- Uranium has become one of the world’s most important energy minerals in the last 60 years.

- Though uranium is used almost entirely for making electricity, some of it is used for producing medical isotopes, and some are also used for marine propulsion

- The global Uranium market size was valued at US$2736.31 million in 2022 and is expected to reach US$3398.52 million by 2028

- Canada is the second-largest uranium producer in the world, making up 13 per cent of total global output

One commodity that investors are eagerly tracking is Uranium.

Uranium has become one of the world’s most important energy minerals in the last 60 years.

A silver-white metal chemical element, Uranium is micro-radioactive, and its isotopes are unstable. Uranium-238 and uranium-235 are the most common.

Though uranium is used almost entirely for making electricity, some of it is used for producing medical isotopes, and some are also used for marine propulsion.

According to the latest research study released by Market Reports, the global Uranium market size was valued at US$2736.31 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 3.68 per cent reaching US$3398.52 million by 2028.

It is mined and concentrated like many other metals, and Canada is the second-largest uranium producer in the world, making up 13 per cent of total global output. Canada also has the largest deposits of high-grade uranium found anywhere across the globe, with the quality of deposits 100 times greater than the world average.

Who are some of the fastest-growing suppliers of fuel for the green energy transition to a low-carbon future? Let’s find out ….

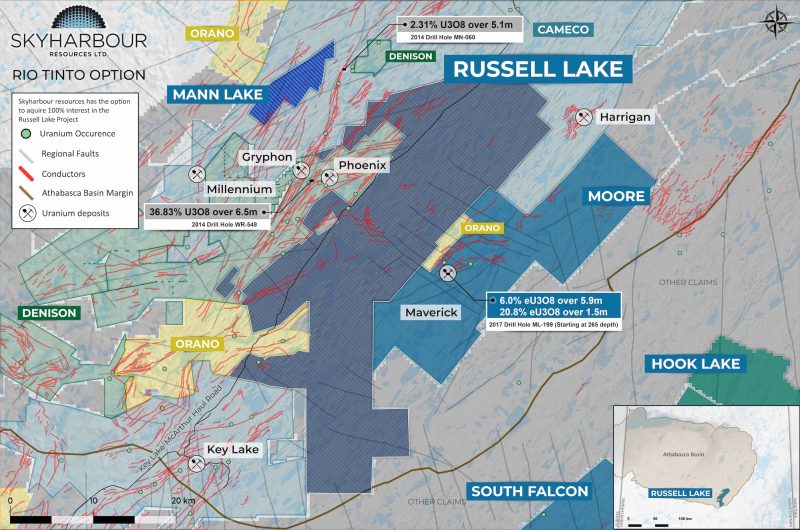

Skyharbour Resources Ltd. (TSXV:SYH) holds an extensive portfolio of uranium exploration projects in Canada’s Athabasca Basin.

This exploration company is principally engaged in the acquisition, exploration, and evaluation of resource properties in Saskatchewan. Its projects include Falcon Point and Yurchison, Moore Lake, Mann Lake, Preston, and others.

SYH stock is up 24.6 per cent year to date.

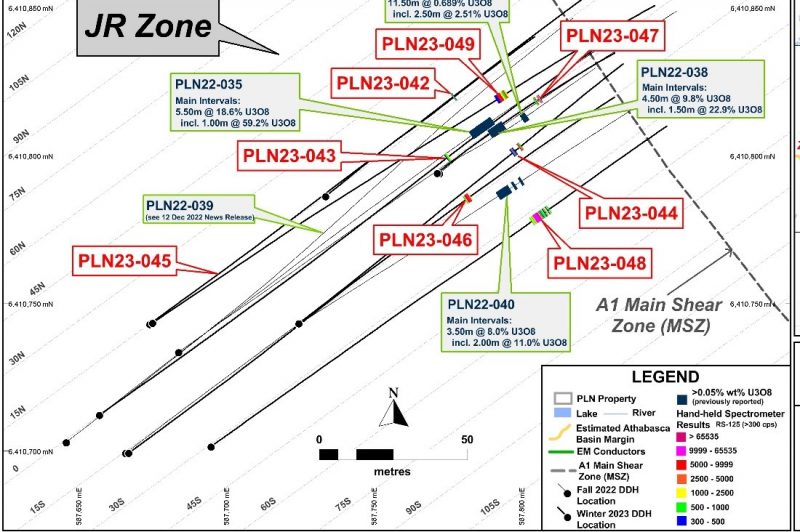

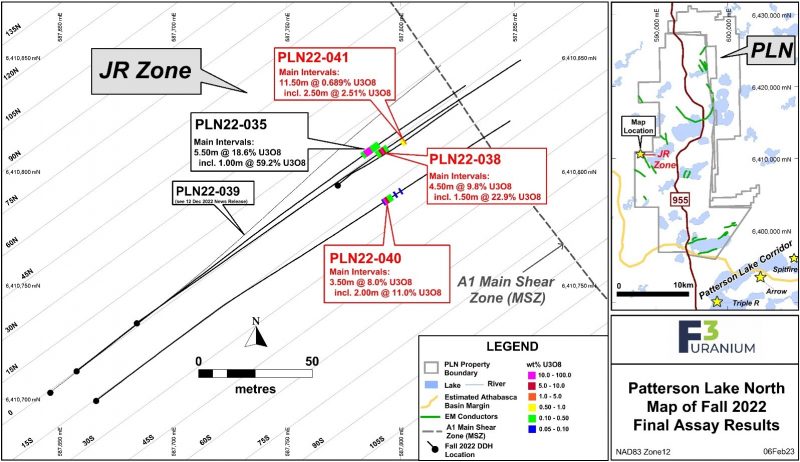

The Athabasca Basin is home to some of the world’s largest high-grade uranium discoveries, including F3 Uranium Corp.’s (TSXV:FUU) most recent discovery at its Patterson Lake North project.

A project generator and exploration company focused on the Athabasca Basin, F3 has a drilling program underway to expand its high-grade discovery at Patterson Lake .

F3 currently has 16 projects in the Athabasca Basin, and several near-large uranium discoveries, including Triple R, Arrow, and Hurricane.

This company’s stock is up 15.8 per cent since this time last year and has risen 160.7 per cent since the year began.

Uranium Energy Corp. (NYSE American: UEC) is the largest, diversified North American-focused uranium company, advancing the next generation of low-cost, environmentally friendly In-Situ Recovery (ISR) mining uranium projects in the United States and high-grade conventional projects in Canada.

This stock has seen 0.77 per cent growth year-to-date and has risen 35.7 per cent since the beginning of the year.

Finally, one of the largest global providers of the uranium fuel needed to energize a clean-air world is Cameco Corp. (TSX:CCO). A stock you’ve likely heard of before, the company’s competitive position is based on its controlling ownership of the world’s largest high-grade reserves and low-cost operations.

Year-to-date, this stock is up 25.9 per cent.

Utilities around the world rely on nuclear fuel products to generate safe, reliable, carbon-free nuclear power.

The world is becoming bullish on uranium, and with so many promising resource-rich projects in Canada, it is no surprise that the Toronto Stock Exchange is full of cyclical companies that deal with the likes of gas, oil, gold, and uranium.

These are just a few stocks worthy of keeping on the radar of resource investors.