- Burin Gold Corp. has completed its initial public offering for $6.9 million and listing on the TSX Venture Exchange

- The offering consisted of the issuance of 7.78 million units issued at a price of $0.60 per Unit, and 3.26 million flow-through (FT) shares issued at a price of $0.69 per FT share

- Burin Gold will use the proceeds from the flow-through portion of the offering for Canadian exploration expenses on its properties located in Newfoundland that will qualify as flow-through mining expenditures

- The company will use the net proceeds from the non-flow-through portion of the offering to fund its business

- Burin Gold’s common shares were listed as of today and are expected to commence trading on the TSX-V under the symbol “BURG” on November 24, 2021

Burin Gold Corp. (BURG) has completed its initial public offering for $6.9 million and listing on the TSX Venture Exchange.

The offering consisted of the issuance of 7.78 million units issued at a price of $0.60 per Unit, and 3.26 million flow-through (FT) shares issued at a price of $0.69 per FT share.

Each unit is comprised of one common share in the capital of Burin Gold and one-half of one common share purchase warrant.

Each whole warrant will entitle the holder thereof to purchase one Share at an exercise price of $0.85 per Warrant for a period of 24 months from the date of issuance.

Burin Gold has paid the agents involved an aggregate cash commission of $402,846.91 and issued to the agents 642,187 broker warrants.

Each broker warrant is exercisable for one common share at a price of $0.60 per warrant for a period of 24 months from the date of issuance.

The company paid the lead agents a corporate finance fee of $50,000 payable in cash and 41,666 shares issued at price of $0.60 per share.

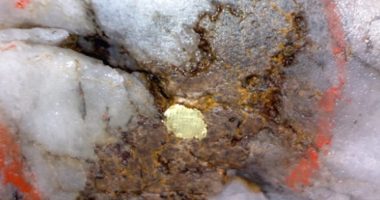

Burin Gold will use the proceeds from the flow-through portion of the offering for Canadian exploration expenses on its properties located in Newfoundland that will qualify as flow-through mining expenditures.

The company will use the net proceeds from the non-flow-through portion of the offering to fund its business.

Insiders of Burin Gold acquired an aggregate of 535,331 units and 25,000 FT shares.

The initial public offering constituted a “related party transaction” requiring the company, in the absence of exemptions, to obtain a formal valuation and minority shareholder approval thereof.

Burin Gold has relied on the exemptions from the valuation and minority shareholder approval requirements of MI 61-101 contained in Sections 5.5(b) and 5.7(1)(b), respectively, of MI 61-101 in respect of such insider participation.

Burin Gold’s common shares were listed as of today and are expected to commence trading on the TSX-V under the symbol “BURG” on November 24, 2021.