Copper in Canada is one of the country’s hottest resources, having produced almost 476,000 tonnes of copper in concentrate as recently as 2020.

While Ontario is the biggest province in the nation, out west British Columbia is Canada’s top producer of the base metal, accounting for over 53 per cent of production in 2020 at 255,700 tons. In line with this, the British Columbia Geological Survey’s MINEFILE database claims that there are over 7,800 copper-bearing occurrences in the province. At the same time, over 4,000 of them list copper as the primary commodity.

All of this is to say that the province of British Columbia is an attractive region for copper production, not just within Canada but the world. Companies like Fabled Copper (CSE:FABL, OTC Pink:FBCPF, Forum) are capitalizing on the province’s opportunities.

Headquartered out of Vancouver, BC, Fabled Copper officially became public in late December 2021 and has been actively exploring its copper project ever since. The company is the result of a split from its parent company Fabled Silver Gold so that it can continue advancing its copper assets.

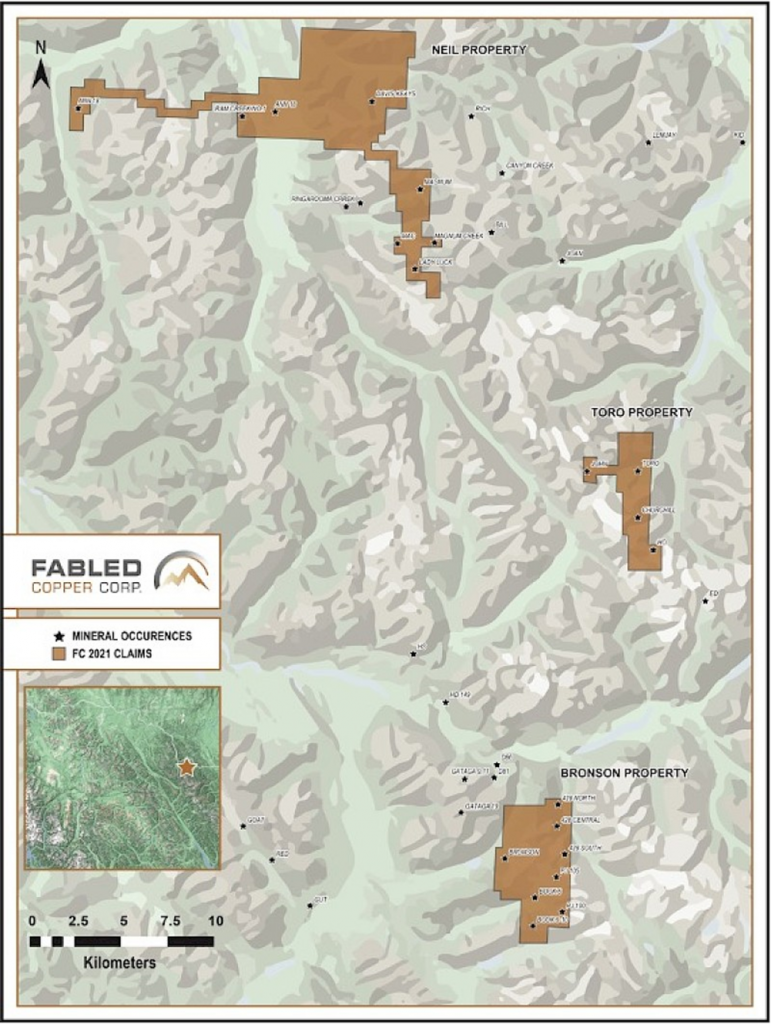

Located in northern British Columbia, the company’s Muskwa project consists of 22 documented copper occurrences — four of which are defined deposits with historical reserves and resources.

The company owns multiple claims, including Davis-Keays, Churchill Copper, Fort Reliance, David-Keays North (Okey), Bronson, Windermere, Toro, and Churchill. Of note, the properties sit within mining-friendly jurisdictions that host significant copper production near past-producing mines, perhaps most notably the Bell Mine, which has produced roughly 667 million pounds of copper.

The Muskwa project

In an interview with The Market Herald Canada, Fabled Copper CEO Peter Hawley said there have already been millions of dollars spent on infrastructure and development underground in the past and that there’s been a defined copper body in addition to a feasibility study done, which he said already gives the company a competitive advantage.

