Gitennes Exploration Inc (TSXV:GIT/OTC:GILXF), a junior exploration company based in Quebec, has just announced new option agreements on two of its properties.

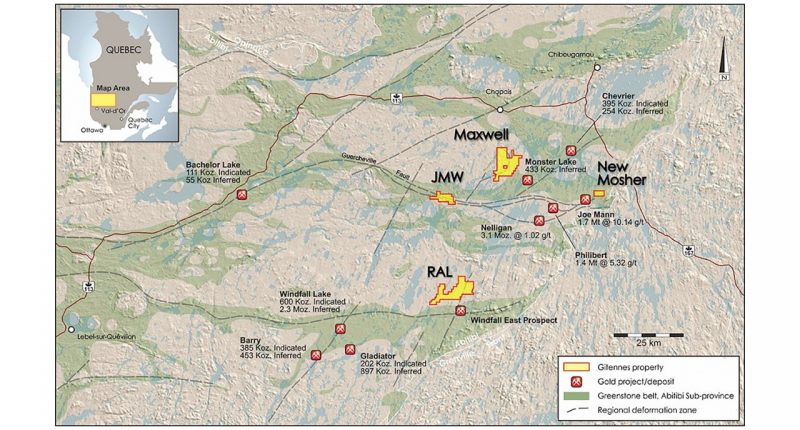

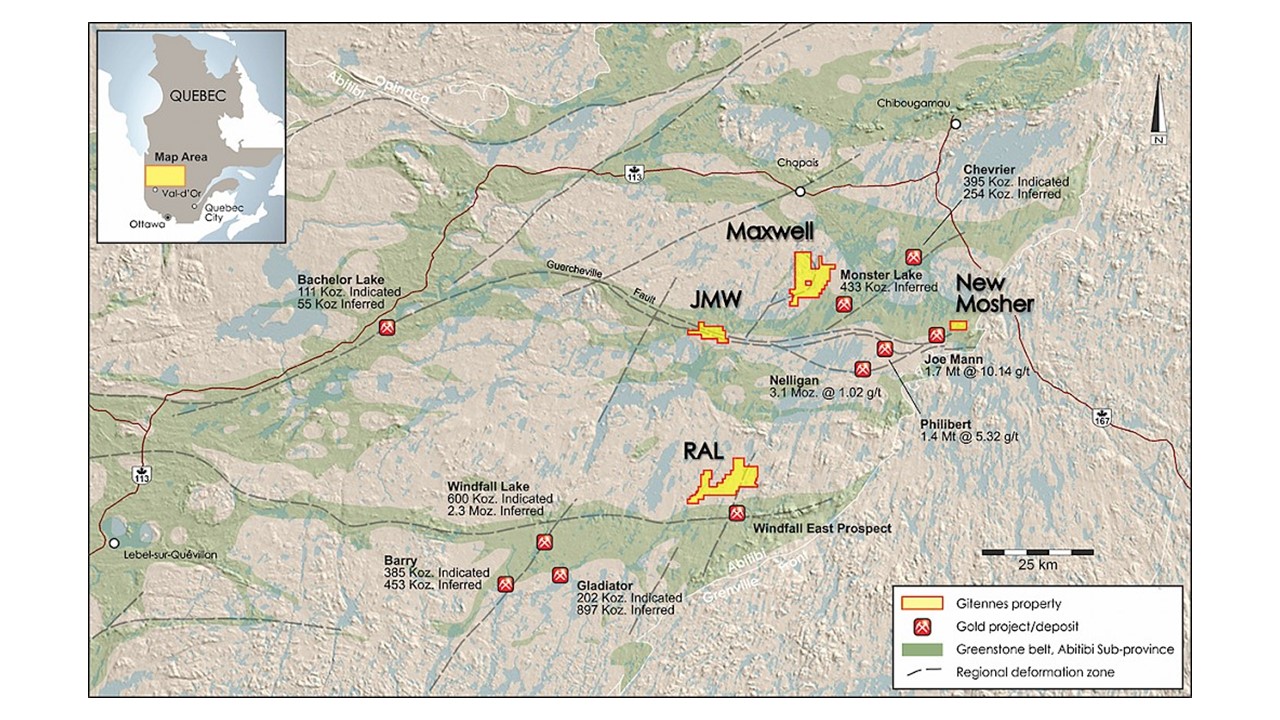

On November 3, 2022, Gitennes announced option agreements on its JMW and Maxwell gold properties, both in the Chapais-Chibougamau Area, with Newfoundland Discovery Corp (CSE:NEWD). Gitennes Exploration currently holds a 100% interest in both properties.

