- Cruz (CRUZ) has yielded up to 900 ppm lithium from initial phase II results from its Solar Lithium Project in Nevada

- The findings will allow for an expanded phase III drilling program later this year

- Lithium continues to trade at an all-time high

- Cruz Battery Metals acquires and develops metals projects for the rechargeable battery and renewable energy sectors

- Cruz (CRUZ) is down by 11.36 per cent trading at $0.195 per share

Cruz (CRUZ) has yielded up to 900 ppm lithium from phase II results from its Solar Lithium Project in Nevada.

Hole 3 achieved a high of 900 ppm lithium, hole 4 achieved a high of 790 ppm lithium, and hole 5 reached as high as 820 ppm lithium.

Further results are pending from ALS Labs in Reno.

The company has hit potential lithium-bearing claystone with every drill hole through phases I and II and is optimistic about further drilling to delineate a domestic battery-grade lithium deposit.

The price of lithium remains at an all-time high.

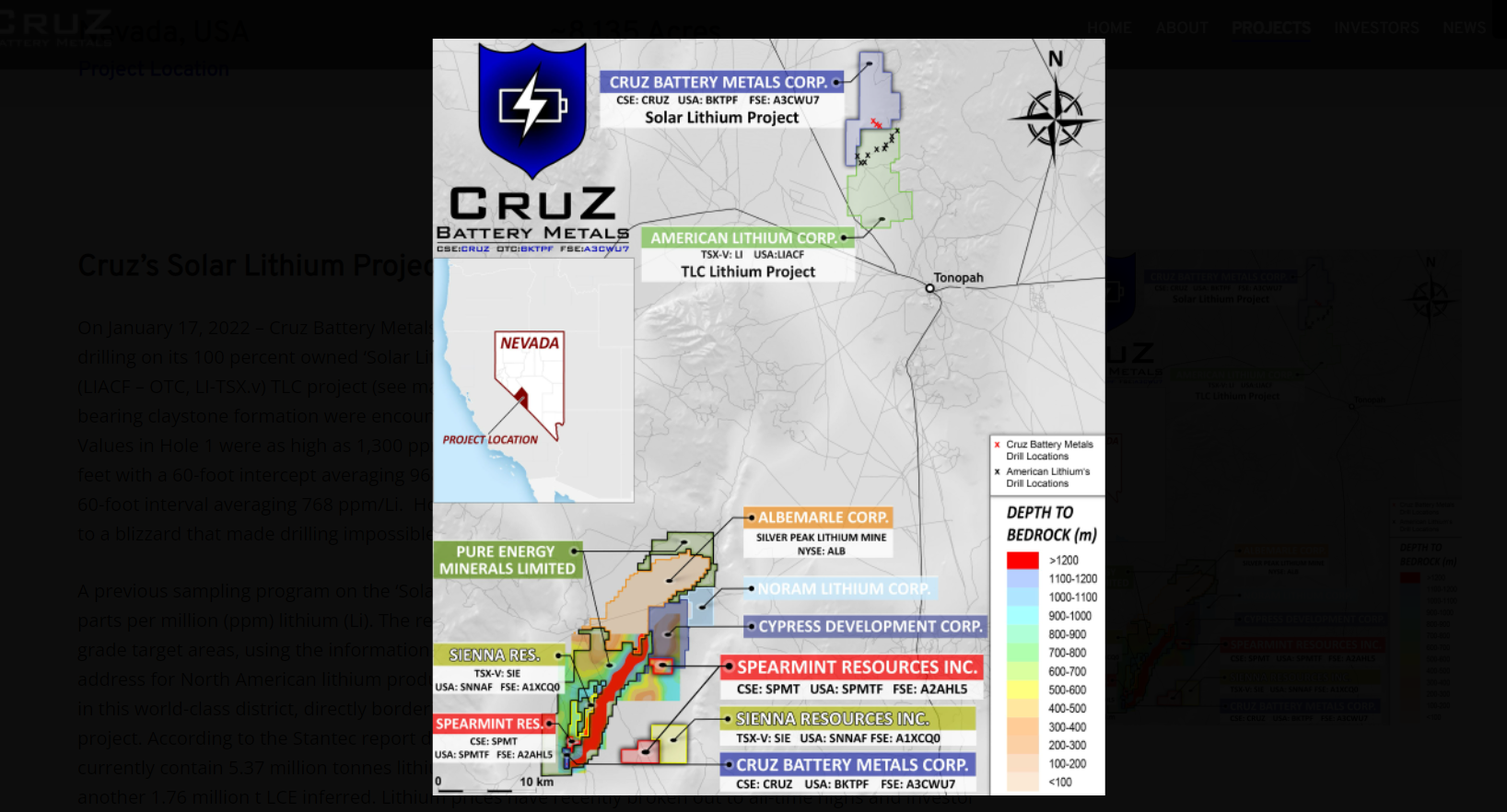

“Cruz has encountered further evidence of lithium present on the Solar Lithium Project, close to the border of American Lithium’s TLC Project,” stated Jim Nelson, President of Cruz Battery Metals. “The data provided by the first two phases of drilling will allow the company to plan a larger phase III program in the second half of 2022.”

Cruz Battery Metals acquires and develops metals projects for the rechargeable battery and renewable energy sectors.

Cruz (CRUZ) is down by 11.36 per cent trading at $0.195 per share as of 10:38 am EST.