Additionally, Hawley said that there is a wide range of other copper occurrences on the property, which means there is unprecedented potential for the company to be a game changer in the copper industry.

The region has a world-class metal endowment with over 220 million ounces of gold and a staggering 93 billion ounces of copper, with just 3% of it mined. Past historic mining has included 549,00 tons milled and 14,674 tons of copper produced, with a positive feasibility study generated in 1970 and 1971.

The only reason mining stopped was political, with the provincial government of the day implementing a royalty fee that rendered mining unfeasible due to the low price of copper at the time. This history and infrastructure are what sets the company apart from other juniors. In essence, Fabled Copper is an advanced-stage copper exploration company, and this should pique the interest of investors.

Notably, The Muskwa project contains a total of 76 claims in two non-contiguous blocks and totals roughly 8,064.9 hectares and contains the Neil, Toro and Bronson properties.

The Neil vein, in particular, has been traced over a strike length of 1,185 meters and a vertical extent of at least 1,579 meters to the valley floor.

Meanwhile, the Toro vein contains the Toro, John, Ho and Churchill veins. The Toro’s vein contains copper grades of 2.95 percent, the Churchill’s vein contains copper grades of 1.5 percent. The Toro district property also has four underexplored veins.

Finally, the Bronson vein hosts copper grades of 9.2 per cent, based on 18 samples from eight veins.

In September, Fabled Copper completed its 2022 Muskwa exploration program, which Hawley said was intended to focus on areas the company studied the previous year in addition to testing structural theories regarding new predictable mineralized areas. He added this has resulted in discoveries plus advancing certain areas as it related to a potential 43-101 status at the end of 2023.

In total, 59 areas were prospected, mapped and sampled all across the property, which resulted in new claims being added. Additionally, more than 250-person field days were spent at the property, which also resulted in over 300 samples being collected.

Other accomplishments included:

- 4 areas surveyed by surface geophysics on select targets

- A total of 11 drone missions completed

- Structural mapping completed

- Rehabilitated and secured four adit entrances and completed

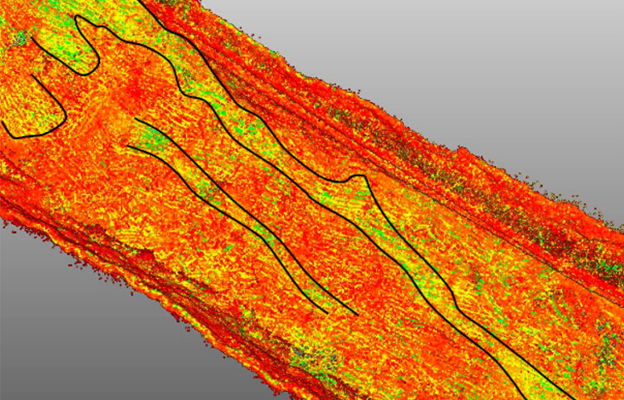

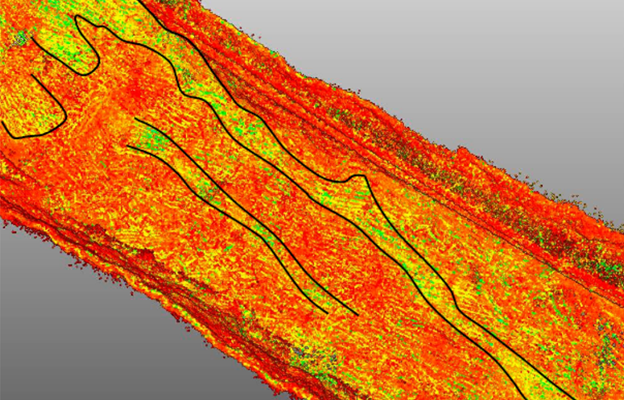

- Two underground LiDAR, drone-supported 3-D mapping completed

- The inspection of historical drill core completed

In November, Fabled Copper also released its 2022 surface fieldwork from the project, notably the Brad Vein area, which had values as high as 16.05 per cent copper.

