- E79 Resources (ESNR) reports initial assay results received from the first two drill holes at its Happy Valley Gold Prospect

- The first two drill holes at Happy Valley confirm the extension of mineralized structures below known historic mining levels

- Confirmation of a section of visible gold assaying at over 78 ounces per tonne demonstrates the high-grade potential of the Victorian Goldfields

- Next steps include follow-up drilling to expand on results and review geophysical data from the Myrtleford exploration license to define additional targets

- E79 Resources is a resource exploration company

- E79 Resources Corp. is up 143.24 per cent, trading at C$0.90 per share at 10:45 am ET

E79 Resources (ESNR) reports initial assay results received from the first two drill holes at its Happy Valley Gold Prospect in Victoria, Australia.

Drilling highlights:

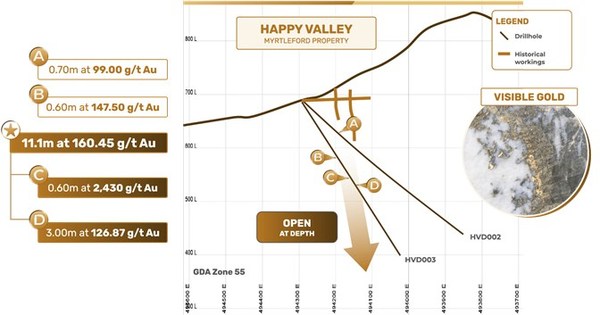

Drill hole HVD002:

- 0.70m @ 99.00 g/t Au from 94.90m downhole

Drill hole HVD003:

- 0.60m @ 147 g/t Au from 165.20m downhole

- 11.10m @ 160.45 g/t Au from 190.40m downhole including:

- 0.60m @ 2,430 g/t Au from 190.40m

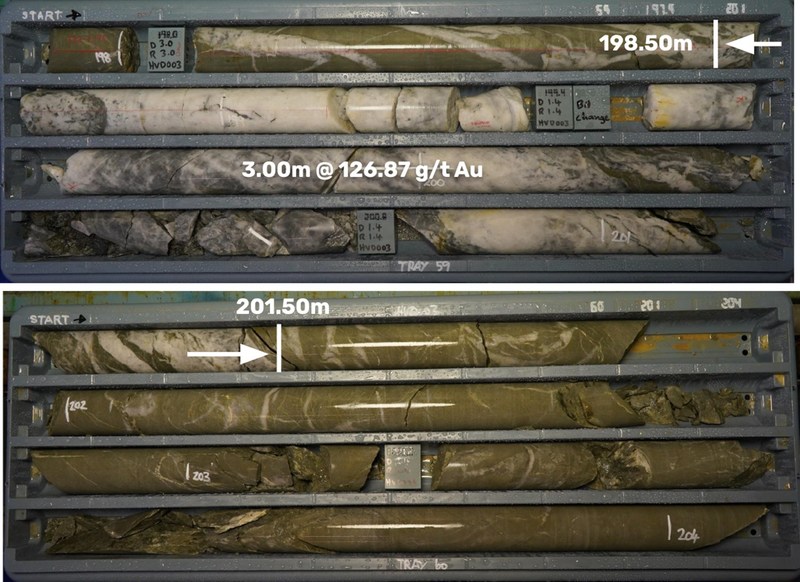

- 3.00m @ 126 g/t Au from 198.50m

Rory Quinn , E79’s President and Chief Executive Officer stated,

“Our drill program at Happy Valley was designed to test for down-dip extensions of previously mined high-grade (~31g/t Au) quartz vein structures. The first two drill holes at Happy Valley confirm the extension of mineralized structures substantially below known historic mining levels. HVD002 intersecting gold roughly 60m beneath known historic mining and HVD003 intersecting gold roughly 80m below that.

