- DIAGNOS Inc. (ADK) closes a non-brokered private placement for gross proceeds of $590,000

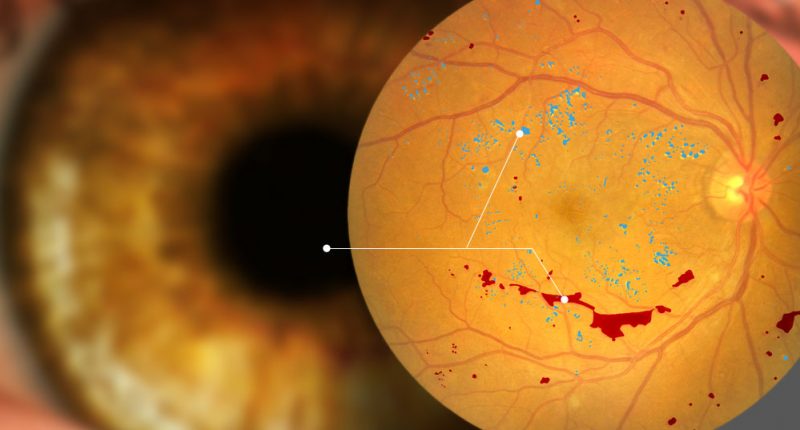

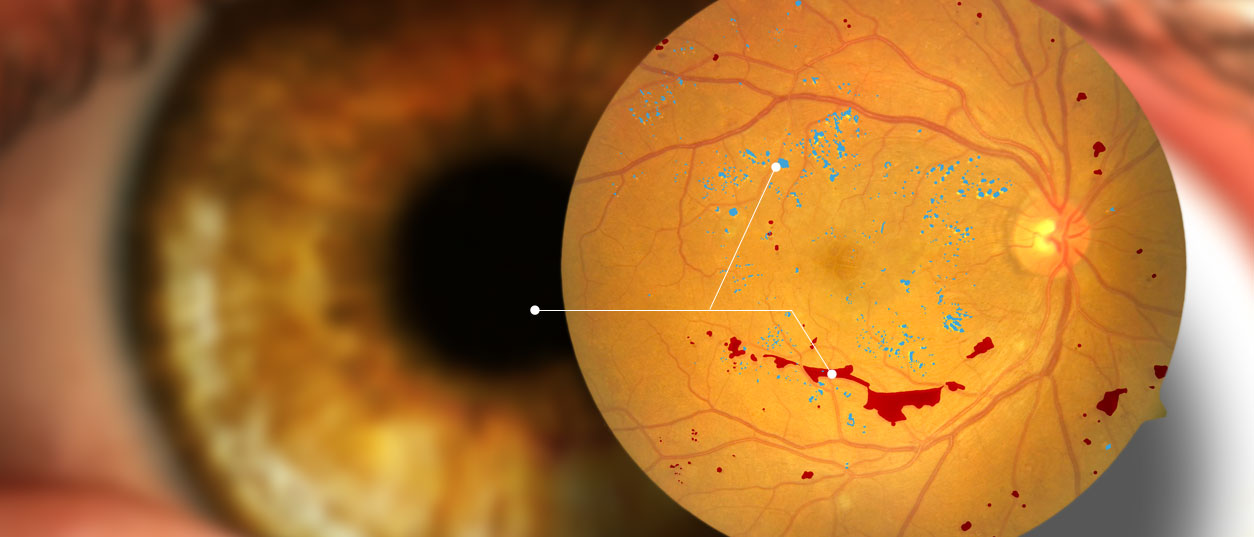

- Diagnos Inc provides software-based interpretation services to assist in the detection of diabetic retinopathy

- The financing is made up of 59 units at a price of $10,000 per unit

- Each unit consists of one unsecured convertible debenture, and 2,500 warrants for $0.33 per unit

- The proceeds from the private placement will be used to fund product development, commercialization of AI-based screening services, and administrative expenses.

- DIAGNOS also paid a cash commission of $25,000 and issued 65,789 broker warrants to the involved finder

- DIAGNOS Inc. (ADK) is unchanged trading at $0.27 per share as of 1:48 p.m. EST

DIAGNOS Inc. (ADK) has completed a non-brokered private placement for gross proceeds of $590,000.

Diagnos Inc is engaged in the provision of software-based interpretation services to assist health specialists in the detection of diabetic retinopathy.

The financing is made up of 59 units at a price of $10,000 per unit. Each unit consists of one unsecured convertible debenture and 2,500 warrants for $0.33 per unit.

Each debenture has a three-year term and bears interest at the annual rate of eight per cent.

At the option of the holder of the debenture, the principal amount may be converted at any time during the term into common shares of DIAGNOS for $0.38 per share. Any accrued interest on the principal will be immediately payable in cash.

Each warrant entitles the holder to purchase one share at a price of $0.33 per share, for 18 months from the date of closing.

If the daily volume-weighted average trading price of the shares exceeds $0.50 for 15 consecutive trading days, DIAGNOS has the option to accelerate the expiry of the warrants.

The proceeds from the private placement will be used to fund product development, the commercialization of AI-based screening services, and administrative expenses.

A director of the corporation, André Larente, subscribed for two units for $20,000. Larente expects to own 2.98 per cent of the total issued shares on a partially diluted basis.

One insider, Tristram Coffin, indirectly subscribed for seven units of $70,000. Coffin may exercise control over 11.79 per cent of the total issued shares on a partially diluted basis.

DIAGNOS paid a cash commission of $25,000 and issued 65,789 broker warrants to the involved finder. Each broker warrant entitles the finder to purchase one share for $0.33 per share until August 1, 2023.

DIAGNOS Inc. (ADK) is unchanged trading at $0.27 per share as of 1:48 p.m. EST.