- Enthusiast Gaming (EGLX) is reporting a record 51.8M unique monthly U.S. visitors in December 2021

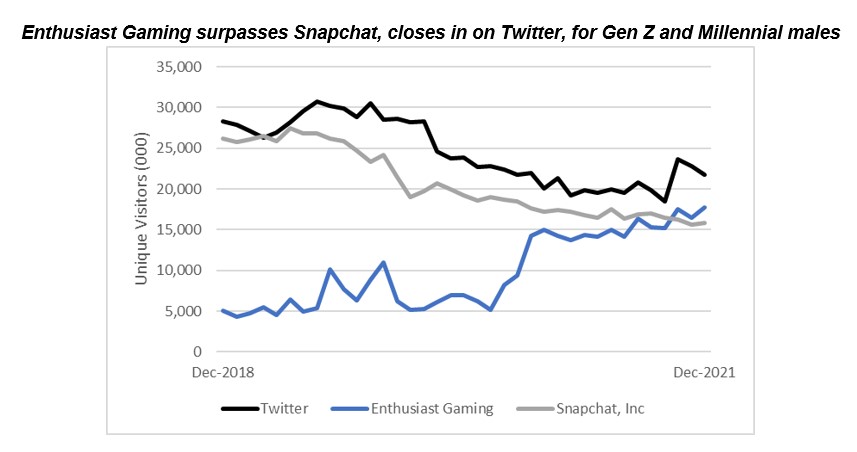

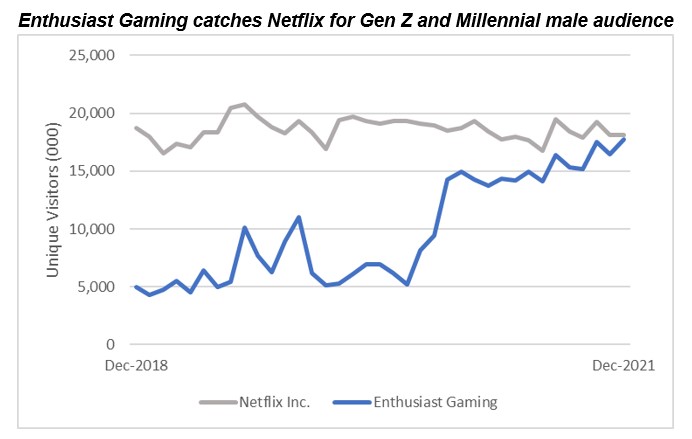

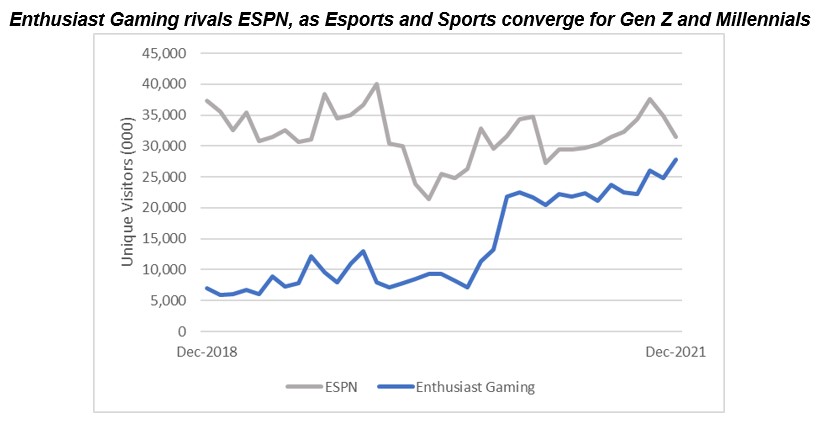

- Its reach with millennial and gen z audiences now rivals Twitter, Netflix and ESPN

- The company believes it is well-positioned to continue benefitting from the shift away from legacy social, streaming and sports media

- Enthusiast Gaming is building the largest media and content platform for video game and esports fans to connect and engage worldwide

- Enthusiast (EGLX) is up by 9.65 per cent trading at $2.84 per share

Enthusiast Gaming (EGLX) is reporting a record 51.8M unique monthly U.S. visitors in December 2021.

The company’s digital media properties reached the record based on ratings from Comscore.

It joins Twitch and Roblox as the only gaming companies to rank in Comscore’s top 100 internet properties for 2021.

The majority of Enthusiast’s audience consists of millennial and gen z visitors aged 13-34, key demographics for growth in gaming media. It generated 254-per-cent growth in these audiences for the three years ended December 2021, and its reach among them now rivals Twitter, Netflix and ESPN.

“Gaming and esports media are the most disruptive forces in digital media. This data not only shows the growth of Enthusiast Gaming’s audience, but also that young people are creating, consuming and sharing gaming and esports content, and spending less time with legacy social media, legacy streaming media and legacy sports media,” stated Adrian Montgomery, CEO of Enthusiast Gaming.

Enthusiast Gaming is building the largest media and content platform for video game and esports fans to connect and engage worldwide.

Enthusiast (EGLX) is up by 9.65 per cent trading at $2.84 per share as of 1:06 pm EST.