Mining investors have two reasons to take a keen interest in the latest news release from Peloton Minerals Corporation (CSE:PMC / OTC:PMCCF / Forum) on its Boulder Copper Porphyry Project, located roughly 16 miles (~26km) from Butte, Montana.

Copper remains one of the hot stories in the new commodities boom. More on this later.

Experienced mining investors may have had their eyes on the Boulder Copper Porphyry Project for a long time. The Butte mining district is home of North America’s largest copper porphyry deposit and mine complex.

Yielding 35.1 million tons of copper, along with significant gold, silver, molybdenum and other base metals credits, this geological system epitomizes the monster potential of copper porphyry deposits.

Peloton’s Boulder Copper Porphyry Project shares many geological similarities in addition to its proximity. On August 25, 2022, Peloton announced that a DEEPEM geophysical survey is now underway on the Project.

For mining investors unfamiliar with this copper property, Peloton’s President, Edward Ellwood explained the significance of this news.

“We first tried to acquire this property in 2010, as did many others, without success. No exploration has occurred on the property since, and finally after all these years the potential of this property can be fully explored.”

After reviewing the historical geophysical data for this property, management chose the DEEPEM geophysical survey to prioritize numerous drill targets within a large IP anomaly that spans several thousand meters.

What is the company looking for? Butte type “Main Stage Veins” that accounted for nearly 95% of the metal produced from the huge Butte mineral system.

The largest of these Main Stage Veins at Butte was the famous Anaconda Vein. The one vein accounted for 40 million tons of ore, boasting extremely rich average grades of 4.5% copper and 5 ounces/ton silver (~150 g/t). The vein also yielded zinc, manganese, lead and gold credits.

The Boulder Copper Porphyry Project is 100%-owned by Celerity Mineral Corporation, which is 50%-owned by Peloton Minerals Corporation. Peloton acquired its current interest in the Project in August 2021, through the acquisition of privately-held Westmount Resource LLC. Celerity was a wholly-owned subsidiary of Westmount.

Peloton has already announced plans to spin-out Celerity as its own self-funding public company.

Upon completion of the DEEPEM survey underway and availability of the data, Celerity plans to issue a NI 43-101 technical report on the Project updating the historical data with this new geophysical survey. The Company also expects to release more guidance on its plans to take Celerity public at that time.

Boulder is a highly prospective copper project. And now is a great time for investors to be adding exposure to copper.

Copper is one of the metals that is strongly participating in the commodities Renaissance now underway. While slipping from recent highs, copper prices remain robust.

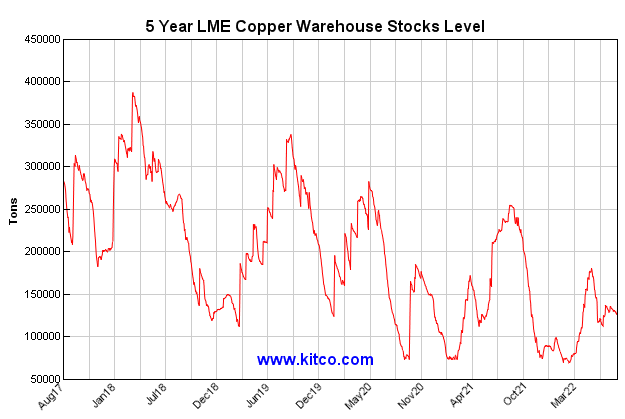

More importantly, copper inventories continue to track near multi-year lows.

Copper is widely used industrially. It has benefitted greatly from the extended construction boom – and the endless miles of copper wiring required for all these new structures.

In the 21st century, however, EVs and renewable energy have stoked the global demand for copper much further.

Conventional gas-powered automobiles need from 18 to 49 lbs of copper. Conversely, the average EV requires 183 lbs. (83kgs) of copper.

With most Western governments having announced plans to phase-out gasoline-powered automobiles, the EV Revolution is going to demand lots more copper.

Then there is renewable energy.

Copper usage “intensity” is 4- 6 times greater in renewable energy systems versus either fossil fuel or nuclear power plants. In solar power alone, the Copper Development Association estimates that the 262 GW of new solar installations planned from 2018 through 2027 will require 1.9 billion lbs of copper.

Got copper?

No? Then maybe now is the time to add some shares of Peloton Minerals Corp.

With a compact market cap of only CAD$7.3 million, Peloton provides investors with very cost-effective exposure to one of the most prospective copper projects in North America.

FULL DISCLOSURE: This is a paid article of The Market Herald.