- Fremont Gold Ltd. (FRE) identifies new gold anomalies at Cobb Creek Project, plans an upcoming drill program, and proposes share consolidation

- The results from Fremont’s recent soil survey reveal new gold anomalies

- Several of which occur in areas that have never been tested

- Eight proposed drill sites have now been chosen with a permit process in the works

- Fremont has authorized the consolidation of its issued and outstanding common shares

- Fremont Gold Ltd. (FRE) is unchanged trading at $0.02 per share as of 1:08 p.m. ET

Fremont Gold (FRE) identified new gold anomalies at the Cobb Creek Project, announced plans for a drill program, and proposed a share consolidation.

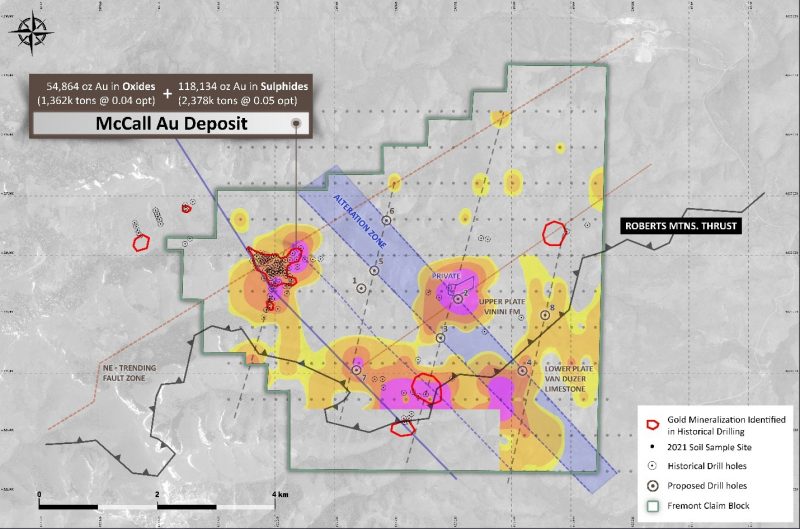

The Cobb Creek project occurs at the northern end of the Independence Trend, one of the most notable gold belts in northern Nevada.

The results from Fremont’s recent soil survey reveal new gold-in-soil and pathfinder anomalies. Several of the anomalies occur in areas that have never been tested by drilling and is nearby the discovered McCall gold deposit.

The image above shows gold results from the survey which display a strong gold-in-soil anomaly directly above the McCall gold deposit.

Fremont VP of Exploration, Dr. Clay Newton, stated,

“The soil results in conjunction with structural interpretation have enabled the identification of exciting new drill targets to the east and southeast of the historical McCall resource… These anomalous zones likely overlie gold mineralization, and we intend to test them as soon as drill permits are in hand.”

Following this success, eight proposed drill sites have now been chosen and Fremont is initiating the permitting process for drilling. A minimum five-hole diamond drill program is planned for late summer.

Fremont’s board of directors has authorized a consolidation of its issued and outstanding common shares of Fremont based on one post-consolidation share for every 10 pre-consolidation shares.

The company currently has 146.1 million common shares issued and outstanding. Following the consolidation, Fremont expects to have approximately 14.6 million common shares issued and outstanding.

The exercise price and the number of common shares issuable upon the exercise of Fremont’s outstanding options and warrants will be proportionally adjusted upon completion of the consolidation.

Fremont Gold Ltd. (FRE) is unchanged trading at $0.02 per share as of 1:08 p.m. ET.