- Eguana Technologies (EGT) has entered into shares for debt agreements with certain remaining holders of the company’s unsecured convertible debentures

- Eliminating the remaining C$1.9 million of debt associated with their 2019 debentures has put the company in a stronger financial position

- C$2,180 of interest owed by the company to the holders under the debentures will be paid through the issuance of 4,588 common shares

- Eguana Technologies designs and manufactures high-performance residential and commercial energy storage systems

- Eguana Technologies (EGT) is down 5.26 per cent, trading at C$0.45 per share at 4 pm ET

Eguana Technologies (EGT) has entered into shares for debt agreements with certain remaining holders of the company’s unsecured convertible debentures.

“One of our core objectives this fiscal was to strengthen our balance sheet and working capital position,” commented Eguana CFO Sonja Kuehnle.

“Eliminating the remaining C$1.9 million of debt associated with our 2019 debentures has put the company in a stronger financial position, with the expectation of converting all remaining debentures in April, as we work toward a debt-free balance sheet.”

Pursuant to the terms of the debentures, the holders had a prior option to convert the remaining interest due into common shares. Under the terms of the agreements, C$2,180 of interest owed by the company to the holders under the debentures will be paid through the issuance of 4,588 common shares at a deemed price of C$0.475 per share.

The agreements and issuance of the shares are subject to the approval of the TSXV.

The common shares will be subject to a statutory hold period of four months and one day.

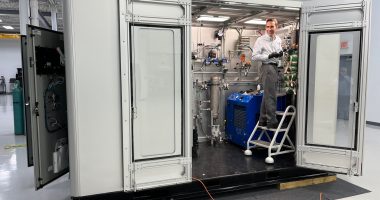

Eguana Technologies (EGT) designs and manufactures high-performance residential and commercial energy storage systems.

Eguana Technologies (EGT) is down 5.26 per cent, trading at C$0.45 per share at 4 pm ET.