As we draw closer to the end of 2022, many investors wonder if 2023 will be any different.

Markets are still absorbing the influx of activities this year, which kept almost everyone on the edge of their investing seats.

From the return to the new normal to the war in Ukraine to high inflation and interest rate hikes, all have driven market volatility throughout the year.

However, investors remain optimistic that 2022 is heading towards a better conclusion as major commodity consumer, China, loosens its COVID-19 restrictions and major central banks are reassessing their stance on their monetary policies.

In this edition, we will cover stories from companies and sectors making headlines amid all the market’s hot discussions.

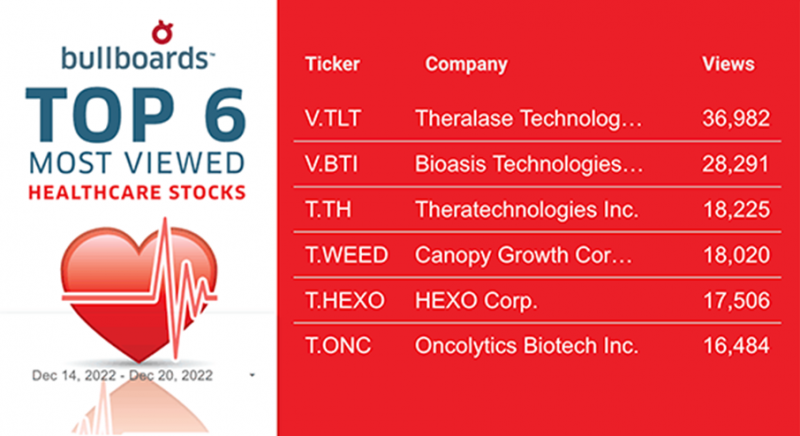

The Healthcare sector seems to have become a top choice for market participants, and healthcare companies seem to be making the most of this new shift in focus. Bioasis Technologies (TSXV:BTI.V) has signed a merger agreement with Midatech Pharma plc.

Midatech will acquire 100 per cent of the issued and outstanding common shares in the capital of Bioasis from Bioasis’ shareholders in exchange for ordinary shares of Midatech in the form of American depositary shares.

The combination of Bioasis and Midatech will create a multi-asset rare and orphan disease company that will be renamed Biodexa Pharmaceuticals PLC.

Improving safety and security and implementing measures to mitigate any sort of risk is becoming critical, especially in the public sector domain, as we move to use more sophisticated technologies.

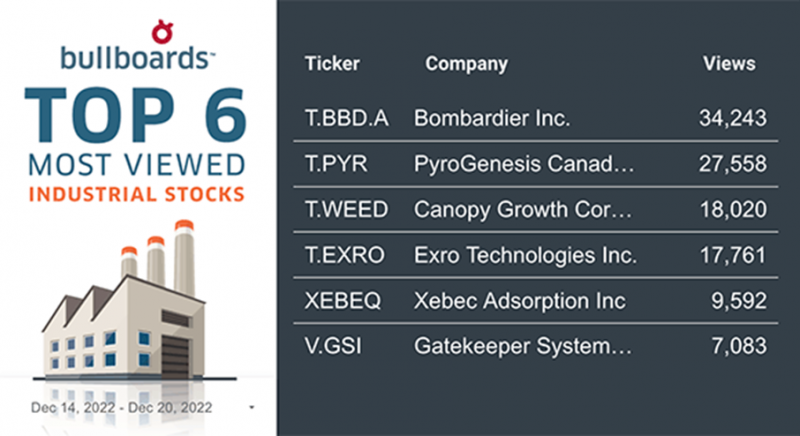

Gatekeeper is a video and data solutions provider for public transportation and smart cities. It uses AI, video analytics, thermal cameras, and mobile data collectors to interconnect public transit assets as part of intelligent transportation systems in a Smart City ecosystem.

Gatekeeper Systems (TSXV:GSI) U.S. subsidiary, Gatekeeper Systems USA, has received a purchase contract from Southeastern Pennsylvania Transit Authority (SEPTA) for transit bus video upgrades and mobile data collector upgrades.

The contract is for approximately US$2.94 million and is expected to be completed during the company’s second fiscal quarter ending February 28, 2023.

SEPTA is Gatekeeper’s largest customer. During the 2022 calendar year, Gatekeeper announced approximately US$9.35 million (approximately CAD $12.7M) in aggregate contracts with SEPTA.

SEPTA is one of the largest transit systems in the United States. It serves five counties in the Greater Philadelphia area and connects to transit systems in Delaware and New Jersey.

Leading global cannabis-lifestyle and consumer packaged goods company Tilray Brands (TSX:TLRY) has launched a new limited edition premium craft flower series by lifestyle brand RIFF.

The new series will introduce two new collections of craft flower featuring a rotation of limited edition, rare genetics. These products result from collaborative efforts between RIFF and the talented local craft growers in its community.

The new craft strains will launch in the market under the Orbital Indica and Crossfade Sativa collection. It will feature higher THC potencies and elevated terpene levels, with a new, exclusive strain to be introduced for each rotational drop.

Get “Buzz on the Bullboards” delivered to your inbox every Thursday! Buzz on the Bullboards | Sign Up Here