- Christina Lake Cannabis (CLC) recap its second quarter financial results for the six-month period ended May 31, 2022

- Total revenue for the six months was $3.9M, exceeding the full fiscal 2021 year-end total of $3.6M

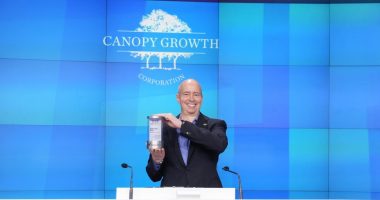

- Christina Lake is a licensed cannabis producer which cultivates cannabis using strains specifically developed for outdoor cultivation

- Christina Lake Cannabis Corp. (CLC) remained unchanged, trading at C$0.15 per share at 2:21 pm ET

Christina Lake Cannabis (CLC) recap its second quarter financial results for the six-month period ended May 31, 2022.

Q2 financial highlights:

- $2.3 million of total revenue, 40 per cent growth over Q1 of 2022 and 971 per cent over Q2 2021

- Total revenue for the six months was $3.9M, exceeding the full fiscal 2021 year-end total of $3.6M

- Gross margin before fair value adjustments was 56 per cent versus 55 per cent in Q1 2022 and 67 per cent in Q2 2021

Total general & administrative expenses declined by 70 per cent. This was driven by year-over-year reductions in corporate development, marketing, and share-based compensation expenses.

Net income in Q2 2022 was $22 thousand. The Year-over-year improvement is primarily driven by significant revenue growth and reduced G&A Expenses.

The company posted $184 thousand in positive EBITDA in Q2 2022, compared to a loss of $507 thousand in Q1 2022 and a loss of $1.6 million in Q2 FY2021.

As of May 31, 2022, the company had $1.26 million of cash and $1.03 million in receivables. It entered into a secured promissory note agreement of $2,000,000 with an interest rate of 8 per cent, maturing on August 31, 2024. This was in connection with the redemption and subsequent cancellation of the Class B Preferred Shares.

Christina Lake issued 13,000,000 common shares at $0.20 in connection with the redemption. It also extended the maturities of its $3.1 million of existing convertible debentures from twenty-four months to forty-two months. This reduced the current liabilities by approximately $6.2 million, shifting a large portion of the liabilities out to long-term debt.

The company optimized processing techniques leading to consistent production of high potency distilled oils and other extracts, while adding additional processing capacity. The improvement was a key contributor to the significant increase in the revenue from the prior fiscal year.

Christina Lake is a licensed cannabis producer which cultivates cannabis using strains specifically developed for outdoor cultivation.

Christina Lake Cannabis Corp. (CLC) remained unchanged, trading at C$0.15 per share at 2:21 pm ET.