- Brixton Metals (BBB) has raised almost C$4.5 million to fund exploration work at its properties in Ontario and British Columbia

- The company issued just under 12.4 million flow-through shares at a price of $0.36 each

- Winter drilling will now be carried out at the Langis Project in Ontario while further drilling will take place at the Thorn Project in British Columbia next season

- Brock Riedell, with more than 40 years experience in minerals exploration and mining economic analysis, has been appointed as a Senior Technical Adviser to the company

- Brixton Metals is currently up 8.93 per cent to $0.30 per share

Brixton Metals (BBB) has raised almost C$4.5 million to fund exploration work at its properties in Ontario and British Columbia.

Under the terms of the non-brokered placement, the Vancouver-based company issued just under 12.4 million flow-through shares at a price of $0.36 each.

In connection with the offering, roughly $137,000 was paid in cash to certain finder’s parties, along with 381,724 finder’s warrants. Each warrant will be exercisable at a price of $0.36 per share for a period of 24 months.

With the financing now complete, Brixton said it is fully-funded going into 2021 with a total treasury of approximately $9 million.

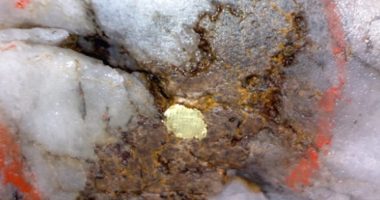

“This winter we are drilling for high-grade silver and cobalt at the Langis Project in Cobalt, Ontario, and will be drilling further high-impact targets at the Thorn Project next season,” said Gary Thompson, Chairman and CEO of Brixton Metals.

“We’re encouraged by the confidence we’ve seen from major shareholders, and are looking forward to positive near-term catalysts,” he added.

In addition to the financing, Brixton has appointed Brock Riedell as a Senior Technical Adviser.

With more than 40 years of experience in minerals exploration and mining economic analysis, Brock has primarily been involved in porphyry, volcanic and sediment-hosted gold discoveries in British Columbia, Nevada, Utah and Arizona.

In addition to consulting for Brixton, Brock has also assisted Imperial Metals, Fortuna Silver, Adventus Mining, Redhawk Resources, and Abacus Mining and Exploration.

“In addition to Brock’s work with the company we plan to continue work with UBC’s MDRU (Mineral Deposit Research Unit) as we look to unlock the giant porphyry potential at the company’s wholly owned 2,600-square-kilometre Thorn Project,” Gary said.

Brixton Metals is currently up 8.93 per cent to $0.30 per share at 10:29am EST.