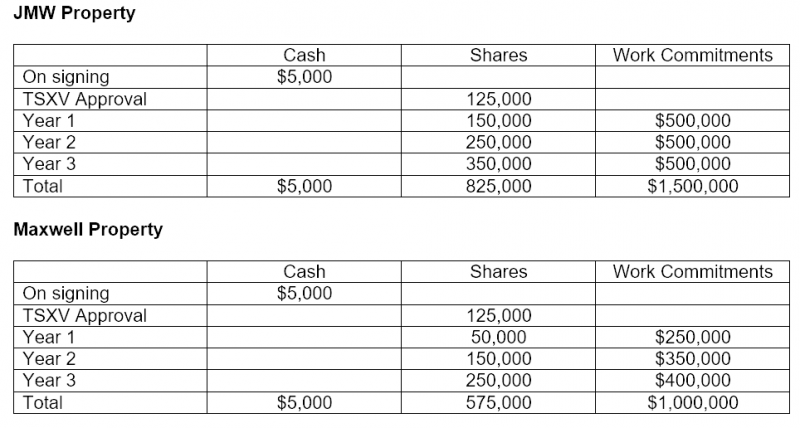

There is a two-stage earn-in with each property. To earn a 70% interest in the properties, Newfoundland Discovery must satisfy the following terms:

Newfoundland Discovery can earn an additional 15% interest on either/both properties (85% interest, in total) by completing an NI 43-101 resource estimate on each property.

Both the JMW and Maxwell properties are associated with gold mineralization.

The JMW property lies along the prolific Guercherville Deformation zone. This geographical formation has (historically) hosted several past-producing gold mines. The zone also hosts IAMGOLD’s Nelligan Gold Deposit (3+ million ounces of gold).

Previous field work on the JMV property has identified visible gold in previous drill holes associated with the Deformation zone. There is an additional sedimentary target on the JMV property that is derived from the host rock of the Nelligan Deposit.

The Maxwell property is ~15 kilometers northeast of the JMV property. The Maxwell property is close to another IAMGOLD gold deposit: the 433,000-ounce Monster Lake deposit.

Previous exploration at Maxwell has identified several occurrences of gold. Gitennes has noted “gold in both the fine and heavy fraction of glacial tills and the gold in tills is associated with mapped structures.”

Newfoundland Discovery Corp is also a junior explorer, with a strategic interest in Quebec mining properties. To help finance work on the JMV and Maxwell properties, Newfoundland Discovery Corp recently announced LOIs for the sale of its Bouvier Lithium property and Chubb Lithium property.

As Newfoundland Discovery works towards its earn-ins on the two gold properties, Gitennes Exploration will benefit from both its direct and indirect interest in the JMV and Maxwell properties.

In addition to retaining its 30% interest in the properties (15% if Newfoundland Discovery moves a property to a NI 43-101 resource estimate), Gitennes will also participate in development of the properties as a shareholder of Newfoundland Discovery.

Gitennes can acquire up to 1.4 million shares of Newfoundland Discovery as it meets exploration milestones on the two properties. This would translate into as much as a ~3% interest in Newfoundland Discovery.

The earn-in agreements represent exploration work in Year 1 of the agreement of CAD$750,000 on the two properties ($500,000 on JMW and $250,000 on Maxwell). In a recent interview, Ken Booth, President of Gitennes was anticipating near-term diamond drilling on the JMW property, to test three gold targets near IAMGOLD’s 3-million ounce Nelligan Deposit.

To earn its 70% interest, Newfoundland Discovery must complete total exploration expenditures over the 3-year term of the option of CAD $1.5 million on JMW and CAD$1.0 million on Maxwell.

The price of gold has been knocked lower in recent weeks, but this is primarily due to a strong-but-temporary surge in the exchange rate of the U.S. dollar.

With “record central bank buying” of gold just announced (399 tonnes of gold purchased in Q3 of 2022), experienced gold analysts are expecting a major surge in the price of gold as dollar strength ebbs.

For investors eying Gitennes Exploration as an investment prospect, JMW and Maxwell are just two of five gold properties that Gitennes is holding in the province of Quebec. The Company is anticipating additional exploration work on its other properties as it moves into 2023.

Gitennes Exploration also holds the Snowbird gold property in British Columbia and a 1.5% Net Smelter Return royalty on the 18-million ounce Urumalqui Silver Project in Peru.

With savage market conditions having taken most mining stocks near/at 52-week lows, investors have rarely had so much buying power in adding to their gold exposure. Junior gold mining stocks have been hammered by both weak market conditions and a weak gold price, but better days are likely just around the corner for the gold sector.

Investors seeking to maximize leverage in their gold investing will want to seriously look at junior exploration prospects like Gitennes Exploration.

FULL DISCLOSURE: This is a paid article from The Market Herald.