2020 was a good year for gold. It was one of the best performing assets due to a mix of high risk, low interest rates and positive price momentum – particularly during the latter half of the year. Investors are predicting this momentum to continue into 2021. Some major banks like Goldman Sachs, Commerzbank and CIBC are predicting that gold could reach $2,300 an ounce this year.

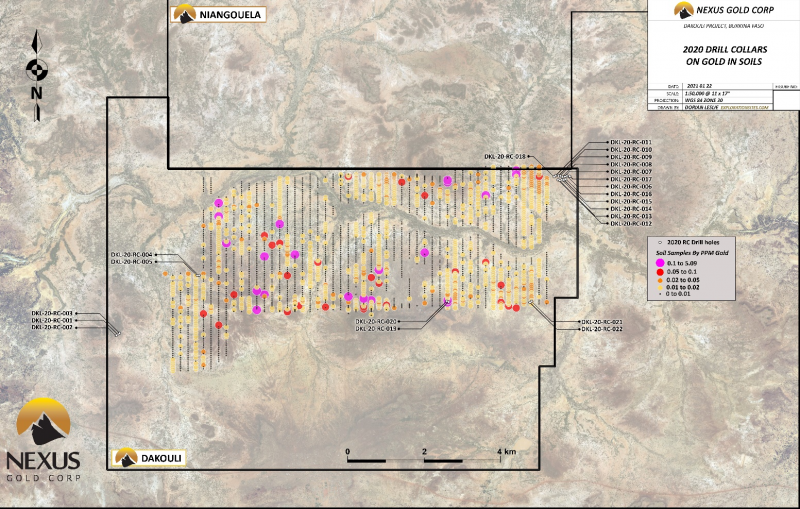

With these projections, and the latest findings from a Canadian gold explorer, it seems like a good time to be in the gold business. On January 26, Nexus Gold Corp. (TSX-V: NXS, OTC: NXXGF, Forum), reported initial results at its 100 per cent owned Dakouli 2 gold project in Burkina Faso, West Africa.

The Dakouli 2 exploration permit is a 98-sq km gold exploration property located approximately 100 kilometers north of the capital city, Ouagadougou. The project also has a nine year mining lease.

The reverse circulation drill program consisted of 2,914 meters of exploratory drilling. The drill program discovered significant results of gold such as 4.83 grams-per-tonne gold over 20 meters, including 14.51 g/t Au over 6m.

Other results returned 1.61 g/t Au over 10 meters, including 4.11 g/t Au over 2 meters, and 1.89 g/t Au over 8 meters, including 6.54 g/t Au over 2 meters.

Nexus Gold Corp. Vice President of Exploration, Warren Robb said this new discovery is very exciting.

“The intercepts we have encountered from the northeast corner of the property are indicating a broad zone of gold mineralization. The extent of the mineralization is encouraging and certainly requires follow up with diamond drilling. This will allow us to generate better data concerning the nature of the mineralization and the lithologic and structural aspects of the host rocks. The location of the drilling corresponds well with our interpretation of the location of the Sabce shear zone and our ground geochemistry and termite sampling suggest that this mineralization may extend for at least a kilometer to the south west.”

(Image via Nexus Gold)

The gold mineralization encountered in the northeast zone consisted of disseminated sulfides, containing pyrite, chalcopyrite, galena, and particles of visible gold. Assays are pending for the remaining six holes and the companysaid it will report those results once they’ve been reviewed and verified.

Nexus Gold Corp. President and CEO Alex Klenman said he’s pleased with the early results at Dakouli.

“The drill program has confirmed widespread mineralization in the northeast zone of the property. Positive results, particularly like those received in hole 7, in this, a relatively small maiden drill program, is both significant and encouraging. And beyond the target areas we tested in this first phase, Dakouli presents a potential district-scale opportunity with numerous targets yet to drill, and a lot of ground still in need of detailed reconnaissance. We like what we’re seeing so far and look forward to the next phase of drilling.”

In late 2018 company geologists conducted a comprehensive ground reconnaissance program to the west and south of the main orpaillage (artisanal zone) and identified new near surface workings being exploited by artisanal miners. Rock samples collected from these new zones contained various concentrations of visible gold, including coarse nuggety samples.

To date, 40 samples have been collected at the Dakouli concession, with 20 returning assay values greater than 1 g/t Au, and 11 assaying greater than 10 g/t Au, with significant values as high as 98.9 g/t Au.

Nexus Gold Corp. has 11 projects in Canada and West Africa. The company’s West African-based portfolio totals five projects encompassing over 750-sq kms of land located on active gold belts and proven mineralized trends, while it’s 100 per cent owned Canadian projects include the McKenzie Gold Project in Red Lake, Ontario; the New Pilot Project, located in British Columbia’s historic Bridge River Mining Camp; and four prospective gold and gold-copper projects in Newfoundland.

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.