- Greenbriar Capital (GRB) has shared a number of updates on its real estate and renewable energy projects

- The company is finalizing a formal binding offer to purchase a regional real estate franchise network

- The network employs 3,300 realtors comprising annual real estate sales of US$7.8 billion and consolidated commission income of US$164 million

- City planning documentation for the company’s US$450 million Sage Ranch subdivision is 90 to 95 per cent complete

- Greenbriar is in talks with three corporate customers to supply solar power to their organizations

- The company is also in talks with the U.S. and Puerto Rican governments to contest the overturning of two recent projects

- Greenbriar Capital is a developer of sustainable real estate and renewable energy

- Greenbriar (GRB) is up 5 per cent and is currently trading at $1.68 per share

Greenbriar Capital (GRB) shares a number of updates on its real estate and renewable energy projects.

Regional Real Estate Agency Acquisition

The company is finalizing a formal binding offer to purchase a regional real estate franchise network.

The company intends to purchase the rights to 3,300 realtors comprising annual real estate sales of US$7.8 billion and consolidated commission income of US$164 million.

The agency has grown into the #1 franchisee outside of Texas and the #1 spot for market share in Los Angeles.

The purchase price for the agency can be financed by bank loan for the full price, or by common shares, preferred shares or any combination of the above.

Sage Ranch

The US$450 million sustainable Southern California subdivision’s outstanding water report is currently being updated.

CEO Jeff Ciachurski has purchased US$2.6 million of deeded water rights and transferred 95 acre-feet of his annual pumping rights to Sage Ranch as a gesture of goodwill to the city.

Sage’s City Planning Commission documentation is 90 to 95 per cent complete. The final version of the Tentative Tract Map was submitted last week.

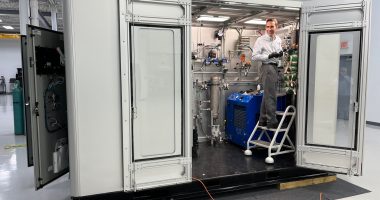

Alberta Solar

Devon Sandford, President of Greenbriar Alberta, has advised that three corporate customers are in negotiations with the company to supply solar power to their organizations.

Montalva

Greenbriar’s President, Cliff Webb, has applied for Montalva to participate in an existing RFP.

Greenbriar is in contact with the U.S. Congress, the FOMB, PREPA and PREB to contest the overturning of two previous projects, or for the acceptance of its proposal outside of the RFP.

In July of 2020, the Puerto Rico Energy Bureau and Public Service Regulatory Board approved Greenbriar’s projects with US$250 million of ratepayer savings.

The company’s revised pricing has increased this savings to US$425 million from its original US$1.9 billion 2012 contract.

On March 18, 2021, the Puerto Rico Energy Bureau and Public Service Regulatory Board issued a summons to PREPA to answer Greenbriar’s complaint that its key price information and interconnection costs were entered incorrectly, thus resulting in the overturning of the two projects.

The PREB has appointed an administrative law judge to expedite Greenbriar’s case and make a ruling.

Greenbriar Capital is a developer of sustainable real estate and renewable energy.

Greenbriar (GRB) is up 5 per cent and is currently trading at $1.68 per share as of 9:31 am ET.