Canada is the fastest growing export market for Brazilian gold, and given how the precious metal serves as a strong hedge against inflation and a safe haven during times of uncertainty, this trend is expected to continue.

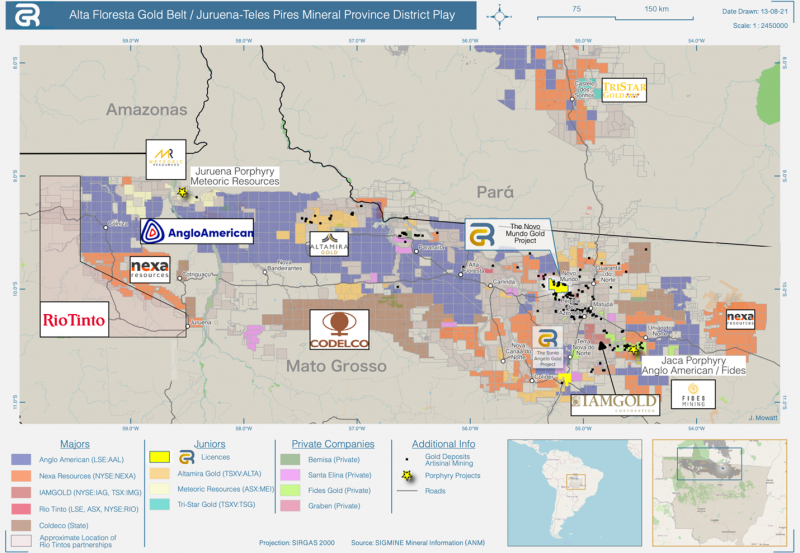

Resouro Gold Inc. (TSXV:RAU) is a Canadian-based mineral exploration, and development company focused on discovering and advancing economic mineral projects in Brazil. The company’s key asset is the 100 per cent-owned Novo Mundo Gold Project located in the prolific Alta Floresta Gold Belt in Mato Grosso.

With a name that literally means “Gold Resources” in Portuguese, it also has three other wholly owned projects in the mining-friendly states of Mato Grosso, Tocantins / Goias, and Pernambuco.

Novo Mundo and Buracão are in the advanced exploration stage whilst the Santa Angela and the Pernambuco Projects make up the company’s exploration pipeline.

This company is out to differentiate itself from other junior explorers by exploring and drilling for near-surface, high-grade, open-pittable gold resources that could become early cash-flow opportunities.

The company is headed by mining entrepreneur and executive Chris Eager, former co-founder of Monterrico Metals PLC, which advanced the Rio Blanco copper project in Peru and was sold to Zijin Mining for USD 200 million. Chris is joined by Dr. Marcelo de Carvalho, who has decades of experience in Brazil working for Anglo Gold, Vale, Yamana Gold and Meteoric Resources, and has been involved with multiple gold discoveries (see Meet the Team below).

Novo Mundo:

Resouro’s flagship Novo Mundo Project covers over 167km2 of the highly prospective Alta Floresta Gold Belt, which has seen several major discoveries in recent years, including the Jaca and Juruena discoveries.

Resouro recently announced drill results from two out of eleven holes completed along part of the 4 km-long Luisão – Dionísio trend. Results include 11.65 m grading 5.1 g/t Au, including 2.5 m grading 8.1 g/t Au, with further assays pending. Luisão-Dionísio is one of several mineralized trends on the property characterized by numerous artisanal pits and surface workings.

The company also announced preliminary metallurgical test work results, demonstrating recoveries of more than 90 per cent using conventional techniques, and importantly, the granting of a trial mining license (“Guia de Utilização”) inclusive of environmental and installation license by the Brazilian Mining Agency. The trial mining license allows the company to start trial mining, as well as the installation of all necessary infrastructure and equipment at Novo Mundo.

Christopher Eager, CEO and President of Resouro, sat down with the Market Herald’s Daniella Atkinson to discuss the drill results and receipt of the trial mining license.

“We are very pleased with these initial results at Novo Mundo, where our exploration is confirming the significant grades and mineralized widths seen in historical exploration and is improving our understanding of the mineralization controls. Importantly, what is becoming very evident is the significant exploration potential over the remainder of the property outside of the Luisão-Dionísio-Modesto trend. We look forward to updating our shareholders with additional results over the next few weeks.

The approval of the Trial Mining License and highly encouraging preliminary metallurgical test results reaffirm Resouro’s commitment to moving Novo Mundo toward development. Mining regulations in Brazil enable projects to be advanced towards production rapidly, and the grant of Resouro’s Trial Mining License demonstrates that this path can be navigated successfully. The preliminary test work showed that conventional processing flowsheets using off-the-shelf processing equipment can achieve over 90 per cent gold recovery, which is very encouraging for us. With the license in hand and a good grip on the processing methods the mineralization at Novo Mundo requires, the company is well placed to advance discussions with local equipment manufacturers for initial project development.”

Piexoto Project:

In September 2022, Resouro Gold announced that it had signed an arm’s length term sheet with IAMGOLD Corp. (TSX:IMG) to acquire the Peixoto Gold Project.

The Peixoto Project is comprised of eight mineral processes and rights totalling 520.2 sq. km. and is adjacent to the company’s Novo Mundo and Santa Angela gold projects. The mineral rights are all at the initial three-year exploration period and have partial exploration reports.

The terms of the proposed transaction include issuing an aggregate of 2,314,471 common shares of the company to IAMGOLD. The company and/or ISON Brazil will assume all of the remaining obligations of IAMGOLD and its affiliates.

The company would take a 100 per cent interest in the project, located in the State of Mato Grosso, Brazil.

