- EarthRenew (ERTH) has announced a non-brokered private placement financing for gross proceeds of up to $1,100,000

- The company will issue 5,500,000 units at a price of $0.20 per unit

- The financing is expected to close on or about October 15, 2021

- EarthRenew intends to use the net proceeds to expand the fertilizer production capacity of its existing facilities

- EarthRenew transforms livestock waste into a high-performance organic fertilizer to be used by organic and traditional growers in Canada and the United States

- EarthRenew Inc. (ERTH) opened trading at C$0.20 per share

EarthRenew (ERTH) has announced a non-brokered private placement financing for gross proceeds of up to $1,100,000.

The company will issue 5,500,000 units at a price of $0.20 per unit.

Each unit consists of one common share and one share purchase warrant. Each purchase warrant entitles the holder to acquire one additional share at a price of $0.20 for a period of 6 months.

The financing is expected to close on or about October 15, 2021.

All securities issued will be subject to a statutory hold period of four months and one day.

Completion of the offering is subject to receipt of approval of the CSE. Finder’s fees may be paid to eligible finders consisting of a cash commission equal to up to 7 per cent of the gross proceeds raised under the offering and finder warrants.

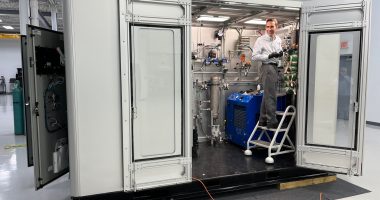

EarthRenew intends to use the net proceeds to expand the fertilizer production capacity of its existing facilities and for working capital purposes.

EarthRenew transforms livestock waste into a high-performance organic fertilizer to be used by organic and traditional growers in Canada and the United States.

EarthRenew Inc. (ERTH) opened trading at C$0.20 per share.