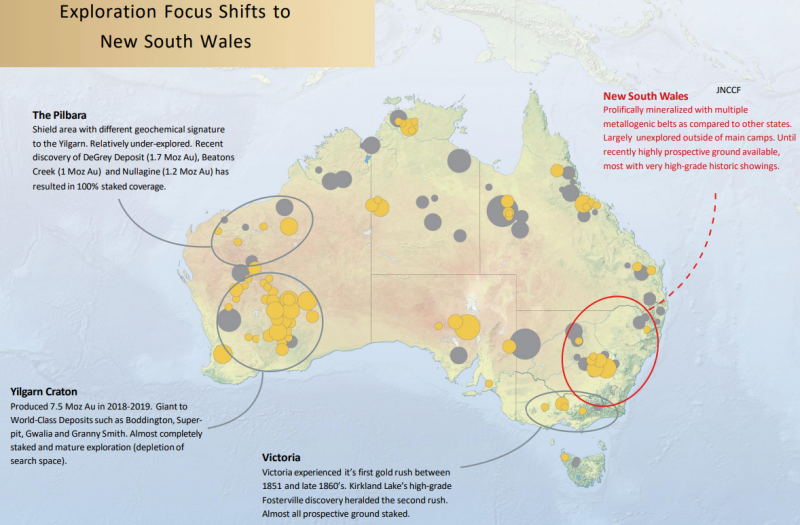

To understand the exploration strategy of Roo Gold, it’s important for investors to take a closer look at New South Wales, Roo Gold’s base of operations.

To gain a better insight here, The Market Herald sat down with Dr Chris Wilson, currently a Technical Advisor with the Company. With a PhD in geology, Wilson’s 30+ year career as a geologist spans more than 70 countries.

Among his resume credits, while with Ivanhoe Mines, Chris Wilson was part of the exploration team that discovered the legendary Oyu Tolgoi copper/gold deposit (and now mine), in Mongolia.

Wilson knows his geology. His enthusiasm was evident as he began talking about gold prospects in New South Wales, in general, and Roo Gold’s huge land packages, in particular.

Why New South Wales?

Dr. Wilson started off by pointing out that this state of Australia is “under-explored” for gold. That may or may not be a good thing. It might indicate that there isn’t much gold to be found.

Then Wilson mentioned that New South Wales has been the 2nd largest gold-producing state (for the world’s 2nd largest gold producer). Lots of gold.

New South Wales is under-explored and hosting lots of gold. That should start to whet the appetite of experienced gold mining investors.

It gets better. For Roo Gold shareholders, “under-explored” equates to cost-effective exploration. Again, Chris Wilson offered additional insights.

Strewn across Australia and the remnants of the first gold rush are “historical gold workings”. These are abandoned mine sites (and other exploration “prospects”). Generally crude and small-scale operations, but boasting very high grades of gold – as well as other metals. More on that later.

These sites are now the primary focal points for the dozens of mining companies participating in the new Australian gold rush.

In the more heavily explored states (and gold districts), pretty much all of these historical workings have already been claimed. For new mining companies looking to make their fortune, they first need to raise capital to buy such mining concessions.

Not in New South Wales. Wilson explained that in this under-explored state, most of the historical workings were still wide open for staking and claiming.

Not any longer.

