- Galantas Gold Corporation (GAL) is commencing an exploration program at the Omagh gold mine in Northern Ireland

- Drilling will focus on the Kearney and Joshua veins

- The company has completed 2,000 metres of underground development and is currently within 240 metres of accessing the Joshua vein

- Galantas has retained Independent Trading Group (ITG) to provide market-making services

- Galantas Gold Corporation is focused on operating and expanding Ireland’s first gold mine

- Galantas Gold Corporation (GAL) opened trading at C$0.78 per share

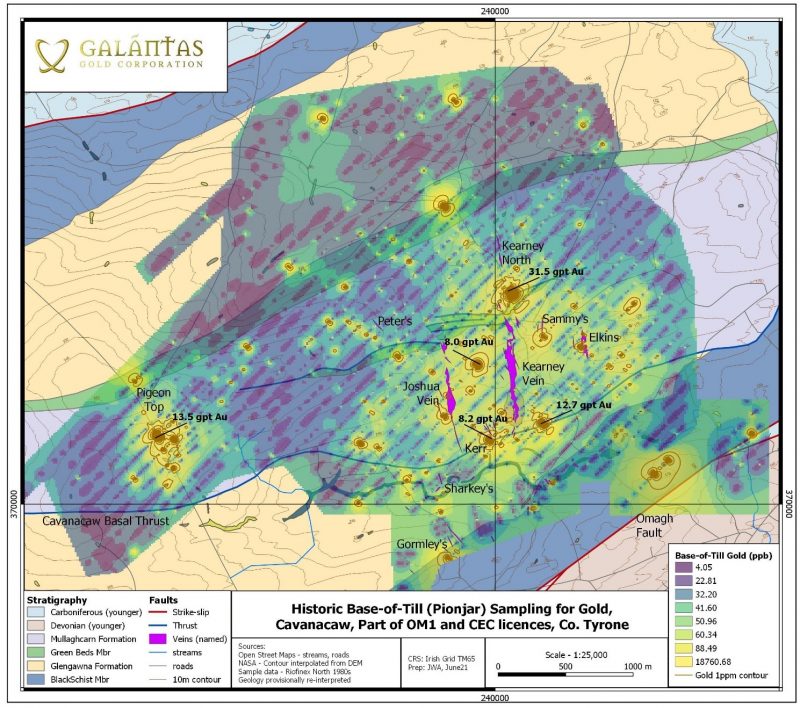

Galantas Gold Corporation (GAL) is commencing a surface and underground exploration program at the Omagh gold mine in Northern Ireland.

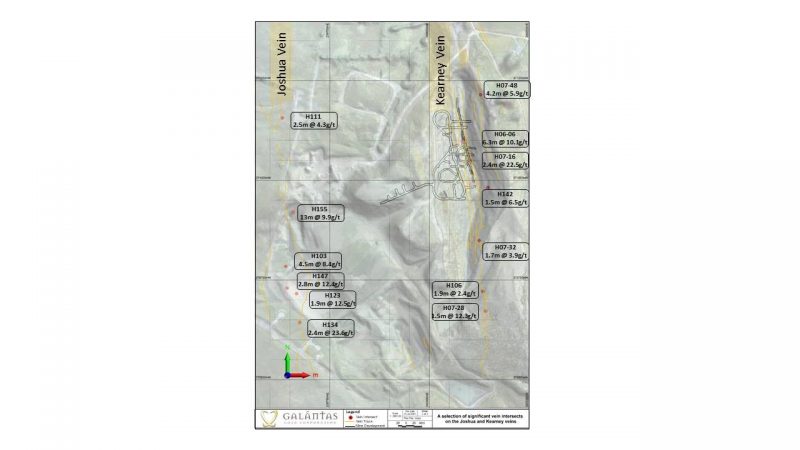

Drilling will focus on the Kearney and Joshua veins, two of many high-priority targets on the company’s land package. Underground drilling on the Kearney vein (Figures 1 & 2) will test deeper extensions of mineralized dilation zones targeting higher widths of mineralization within the vein.

Drilling will also target continuity and grade of additional mineralized zones running parallel to the main orebody.

Drill results will support the mine plan as the company moves into a new phase of underground mining and accelerated development.

The company has currently completed 2,000 metres of underground development at Kearney and development is currently within 240 metres of accessing the Joshua vein. Development has recently restarted on the Joshua decline.

The surface drilling program will target the Joshua vein. The Company will follow up on its best intersection to date of 21.6 metres of 9.9 grams per tonne (g/t) gold

(13 metres true width) at a vertical depth of 117.2 metres (hole OML-DD-15-155), which was identified towards the end of the last drilling program in 2015.

Drilling will also target a central area of the vein 70 metres from where the underground development is first planned to intersect the Joshua vein. Earlier drilling of central Joshua includes hole OM-DD-11-103 resulting in 26.6 metres of 8.4 g/t gold.

Mario Stifano, CEO of Galantas, commented on the drilling program.

“We are excited to kick-off drilling to unlock the significant exploration upside at Omagh, on the heels of our oversubscribed private placement. This exploration program represents a critical opportunity for Galantas to extend the mine life and expand high-grade gold production.”

Galantas has retained Independent Trading Group (ITG) to provide market-making services in accordance with TSX Venture Exchange policies.

ITG will trade the securities of Galantas on the TSXV for the purposes of maintaining an orderly market. In consideration of the services provided by ITG, Galantas will pay ITG a monthly cash fee of $5,000 for a minimum term of three months and renewable thereafter. ITG will not receive shares or options as compensation. The capital used for market making will be provided by ITG.

Galantas Gold Corporation is focused on operating and expanding Ireland’s first gold mine.

Galantas Gold Corporation (GAL) opened trading at C$0.78 per share.