- Foremost Lithium Resource & Technology Ltd.’s (FAT) Zoro Lithium phase one program confirmed a 6.00 per cent battery-grade lithium concertante production

- The test work determined the spodumene-bearing pegmatite from Zoro Dyke 1 is viable for production

- The sample produced a final spodumene concentrate with 5.93 per cent lithium oxide

- The program’s second phase will continue with ongoing work, which includes optimizing the lithium recovery

- Foremost Lithium Resource & Technology Ltd. (FAT) is up 2.94 per cent, trading at $0.17 per share as of 1:25 p.m. EST

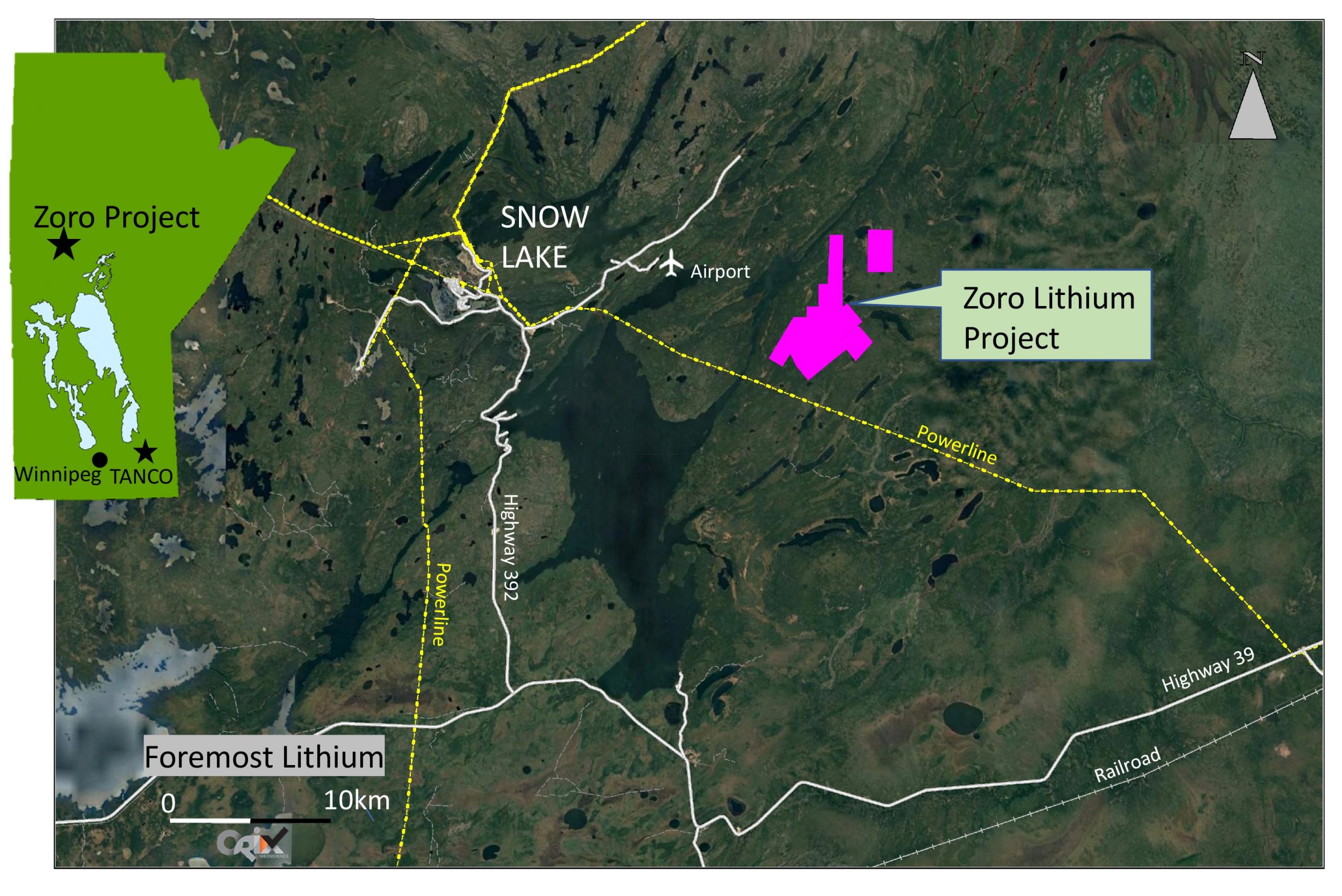

Foremost Lithium Resource & Technology (FAT) completed the first phase of its Zoro Lithium property bulk sampling and metallurgical program.

The program confirmed a 6.00 per cent battery-grade lithium concertante production. Specifically, the project’s test work determined the spodumene-bearing pegmatite from Zoro Dyke 1 is viable for production.

Jason Barnard, Foremost Lithium’s President and CEO, commented,

“Our goal for this project is to be able to market our lithium while still in the ground directly to battery suppliers… We are well on our way to reaching our objective.”

The collected bulk sample produced a final spodumene concentrate assaying 5.93 per cent lithium oxide, with a lithium recovery of 66.90 per cent in 26.50 per cent mass after magnetic separation. The iron content in the spodumene concentrate assayed 1.23 per cent iron oxide, just above its target, but is acceptable for hydrometallurgical processing.

The program’s second phase will continue with ongoing work, which includes a mineralogical assessment of the dense media separation products and flotation test work to optimize lithium recovery.

Foremost Lithium Resource & Technology Ltd. (FAT) is up 2.94 per cent, trading at $0.17 per share as of 1:25 p.m. EST.