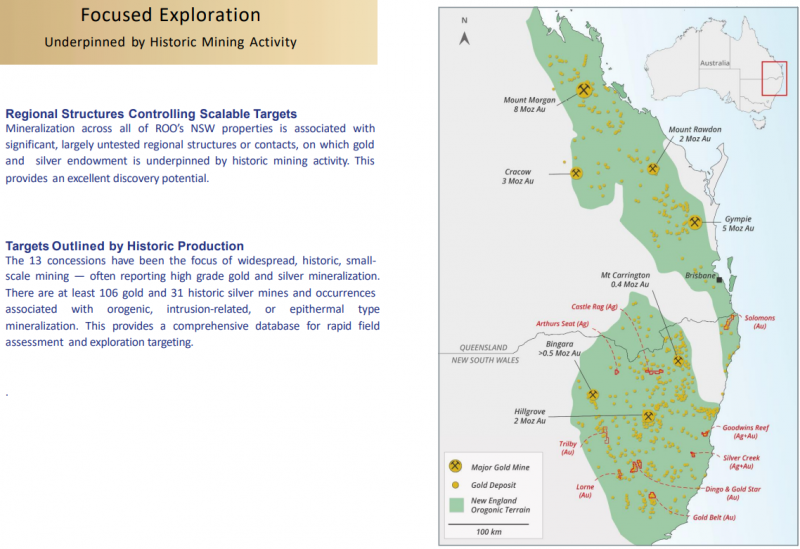

Today, Roo Gold has consolidated many of these historical sites that are prospective for gold exploration. It sits with an overall land package of 1,380 km2, staked-and-claimed concessions for which the Company now holds 100% ownership.

Mining investors can be somewhat cynical regarding junior exploration companies that have staked out large land packages. The derogatory term often tossed out to describe such holdings is “moose pastures”.

Roo Gold’s 13 concessions contain >130 “high grade historical precious metals mines and prospects”.

Historic, small-scale production on these concessions yielded grades as high as 132 g/t gold and 1,648 g/t silver. Across the state itself, New South Wales has a current gold endowment in excess of 100 million ounces.

Not moose pastures.

These are large, low-cost concessions that are known to host high-grade gold and silver. As Dr. Wilson explained, this is the first thing a junior mining company can do to de-risk its operations: acquire multiple prospective properties, at minimal cost.

Top-tier projects are kept and explored. Second-tier projects can be farmed out (to later arrivals in the jurisdiction), offering the potential for some early revenue generation. More de-risking.

The second thing that a junior exploration company can do to reduce shareholder risk is to be methodical in its field work and early exploration before bringing in a drill rig.

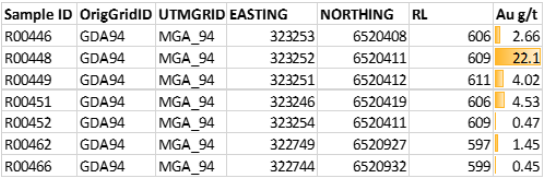

This is where Roo Gold currently sits in its path to development. On August 23, 2022, Roo Gold announced sampling results from its Lorne Gold Project.

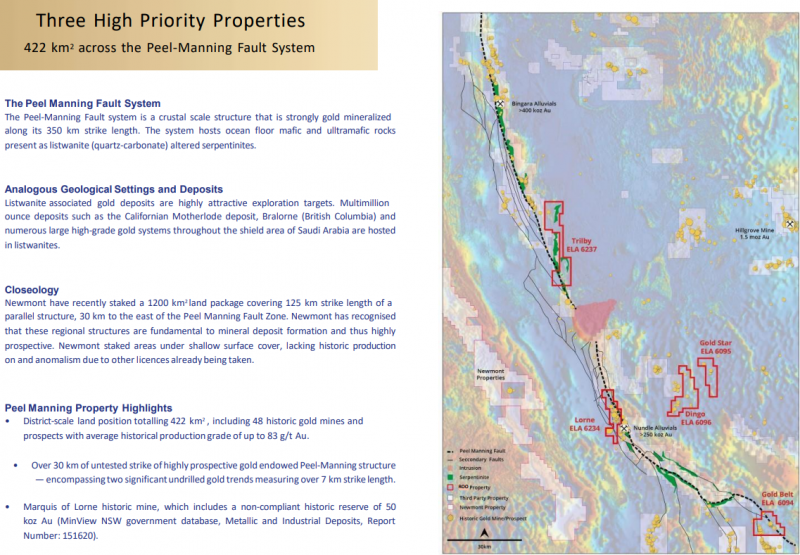

This is one of three high-priority properties for the Company (along with the Trilby and Gold Belt Projects) that are situated along the Peel-Manning fault structure.

Experienced mining investors understand that such fault structures are especially prospective for significant metals discoveries – of whatever mineralization is hosted in the local geology.

