Though inflation has lingered and employment is strong, most economists predict a Canadian recession in 2024.

Inflation slowed to 5.9 per cent in January – down from 8.1 per cent in the summer – amidst a gain of over 150,000 jobs, a hiring spree that should cushion the economy, along with household spending recovering by 0.5 per cent in Q4, as high-interest rates continue to hinder business activity.

The TSX has kept its head up, despite this gloomy view, sitting at a 6.36-per-cent gain YTD as of 1:19 pm EST. Today’s 1.2-per-cent gain marks the index’s third-straight day in positive territory, spurred on by Chinese economic data suggesting strengthening materials demand.

While the consensus is for the Bank of Canada (BoC) to hold interest rates at its meeting next Wednesday, the central bank must weigh the fact that 65 per cent of CPI components are still experiencing over 5-per-cent growth, led by fuel and food.

Markets are also pricing in a further 100 basis points in hikes from the U.S. Federal Reserve, which may force the BoC’s hand at the risk of inviting further inflation.

While Tuesday’s report from Statistics Canada showed real GDP was unchanged in Q4 2022 from lower inventory accumulation and business investment – which comes after five consecutive quarters of growth – a preliminary estimate for January sees a return to growth at 0.3 per cent, pointing to a resilient economy with no looming indicators of a downturn.

Our readers have been siding with this resilience thesis over the past week, focusing on prospective tech plays, despite their generally higher vulnerability to macro headwinds, to go along with a graphite miner making its case as a potential supplier to the North American electric vehicle market. Despite positive news flow, all three are trading at severely depressed prices over the past year:

Graphano (TSXV:GEL) unearths significant graphite grades at the Standard Mine Project

Graphano Energy has received all assay results from its 2022 winter drilling program at the Standard Mine Project in Quebec.

The program intersected very significant graphite mineralization over more than 500 m at an average thickness of 9.3 m.

CEO Luisa Moreno sat down with Sabrina Phillips to discuss the results.

The findings follow recent drilling at the Lac Aux Bouleaux graphite property, with prospecting work yielding strong drilling results.

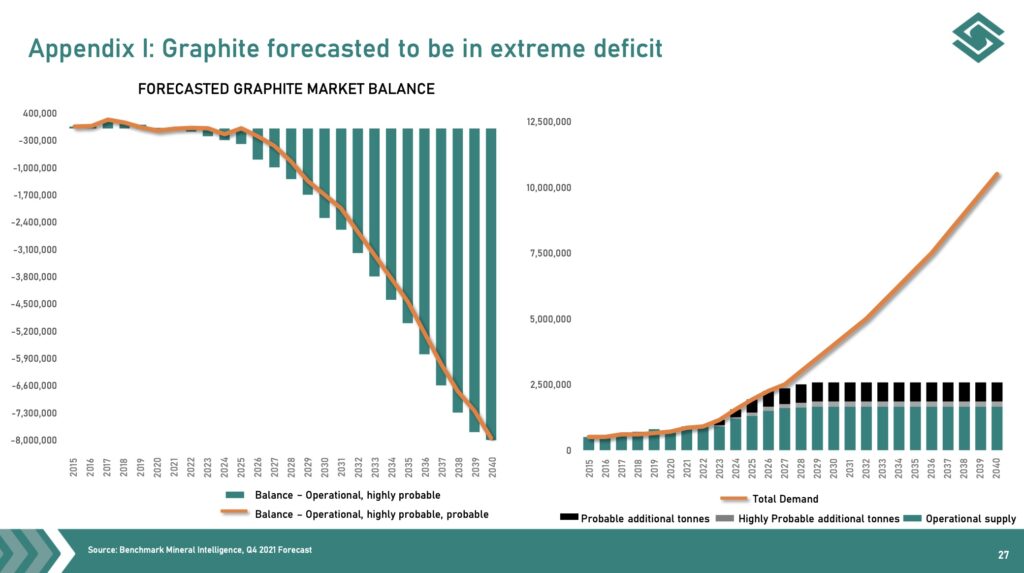

Graphite market forecast

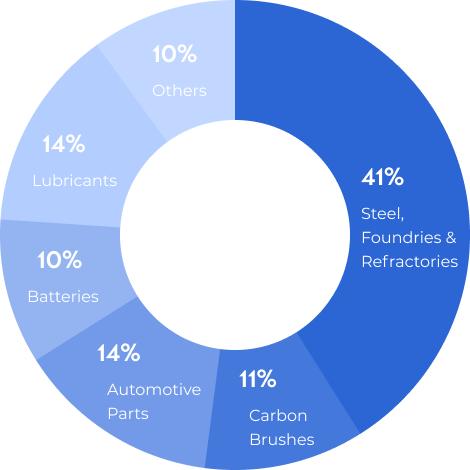

Global graphite use-cases

Graphano Energy (GEL) is down by approximately 40 per cent over the past year while sitting on a 5.36-per-cent gain since inception.

Nextech AR’s (CSE:NTAR) (OTCQX:NEXCF) on track for record Q1 3D-model revenue and FY 2023 growth

Nextech AR is announcing that Q1 2023 is tracking to be a record quarter for 3D modelling.

The company believes that as a preferred 3D model supplier to Amazon, it is perfectly positioned to lead the $5.5 trillion e-commerce market as it transitions from 2D to 3D.

CEO Evan Gappelberg met with Sabrina Phillips to discuss the projection.

The optimistic outlook follows news of a spin-out of the company’s Toggle3D platform and a 3D model supply deal with a major U.S. e-commerce retailer and S&P 500 constituent.

Nextech AR Solutions (NTAR) is down by over 43 per cent over the past year, though it has gained 184 per cent since inception.

Datametrex (TSXV:DM) subsidiary Nexalogy launches Analytics GPT beta program for SMEs

Datametrex (DM) artificial intelligence subsidiary, Nexalogy Environics, is launching a beta program for its new Analytics GPT software beginning on March 6, 2023.

Participants will learn about the software’s functionality through use-case examples, which will provide actionable business insights through the analysis of large data sets.

CEO Marshall Gunter joined Sabrina Phillips to discuss the benefits of Analytics GPT.

I recently analyzed Datametrex’s favourable investment prospects in The Cash-Rich Report, our new series about profitable companies with coffers fortified enough to weather a multitude of headwinds.

Datametrex (DM) is down by over 35 per cent over the past year but has amassed gains of 1,000 per cent since inception.