One of Canada’s cannabis industry leaders, Delta 9 Cannabis Inc (TSX:DN / OTC:DLTNF) recently released its Q2 and 6 month numbers for 2022. But investors may be much more interested in looking ahead to future operational growth versus looking back at the previous results.

The second quarter revenue continued to grow over the first quarter results There was no problem with revenues. Revenues for H1 of 2022 remained strong at CAD$30 million and Q2 revenues actually rose to CAD$17.5 million up from $12.5 million in Q1 2022.

The Delta 9 team delivered strong second quarter results with sequential and year over year topline growth driven by a focus on their strategic growth plan. Delta 9 recently announced a strategic planning review with the Board of Directors that has identified several proactive growth opportunities to maneuver the current economic conditions by continuing to expand their retail cannabis store network across Canada and expand certain aspects of their businesses into new markets. The balance sheet remains strong, while also providing meaningful working capital to support organic growth and pursue strategic M&A acquisitions.

What is more encouraging for investors was what the company did during the first half of the year.

- Closed a 17 cannabis retail stores acquisition for $12.5 million

- Completed a strategic financing of $10 million with Sundial Growers Inc.

- Closed a $32 million Credit Facility with connect First Credit Union at a 4.55% fixed interest rate.

- Retired CAD$11.8 million of its unsecured 8.5% convertible debentures and drew an equal amount from Delta 9’s credit facility – at an interest rate of 4.55%.

- Raised ~CAD$2 million in an overnight marketed equity raise.

- Opened its 35th retail cannabis store (in Winnipeg).

- Negotiated a shareholder loan in the amount of ~CAD$5 million, payable at a 6% interest rate.

Complimenting Delta 9’s progress in expanding its retail footprint organically was an acquisition announced on August 15, 2022.

The company has acquired three additional cannabis retail stores in Manitoba, two in Winnipeg and one in Brandon. These stores have operated under the “Garden Variety” label.

Delta 9 CEO, John Arbuthnot, framed that news for investors.

“We are pleased to announce another strategic retail acquisition to grow our market share across the Canadian prairies. On closing of this transaction Delta 9 will operate 38 stores, positioning us as one of Canada’s largest vertically integrated cannabis retailers.”

The deal has also solidified Delta 9’s position in the province of Manitoba as a cannabis retail leader.

Given the significant growth in revenue, EBITDA and earnings of the Garden Variety cannabis stores over the past two years, Delta 9 is projecting this acquisition to already be accretive later this year – even before factoring in cost synergies from the acquisition.

The new cannabis stores should provide a significant boost to financial results going forward. Meanwhile, the additional financings provide capital to fuel future operational growth – either organically or by way of more acquisitions.

The combination of significantly reduced borrowing costs (despite an environment of rising interest rates) and ~CAD$7 million in new capital provides a substantial boost to Delta 9’s financial resources going forward.

Here, investors may want to step back and take a broader look at the company, in order to connect the dots with these latest announcements.

Delta 9 Cannabis Inc is one of a relatively small number of vertically-integrated players in the Canadian cannabis industry. As the global economy reels from supply-chain breakdowns and transportation disruptions, vertical integration is acquiring increasing importance.

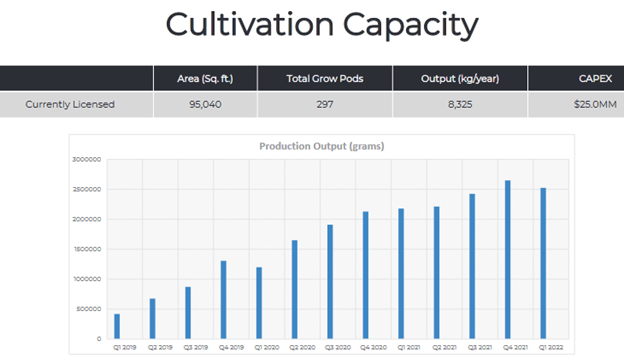

Approximately 25% of the cannabis sold in the company’s 38 cannabis retail stores is from Delta 9’s own cultivation. Its fully licensed cultivation facility in Manitoba can be easily/efficiently scaled up as cannabis demand increases or there are disruptions to other supply sources.

Delta 9’s proprietary “Grow Pods” provide both high yields and consistent quality in the cannabis flower being cultivated. This allows Delta 9 to cultivate 30 commercial dried strains of cannabis (and 12 core strains) at costs as low as $0.57 per gram.

Combine one of the industry’s most-efficient cultivation platforms with a large-and-growing cannabis retail network and what do you get? High margins and rising gross profits.

Delta 9 stock market valuation is $20 million and is trading at 1/3 of its 2021 revenue of $62 million. This creates a good buying opportunity for Delta 9 shares, as it is currently trading near its low for the year.

With all the recent moves the company has made to strengthen both its balance sheet and operations, this looks like a glass half-full set up for investors. In hindsight, shareholders could see this moment as an important pivot-point in Delta 9’s development.

Many companies have been going through recent tough times, as reflected by the slump in the broader markets. Delta 9 Cannabis is clearly a company more focused on building for the future than dwelling on the past.

FULL DISCLOSURE: This is a paid article for The Market Herald.