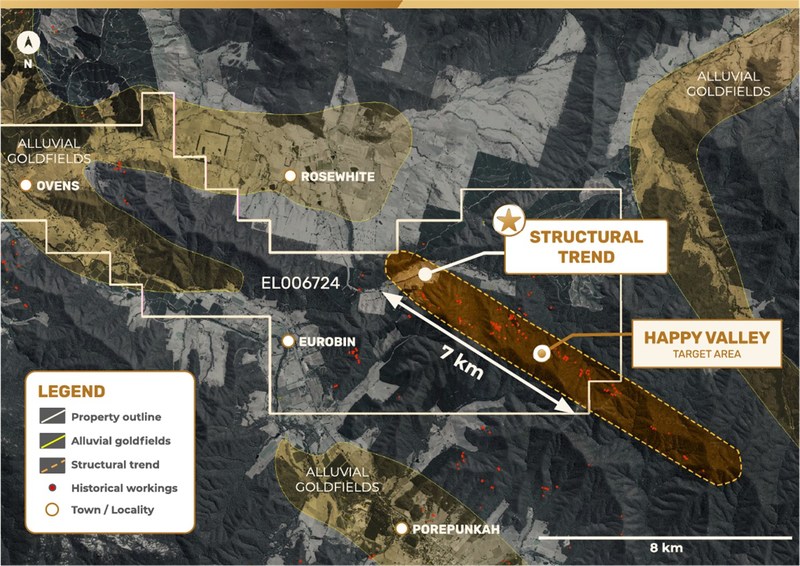

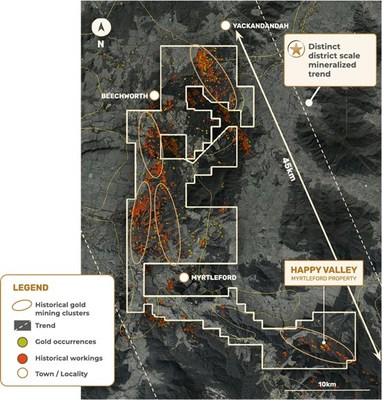

Confirmation of a section of visible gold assaying at over 78 ounces per tonne (2,430 g/t Au) demonstrates the high-grade potential of the Victorian Goldfields. The presence of four other intersections assaying greater than 3 ounces per tonne demonstrates this is not a ‘one-hit wonder’ at Happy Valley. Happy Valley sits within a ~7km corridor of historic gold mines at Myrtleford and that is one of 5 distinct corridors of historic gold mines observed on our Myrtleford property.”

The remaining results for HVD002 and HVD003 and the initial results for HVD004 and HVD005 are pending.

Analytical assay results have confirmed the tenor of visible gold and other mineralized zones identified in drill core from the first two diamond drill holes at the Happy Valley prospect.

These results confirm the company’s belief that high-grade gold mineralization exists at depth below historic gold mining areas.

The current program will generate structural, lithological, alteration and geochemical information to determine their relationship to gold mineralization at the Happy Valley Mining Centre. This information will provide a model for exploration along strike and a broader model for the company’s Myrtleford prospects.

The Happy Valley Prospect is situated in the south eastern portion of the company’s Exploration Licence EL006724 in Victoria, Australia (Figure 4). It lies within a 7km long trend of historical workings.

The Happy Valley Mining Centre has a documented historical production of 34,200 ounces of gold predominantly between 1866 – 1875. It produced at an average grade of ~31g/t Au, which presents E79 with an extremely attractive target. To date, only limited modern exploration has been conducted at this prospect.

Gold mineralization at Happy Valley occurs as quartz infill fractures and spurry formations within carbonate altered sedimentary units of Lower Ordovician age (448 – 443MA). Regionally mineralization appears to be proximal and related to the emplacement of several major regional Devonian age granitic plutons. The gold can occur as free particles within the quartz veins and can also be associated with sulphides, including pyrite and to lesser degrees arsenopyrite and galena.

Drill hole HDV003 was drilled at a dip of -55 o , (16 o steeper than HVD002), and on the same azimuth as HVD002 (216 o mag, 228 o Grid). The drill hole has intersected two zones of quartz containing both sulphides and coarse gold. All intersections represent downhole lengths and as such do not represent true width intersections. Historic mining operations were undertaken on subvertical steeply dipping quartz vein structures.