CEO Eager said that the company has made substantial progress at its 100 per cent owned Novo Mundo Gold Project since its reverse takeover in April 2022.

“The acquisition of the Peixoto Project will increase Resouro’s Novo Mundo Gold project land holding by over 310 per cent to 687.5 km2. This is a major holding in the highly prospective Alta Floresta Belt in Mato Grosso, Brazil. The package comes with numerous gold occurrences with many historic artisanal workings and recent exploration data including drilling.”

Buracão:

The Buracão property lies in central Brazil on the border between Tocantins and Goias.

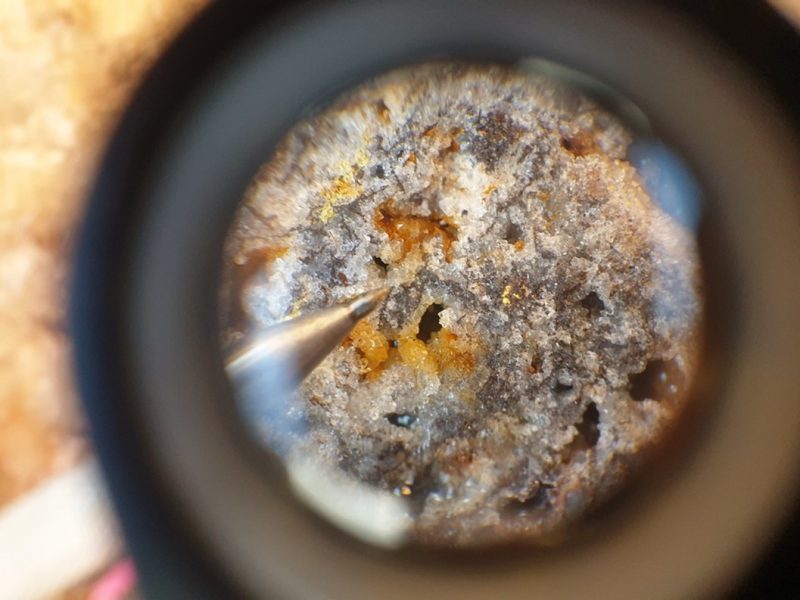

The project consists of two adjacent licences totalling 39.95 km2 and still has many of the old workings dating back to previous discoveries made by Portuguese explorers during colonial times. Artisanal mining has occurred since the 18th century, however, the property has not yet undergone any systematic modern exploration. Gold mineralization evidenced in artisanal pits at Buracão is high grade and typical of orogenic gold deposits, but the property is under-explored with only a few historic drillholes scattered around the area. In particular, the extensive size of the alteration system impressed the Resouro team.

CEO Eager explained the current objectives at Buracão.

“There is a lot of geological work to be undertaken, in particular, understanding the structural controls on mineralization which will be key in defining mineralized trends and drill targets for resource definition. This work will be carried out along the trend of the known mineralization applying geophysical techniques capable of detecting continuations of known surface mineralization below cover.”

The company is also evaluating the extensive tailings accumulated from the primitive gravity-only recovery methods employed by 18th-century and modern-day artisanal miners.

Other operations:

The Santa Angela Project is south of the Novo Mundo project and is adjacent to a historic granite-hosted gold mine and has been subject to limited exploration.

The Pernambuco Project is the earliest stage exploration project in the company’s portfolio, where the company is planning a grassroots exploration campaign.

Meet the team:

CEO Eager boasts more than 30 years of experience in the mining industry as an engineer, entrepreneur, and in project finance. As co-founder of Monterrico Metals PLC, he helped unlock value in the Peruvian Rio Blanco copper project that was acquired in 2007 by Zijin at a valuation of around US$200 million. He moved to Brazil in 2016 to develop Resouro.

“Most of my career has been in Latin America,” he said. “What I do, is look for projects that have sufficient data on them already to give an indication of what the economics of the project could be. Resouro’s Novo Mundo really fit the bill because it had sufficient drilling and sufficient high-grade intercepts for me to do my evaluations and say – that’s a project we could develop.”

The company’s Chief Operating Officer and Chief Geologist, Dr. Marcelo de Carvalho, has 20 years of experience in exploration and project development in Brazil, working for Anglo Gold (NYSE:AU), Vale (NYSE:VALE), and Yamana Gold (TSX:YRI), where he was the Exploration Manager. He is currently a Director of Meteoric Resources (ASX:MEI) and managed the recent discovery of the Juruena porphyry deposit.

Director David Cass is a seasoned geologist who brings more than 25 years of international experience in mineral exploration and mining for precious and base metals to the team, with most of this experience focused on Latin America. He spent 15 years of his career with a major international mining company Anglo American plc, where he held positions of increasing responsibility in jurisdictions, including South and Central America, Mexico, Canada, Turkey, Iran, and Eastern Europe.

Also, the key to the operation is the company’s internal council lawyer, Philippe Martins, who manages all legal, due diligence and transfer of concessions and mineral rights. With 25 years of experience in the business, he has been an internal player for several mining companies, and CEO Eager noted his “tremendous network”.

Investment summary:

The jurisdiction is very important to see the company’s projects through to success. The team emphasized that projects are selected where they know that communities are a hundred percent pro-mining. In Brazil, licensing is a straightforward, streamlined process, and management is familiar with it, having worked in the region for decades.

Similarly, local infrastructure is as solid as the geological potential of Resouro’s projects.

Regarding capital structure, another interesting side of Resouro is that management and insiders own just over 51 per cent of the company, with very strong gold funders as cornerstone investors. As the market gains strength, Resouro Gold is gathering more shares in the market to trade. This is one opportunity where investors would be wise to engage in deeper due diligence.

FULL DISCLOSURE: This is a paid article produced by the Market Herald.