- BlackBerry Ltd. (BB) has struggled performance-wise this week, but this cloud has a silver lining

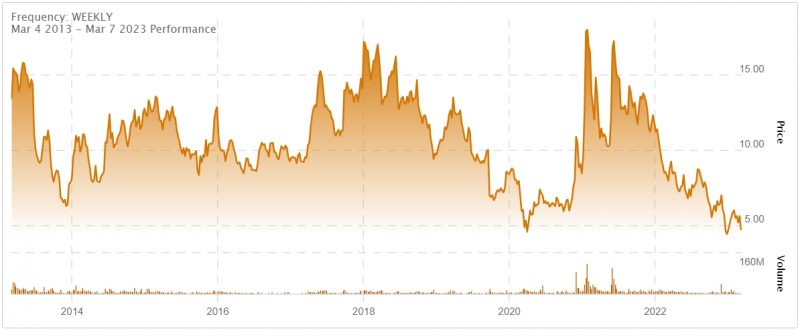

- One of the biggest percentage losers on the Toronto Stock Exchange, its shares have fallen far from when they were nearly C$18 a share in 2021

- Earlier this week, the software firm reported a lower-than-expected annual sales forecast and also noted that macro challenges during the reported quarter negatively impacted revenue

- BlackBerry will provide an outlook for fiscal 2024 during its March 30th earnings call

BlackBerry Ltd. (BB) has struggled performance-wise this week, but this cloud has a silver lining.

One of the biggest percentage losers in Tuesday trading on the Toronto Stock Exchange, its shares have fallen far from when they were nearly C$18 a share in 2021.

Earlier this week, the software firm reported a lower-than-expected annual sales forecast and also noted that macro challenges during the reported quarter negatively impacted revenue.

“Macro challenges were a key factor for BlackBerry’s cybersecurity business unit this quarter, with elongated sales cycles in government causing some large deals to slip into later quarters,” said John Chen, BlackBerry’s Executive Chairman and CEO. “The internet of things (IoT) business unit closed the year strongly, and we expect to deliver year-over-year revenue growth of approximately 16 per cent, in line with the outlook. Given the current macro backdrop, BlackBerry’s management has taken proactive steps this quarter to both balance investments and manage costs to drive towards profitable growth.”

In a preliminary look at its results for the quarter ended Feb. 28, BlackBerry reported expected total revenue of around US$151 million. Revenue from its IoT business is expected to be roughly US$53 million, while cybersecurity revenue is expected to be approximately US$88 million. Licensing and other revenue are expected to be about US$10 million.

For its full financial year, BlackBerry says it expects total revenue of US$656 million, with IoT revenue of about US$206 million and cybersecurity revenue in the neighbourhood of US$418 million. Licensing and other revenue for the full year are expected to be near US$32 million.

The company said it expects its fiscal Q4 2022 results will include a non-cash goodwill impairment of up to US$440 million related to its Spark software unit.

Shares fell roughly 70 cents, or 13 per cent, following this news on Tuesday.

BlackBerry provides intelligent security software and services to enterprises and governments around the world. The company secures more than 500 million endpoints, including over 215 million vehicles.

It has been a hard year for the Canadian cybersecurity company, having lost 24 per cent of its stock value in the last three months, BB shares are down nearly 42 per cent since this time last year.

However, it isn’t all doom and gloom. Looking at the bigger picture, this isn’t the first sag in BB shares, and its value has rebounded more than once. For many value-seeking investors, this could be just the kind of dip to take advantage of before another upward swing.

BlackBerry will provide an outlook for fiscal 2024 during its March 30th earnings call.