All samples were analyzed by a 50 g fire assay with an atomic absorption finish (Au-AA26). This method has an upper detection limit of 100 ppm. All samples were also analyzed by a second fire assay using a reduced charge weight with an upper detection limit of 10,000 ppm (Au-OR1). Approximately 50% of the samples were analyzed by three separate over-range fire assays to confirm the reproducibility of the results. Over-range values from Au-AA26 were also re-run following dilution. Four certified reference materials (CRM) and nine coarse quartz blanks were also submitted with the samples to monitor accuracy and possible cross-contamination, respectively. The results for all quality control samples lie within acceptable limits.

TABLE 1. DRILL HOLES AND SIGNIFICANT INTERSECTIONS

| HOLE ID | Sample ID | From | To | Interval | Grade (g/t) Au | Comment |

| HVD002 | 41842 | 94.90 | 95.30 | 0.40 | 48.00 | Combined to 0.70m @ 99.00 g/t Au |

| 41843 | 95.30 | 95.60 | 0.30 | 167.00 | ||

| 41858 | 110.90 | 111.20 | 0.30 | 2.25 | Combined to 2.60m @ 1.86 g/t Au | |

| 41859 | 111.20 | 111.60 | 0.40 | 0.69 | ||

| 41860 | 111.60 | 112.20 | 0.60 | 1.08 | ||

| 41863 | 112.20 | 113.00 | 0.80 | 0.01 | ||

| 41864 | 113.00 | 113.50 | 0.50 | 6.46 | ||

| 41913 | 153.80 | 154.2 | 0.40 | 1.26 | Combined to 1.20m @ 3.07 g/t Au | |

| 41916 | 43.60 | 43.90 | 0.30 | 0.01 | ||

| 41917 | 27.70 | 28.27 | 0.50 | 6.24 | ||

| HVD003 | 49836 | 165.20 | 165.80 | 0.60 | 147.50 | |

| 49847 | 190.40 | 191.00 | 0.60 | 2430.00 | Combined to 11.10m @ 160.45 g/t Au | |

| 49848 | 191.00 | 192.00 | 1.00 | 0.55 | ||

| 49849 | 192.00 | 193.00 | 1.00 | 0.09 | ||

| 49991 | 193.00 | 194.00 | 1.00 | Assays Pending | ||

| 49992 | 194.00 | 195.00 | 1.00 | Assays Pending | ||

| 49850 | 195.00 | 196.00 | 1.00 | 0.12 | ||

| 49851 | 196.00 | 197.00 | 1.00 | 0.04 | ||

| 49852 | 197.00 | 197.50 | 0.50 | 0.51 | ||

| 49853 | 197.50 | 198.00 | 0.50 | 0.72 | ||

| 49854 | 198.00 | 198.50 | 0.50 | 0.20 | ||

| 49855 | 198.50 | 199.50 | 1.00 | 178.00 | ||

| 49856 | 199.50 | 200.50 | 1.00 | 33.20 | ||

| 49857 | 200.50 | 201.50 | 1.00 | 174.00 |

TABLE 2. DRILL HOLE LOCATIONS

| Hole ID | GDA (Z55)East | GDA (Z55) North | RL (m) | GDA (Z55)Azimuth | Dip | EOH (m) | Status |

| HVD002 | 494221.0 | 5945655 | 714.7 | 229.3 | -40 | 410.90 | High Grade assay received only |

| HVD003 | 494221.0 | 5945655 | 714.7 | 227.7 | -55 | 348.00 | High Grade assay received only |

| HVD004 | 494220.6* | 5945655* | 714.7* | 254.5 | -35 | 248.90 | Assays Pending |

| HVD005 | 494221.6* | 5945655* | 714.7* | 198.4 | -55 | 317.70 | Assays Pending |

| * Coordinates are from drill design. Not yet surveyed. |

Next steps:

- Reviewing follow-up drilling to expand on results once all other assays have been received

- Assessment of geological and structural data collection, assessment of hydrothermal alteration to aid in defining new target areas

- The company continues to apply observations from the initial results to develop a comprehensive structural model for the Happy Valley target area

- A permit wide review and re-processing of geophysical data from the Myrtleford exploration license to define additional targets

E79 Resources is a resource exploration company focused on exploring for Fosterville -type mineralization at its Beaufort and Myrtleford properties in the Victorian Goldfields, Australia.

E79 Resources Corp. is up 143.24 per cent, trading at C$0.90 per share at 10:45 am ET.