- E3 Lithium (ETL) has released results from the third and final well from its inaugural 2022 drill program

- The well demonstrated a concentration of 74 mg/lithium, which is consistent with the second well’s 82 mg/lithium and the first’s 76.5 mg/lithium

- The data from the three wells will allow the company to upgrade its resource from inferred to measured and indicated

- E3 Lithium is developing an inferred resource of 24.3 million tonnes of lithium carbonate equivalent in Alberta

- E3 Lithium (ETL) is up by 0.51 per cent, trading at $1.97 per share

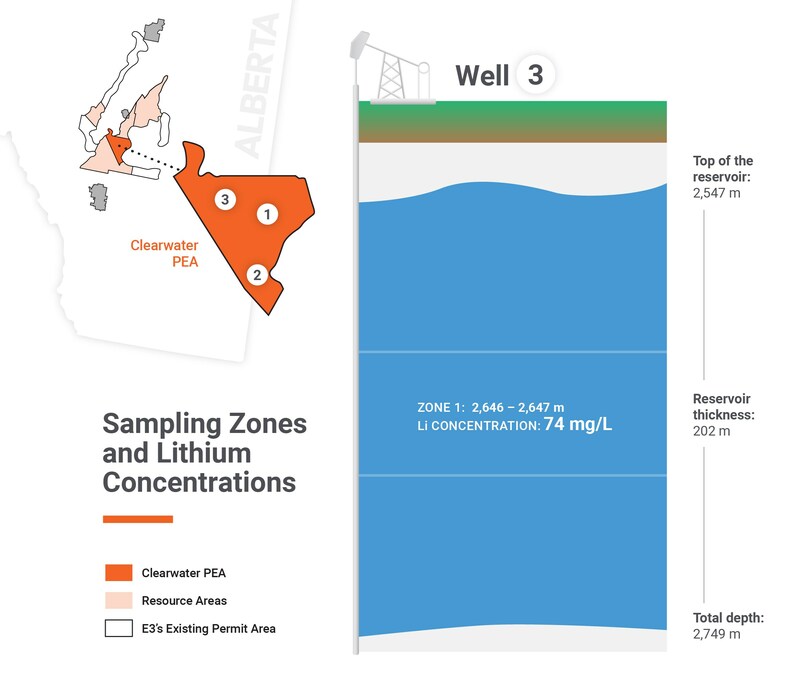

E3 Lithium (ETL) has released results from the third and final well from its inaugural 2022 drill program.

The well-outlined thickness of the Leduc Aquifer in the Clearwater Project as consistent at 202 m. The company collected a brine sample at a single interval, roughly in the middle of the aquifer, demonstrating a concentration of 74 mg/lithium.

The third well – located 10 km northwest of the first and 23 km northwest of the second – was repurposed from an existing oil and gas well, which enabled cost savings of more than $1.5 million and required no new land disturbance.

The consistency allows E3 to design and build its commercial facility without having to handle a large variation in fluid chemistry.

The data from the three wells will also allow the company to upgrade its resource from inferred to measured and indicated.

E3 Lithium is developing an inferred resource of 24.3 million tonnes of lithium carbonate equivalent in Alberta. The company intends to produce high-purity, battery-grade lithium products through its direct lithium extraction technology.

E3 Lithium (ETL) is up by 0.51 per cent, trading at $1.97 per share as of 9:36 am EST.