“The Brad vein was visited by a 3-person field team consisting of 2 geologists and 1 geo technician on July 2, 2022. It was sampled vertically over 255 meters from the valley floor at 1,160 meters to 1,415 meters. A total of 5 samples were collected, 3 floats and 2 grab samples. Of the 5 samples collected, 4 assayed greater than 0.5% copper,” Hawley said.

LiDAR technology

Fabled Copper, in association with the College of the Atlantic’s R&D department, one of two in the world for leading cutting-edge LiDAR mapping technology, surveyed the Davis-Keays mine with spectacular results. With an accuracy of three centimetres, the company was able to map mineralization underground.

Fabled announced preliminary results on October 12, 2022, and found that mineral veins are partly visible, with the upshot being greater accuracy when selecting future drill targets.

What’s next at Muskwa

The company said that news will continue being released from the 2022 exploration program, which will include assay results. Because the company’s team found new extensions of the Brad Vein and gold-silver domain associated with the copper mineralization found in the area, Fabled Copper said it believes it is worthwhile following up.

That being said, Hawley told The Market Herald Canada that the company is “at the point” where it has done just about everything it can do.

“In March of this year, we applied for 45 drill holes, and we’re still pending on that permit,” he said. He explained that the company was notified in July that, pending approval and consultation with the Fort Nelson First Nations, that it can move forward with its plans. “In 2023, in an ideal world, would be the year that the company drills.”

He also said that the company hopes to confirm the historical data from Davis Keays mine, where between the drill holes and underground sampling that there is, in fact, 1.5 million tons of 4 per cent copper outlined, open at depth.

The management team

Peter Hawley, CEO and director

Peter Hawley has over 35 years of experience in the mining industry that spans grassroots exploration through to development, as well as production. Hawley is the co-founder of Fabled Copper and the founder of Scorpio Mining Corporation, now renamed America’s Gold and Silver Corporation. Hawley is also the founder of Scorpio Gold Corp. and Co-founder of Niogold Resources, now known as Osisko Mining.

Luc Pelchat, director

Luc Pelchat is the founder and president of the Canadian Chamber of Commerce in North Mexico. Pelchat has over 24 years of experience with a Canadian multinational company operating in the construction industry. Additionally, Pelchat has formed a number of his own companies and has seen several projects in the construction industry in Mexico realized.

Louis Martin, director

Louis Martin has been a major contributor to the discovery of several gold and base metal deposits in his 35-year career working for major, mid-tier and junior mining companies. Martin’s experience includes exploration and development roles all across Canada. For the last several years, Martin has worked as a technical advisor and geological consultant for various junior and major mining companies. Previously, Martin was vice president of exploration with Clifton Star Resources, while previous experience includes work with Yamana, Agnico-Eagle, Noranda, Falconbridge, Xstrata Copper, Goldcorp, Teck and Aur Resources.

Eric Tsung, CFO

Eric Tsung has over 15 years of experience in financial services and consulting. Tsung has developed extensive experience in internal and external financial reporting, operations, mergers and acquisitions and public and private financing. At present, Tsung is a senior manager of Quantum Advisory Partners LLP and also serves as CFO of Eco Oro Minerals Corp. and VP of finance of Premier Diversified Holdings Inc.

The investment corner

As of the time of this writing, Fabled Copper has a market cap of $4.34 million, a share price of $0.025, 173.65 million total shares and 173.65 million shares outstanding.

With a management team with over 200 years of experience, Fabled Copper is in a unique position in northern British Columbia, thanks to its project and numerous claims.

Fabled Copper will no doubt have a huge impact going forward in the copper sector and with cutting-edge technology and a strong discovery potential property, investors won’t want to miss out on this unique investment opportunity.

Since the start of 2022, Fabled Copper has issued a news release virtually once a week, which means not only is it on the ground doing the work, it is delivering on its goals and promises.

As the demand for copper continues to grow — fueled by its need in the renewable energy market — companies like Fabled Copper won’t be going anywhere anytime soon.

Case in point, copper demand is expected to rise by 600 percent between now and 203, while a supply gap will push copper prices higher as the race to net zero carbon emissions continues. Backed by low-carbon electric vehicles and renewable power-generating capacity, copper will play a critical role in achieving net zero emissions.

FULL DISCLOSURE: This is a paid article produced by The Market Herald Canada