- Global Crossing Airlines Group Inc. (NEO:JET) has qualified to bid for U.S. Dept. of Defense (DOD) contracts.

- The DOD Commercial Airlift Review Board has approved Global Crossing to bid on, and fly DOD contracts for the air transport of military units and service members

- Global Crossing is a U.S. 121 domestic flag and supplemental Airline flying the Airbus A320 family aircraft

- GlobalX currently has one A321F aircraft and is expecting the second A321F to arrive by mid-March, with the third A321F to be delivered in May

Global Crossing Airlines Group Inc. (NEO:JET) has qualified to bid for U.S. Dept. of Defense (DOD) contracts.

The DOD Commercial Airlift Review Board has approved Global Crossing for entry into the DOD Air Transportation Program, which allows the company to bid on, and fly (if awarded) DOD contracts for the air transport of military units and service members.

This business is growing. According to data from the U.S. Government Accountability Office, the DOD awarded nearly $8.4 billion for air support contracts in FY 2015 through 2020.

“We found contract awards for air support have increased since FY 2015. For example, the Air Force awarded an air support contract for $83 million in 2015 and awarded a $6.4 billion contract in 2020.”

On Friday alone, the DOD issued a combined US$139,132,680 to two Air Force contracts, followed by US$53 million on Monday across three contracts.

Global Crossing is a U.S. 121 domestic flag and supplemental Airline flying the Airbus A320 family aircraft.

Last week was National Engineers Week, and the Pentagon held a commemoration ceremony where the deputy undersecretary of defense for research and engineering explained some of the opportunities available to young engineers interested in supporting the nation’s defense.

“DOD is one of the world’s largest engineering organizations and employs more than 100,000 engineers,” he said, “Here, engineers share a unique mission to advance cutting-edge engineering technology, systems and practices, and specializations that range from cyber and space to hypersonics and quantum science and more.”

GlobalX flies as a passenger aircraft, crew, maintenance, and insurance (ACMI) airline as well as a charter airline serving the U.S., Caribbean, European and Latin American markets. GlobalX is also now operating ACMI cargo service flying the A321 freighter.

GlobalX currently has one A321F aircraft and is expecting the second A321F to arrive by mid-March, with the third A321F to be delivered in May.

The company is also scheduled to take delivery of an additional three A321F aircraft in 2023 for a total of six and two more in 2024. GlobalX is currently finalizing leases on lessor commitments for another five A321F aircraft to be delivered in the 2024-2025 time frame and is working on letters of intent for two additional A321F aircraft.

The A321 P2F features a capacity of 14 upper deck and 10 lower deck containers, which is fifty-five percent more containerized volume than the Boeing 737-800 freighter and fourteen percent more containerized volume than the Boeing 757-200 freighter.

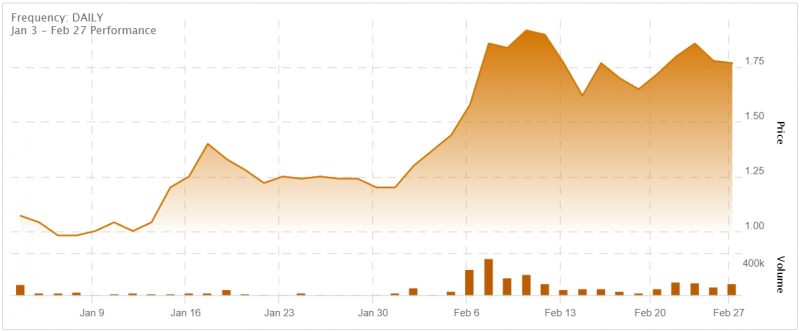

JET stock has risen nearly 90 per cent year-to-date. It also saw a healthy bump last week after releasing news that the team had completed an International Air Transport Association (IATA) International Operational Safety Audit (IOSA) and has been added to the IOSA Registry.

The IATA IOSA program is an internationally recognized and accepted evaluation system designed to assess the operational management and control systems of an airline. The certification is valid for two years when it must be renewed.

CEO Wegel explained that having received this certification, the company joins more than 400 airlines around the world on the IOSA registry, the global industry standard for airline operational safety auditing.

“We believe IOSA certification will open additional markets and customer opportunities.”