Roo Gold currently sits with 422 km2 of land holdings within this prospective geological formation. The Lorne Project, itself, contains 12 kilometers of strike length along the Peel-Manning formation.

Preliminary sampling at Lorne (22 rock samples) has confirmed gold mineralization being broadly distributed through, in particular, the Brands Reef and Norton Mine Prospects.

Gold assay results of up to 22.1 g/t Au have been identified. Highlights are below.

President and CEO, Carlos Espinosa, shared some insights with investors.

“The first pass prospect sampling at our Lorne Project has returned several high-grade gold results from historical workings that confirms the potential for significant mineralization. We have identified numerous other highly prospective gold targets within this tenement covering a further 10 km strike distance that our field team is looking to sample as soon as access is available.”

Dr. Wilson explained to The Market Herald that the geology here is very similar to that of some major high-grade gold discoveries in North America that may be more familiar to investors.

Both the California Motherlode and Bralorne (B.C.) high-grade gold deposits exhibit the same geological traits of “ocean-floor mafic and ultramafic rocks altered to listwanite (quartz-carbonate) altered serpentinites”.

Of Roo Gold’s 13 large concessions in New South Wales, 9 are gold concessions (gold mineralization is dominant) and 4 are silver concessions (primary silver mineralization with secondary gold mineralization).

Chris Wilson explained that management’s strategy when they began researching New South Wales’ very comprehensive mining registry was to be alert for any strong candidates for commercial mineral deposits.

When the Company uncovered several regions of silver-rich mineralization that also hosted substantial gold credits, it was a no-brainer to stake out those additional concessions.

At current prices for silver, primary silver deposits are very scarce – not just in Australia but most of the world. Even if management decides not to develop these silver concessions, the Company still views them as valuable assets.

Top of the list is the Castle Rag concession.

This 135 km2 land package is known to host 11 historic silver/gold mines and prospects. This includes the Castle Rag silver mine, which boasted grades that exceeded 1,200 g/t Ag while in production.

Goodwin’s Reef is a 71 km2 concession that also hosted 11 silver/gold mines and prospects. Historical assays registered grades of up 18,000 g/t Ag. Roo Gold has identified over 15 km of strike length of highly prospective but untested geology within this concession.

Silver is required in enormous quantities to fuel the expansion of solar power. It is the world’s most-versatile industrial metal. Yet silver also retains huge global investment and jewelry demand – reflecting its status as a precious metal.

For most investors, however, the appeal of Roo Gold will be its gold concessions, in a world where the importance of gold is once again asserting itself.

Today, inflation is spiraling higher globally. Inflation numbers are at 40+ year highs.

One nation that is no stranger to spiraling inflation is Zimbabwe. When its own currency was destroyed by hyperinflation, Zimbabwe turned to stronger currencies (such as the U.S. dollar) as a partial shelter against inflation.

Today, all currencies are depreciating rapidly, including the U.S. dollar.

Recognizing this trend, the government of Zimbabwe has begun minting its own gold coins, to protect its citizens from the ravages of inflation, even when holding once-stable U.S. dollars.

With UK inflation just coming out at a blistering reading of 10+%, savvy investors may look at this temporary pull-back in the price of gold (and gold mining stocks) as a superb opportunity to increase gold exposure.

Gold bullion is traditionally the most direct shelter versus inflation. However, gold mining stocks (like all commodity producers) leverage gains in the price of gold – thus offering even greater investment potential.

Roo Gold is a junior gold exploration company with several qualities to entice investors interested in the home-run potential of early-stage gold exploration, in addition to the sheer size of its 100%-owned mining concessions.

- A superior mining jurisdiction (the world’s #2 gold producer).

- Strategically positioned in gold-rich but under-explored concessions.

- Cost-effective strategy for building shareholder value.

- A management team with broad experience in and a deep understanding of gold exploration.

Gold is a go-to asset class in today’s high-inflation environment. Roo Gold is a junior gold explorer currently priced as a microcap, but positioned for major discoveries in Australia’s second gold rush.

FULL DISCLOSURE: This is a paid article of The Market Herald