- Revenue increased by 122.6 per cent in Q3 2021 compared to Q3 2020

- Q3 gross revenue of $10,821,697

- Nine month gross revenue of $40,315,888

- Q3 gross profit of $3,021,838

- Nine month gross profit of $19,309,184

- Datametrex AI Limited is a technology-focused company with exposure to Artificial Intelligence and Machine Learning

- Datametrex AI Limited (DM) opened trading at C$0.20 per share

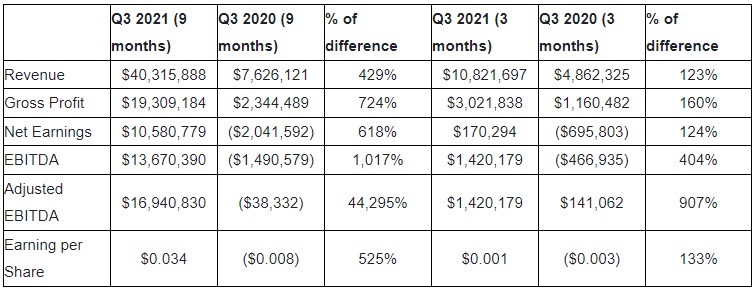

Datametrex AI (DM) is pleased to report record results for the three and nine-month periods ending September 30, 2021.

Marshall Gunther, CEO of Datametrex AI sat down with Caroline Egan to discuss the record results.

“We are pleased with the financial results we have delivered in nine months of 2021 and remain optimistic in our outlook with a calculated progress in the current operating environment as we move through the remainder of 2021. We continue to expect a profitability upturn and notable free cash flow. We also continue working on winning the $40M contract, and it is our belief that we should be able to share the good news in the near future.”

Financial highlights

The company’s improved Q3 financial performance was attributed to growth across its COVID-19 sales and its related services with the film and production industry and uptake in its health technology business.

- Q3 gross revenue of $10,821,697 – 123 per cent increase from Q3 2020

- Q3 gross profit of $3,021,838 – 160 per cent increase from Q3 2020

- Q3 EBITDA of $1,420,179 – 404 per cent increase from Q3 2020

- Q3 net earnings of $170,294 – 124 per cent increase from Q3 2020

Andrew Ryu, Chairman of Datametrex added,

“I am extremely proud of our whole team and we continue to experience growth as a result of our growing and diversified portfolio. The future prospects of Datametrex continue to build along with our growing customer base and we look forward to continue executing our business plan for the growth of the company.”

Q3 business highlights

- Revenue increased by 122.6 per cent in Q3 2021 compared to Q3 2020 bringing in over $10.82M in revenue.

- Cash and marketable securities of $12,915,840.

- Datametrex AI has entered into a $250,000 contract with a Canadian tech company on an Artificial Intelligence (“AI”) contract and received the first 50 per cent payment on August 23, 2021.

- On August 4, 2021, Datametrex announced passed the second round of scrutiny in a Canadian AI bid. The anticipated value of the contract is approximately $40 million.

- The company completed the sale of the issued and outstanding share capital of Concierge Medical Consultants to ScreenPro Securities Inc. for 36,000,000 ScreenPro shares.

Datametrex anticipates continued growth in business and improvement of its balance sheet. The company will continue expanding and improving its AI businesses, to generate continued growth in both its existing cybersecurity AI verticals and new health technology verticals that the company is building on.

There is clear and mounting evidence that people are coming down with breakthrough COVID-19 infections. Testing and contact tracing is a COVID-19 preventative action that will continue for years to come. Only 29.6 per cent of the world population have received at least one dose of a COVID-19 vaccine, and 15.2 per cent are fully vaccinated.

Datametrex AI Limited is a technology-focused company with exposure to Artificial Intelligence and Machine Learning through its wholly-owned subsidiary, Nexalogy.

Datametrex AI Limited (DM) opened trading at C$0.20 per share.