First Mining Gold (TSX:FF/OTC:FFMGF) will already be on the radar of experienced mining investors for two reasons.

The Company has two world-class gold projects that have been advanced to multi-million-ounce resources, including Springpole – one of Canada’s largest open pit gold/silver Projects not currently in production.

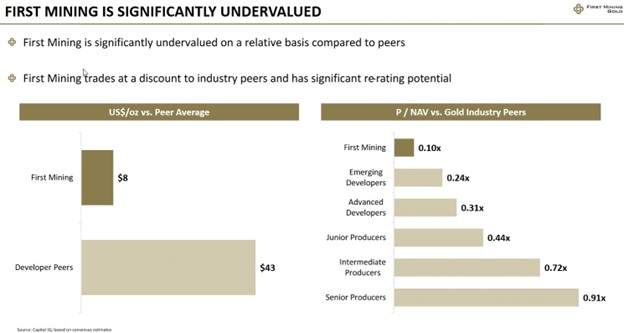

First Mining is also glaringly undervalued. More on this later.

First Mining Gold is in the news again. This time the Company is announcing an update on “district-scale exploration.”

Where? Adjacent to one of Canada’s largest open pit gold/silver Projects not currently in production.

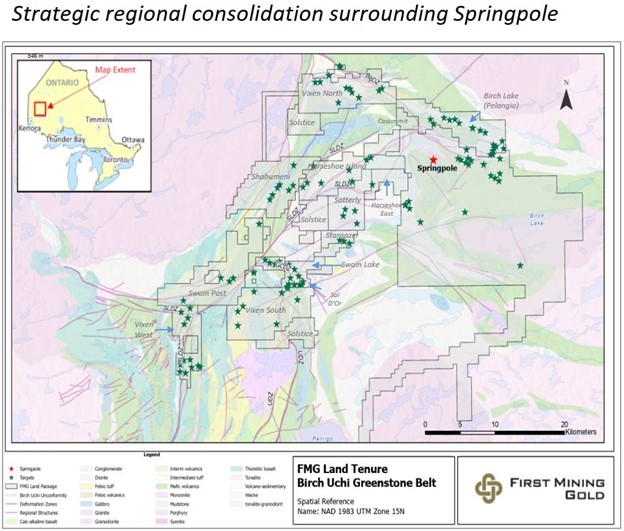

First Mining is ramping up its multi-year exploration strategy for the Birch-Uchi Greenstone Belt.

Birch-Uchi is a massive 70,000+ hectare land package that is a consolidation of a large number of prospective gold (and silver) exploration properties to the west of (and adjacent to) the Springpole Gold Project.

This is Mining Exploration 101.

Where is the best place to look for a new commercial gold deposit? Adjacent to an already-proven commercial gold deposit.

First Mining Gold has methodically consolidated this huge land package around the Springpole Gold Project. Now it is seeking to unlock its riches.

Previous exploration highlights

Highlights of this early-stage exploration of the Birch-Uchi Greenstone Belt include:

- Rock sampling “across multiple centres of mineralization” that have produced assays of up to 42.7 g/t gold.

- These samples, along with other “significant and anomalous” sample results, are creating a “district dataset” for gold mineralization targets of “favourably endowed gold trends.”

- Regional airborne geophysics has completed 3,843 line kilometres of high-resolution magnetic and electromagnetic aerial surveying.

- Soil geochemical analysis: 700+ soil samples have been collected for analysis (and merged with other Project datasets) as First Mining develops its geoscience modelling and targeting initiatives for Birch-Uchi.

- Preliminary drilling: a five-hole drill campaign was completed at the Swain property (southwest corner of Birch-Uchi). Assays are pending, and full data is expected by the end of Q1 2023.

The update also includes an “overview” to provide investors with a big-picture review of this Project. This overview focuses on four “consolidated target opportunities”: Swain – Sol D’or, Horseshoe, Sirius and Canamer.

Swain – Sol D’or

Situated along Grace Deformation Zone. Past-producing Sol D’Or gold mine. The proximal “muck sample” returned a historical assay of 34.7 g/t Au. Favourable geochemical soil anomalies.

Horseshoe

Gold mineralization is “characterized as an intrusion-hosted gold occurrence.” The Horseshoe occurrence, Mustang showing, and Bronco shows are located in a setting of “regional shearing and faulting occurrences.”

Sirius

Located ~2.5 km SW of Springpole. Reported the Project’s best rock sample to date (42.4 g/t Au). Mineralization is hosted in a structurally complex area characterized by “ductile deformed quartz veins.”

Canamer

Rock sample assay of 15.3 g/t Au from 2022 fieldwork followed by “property scale modelling,” generating an advanced drill-ready model for exploration. Mineralization modelling includes higher-grade shoots. A historical drillhole (TWD-DDH-91) reported 244.72 g/t gold over 2.45 meters.

Upcoming exploration plans

- Compiling an Anishinaabe Impact Assessment as part of First Mining’s commitment to working with local First Nation communities regarding both Project negotiations and First Nation employment opportunities.

- Reviewing and interpreting Swain – Sol D’or drilling and additional sampling results to enhance “target evolvement.”

- Advanced geophysical interpretation and modelling by Mira Geosciences to follow up the geophysical surveying by SkyTEM from December 2022.

- 2023 field season: plans to build out, infill and follow up on highlighted anomalies from the 2022 field campaign to advance Project geoscience and explore mineral showings.

The Birch-Uchi Greenstone Belt is showing considerable prospective potential just from early-stage exploration activities and historical workings. However, the main attraction of this Project to investors (at this early stage) is its proximity to the Springpole Gold Project.

- 3.8 million ounces of proven gold reserves (total gold resources of 4.9 million ounces) and 20.5 million ounces of silver

- Strong economics based on the initial mine-life of 11+ years for the Project (a post-tax IRR of 29%), derived from the Springpole PFS from January 20, 2021

- Projected annual production of 300,000+ ounces/year Au from an open pit operation provides exciting revenue potential in a rising gold (and silver) market

Reinforcing First Mining Gold’s status as a major player in gold exploration in Canada is the Company’s acquisition of the Duparquet Gold Project on September 15, 2022.

First Mining immediately followed this up with a new resource estimate for Duparquet: 5 million ounces of total gold resources (3.4 million ounces Measured & Indicated + 1.6 million ounces Inferred).

With two world-class gold projects but a market cap of only CAD$172 million, this leaves First Mining Gold glaringly undervalued versus its peers.

Keep in mind that First Mining Gold also boasts a gold royalties portfolio of 20 royalties spread across four countries.

Gold “royalty” companies typically trade at a premium to producers/explorers, have a glance at a long-term chart for Franco Nevada.

First Mining Gold is ramping up exploration on a highly prospective district-scale gold project. First Mining is already seriously undervalued on the strength of its current assets.

Two good reasons for gold investors to add this Company to their portfolio.

DISCLOSURE: This is a paid article by The Market Herald.