The Covid-19 pandemic continues. However, for many businesses, we have now entered a post-Covid world.

What does that mean?

The Old Economy is gone, perhaps forever. In its place is the New Economy.

In the Old Economy:

- Governments were relatively solvent.

- Robust and complex supply chains fed the global economy.

- Efficient shipping/transportation networks provided a reliable flow of goods.

- This permitted “just in time” supply and inventories.

In the New Economy:

- Governments are drowning in red ink.

- Supply chains are constantly breaking down.

- There are frequent disruptions and serious congestion with shipping/transportation.

- “Just in time” supply and inventory management no longer exists.

One Company that looks like it was custom-designed specifically for the New Economy is Voyageur Pharmaceuticals Ltd. (TSXV:VM, OTC:VYYRF).

CEO Brent Willis knows firsthand about the difficulties and aggravation of trying to source supply inputs from overseas in the New Economy, particularly when it involves a “critical strategic mineral”. More on this later.

How to thrive in the New Economy

In the New Economy, supply is suddenly an issue, for everything from raw materials all the way up to high-end manufactured products.

How can businesses turn the challenges of the New Economy into growth opportunities? Several strategies present themselves.

- Focus on the production of some important manufacturing input, where existing supplies are currently “critical”.

- Become the lowest-cost supplier for some lucrative niche of the economy.

- Look for opportunities to add value, in each facet of the company’s business.

- Vertical integration, where a company becomes its own supplier.

Voyageur Pharmaceuticals is aggressively pursuing all of these strategies. The business model all revolves around the Company’s strong commitment to vertical integration, perhaps soon to become the new mantra of the New Economy.

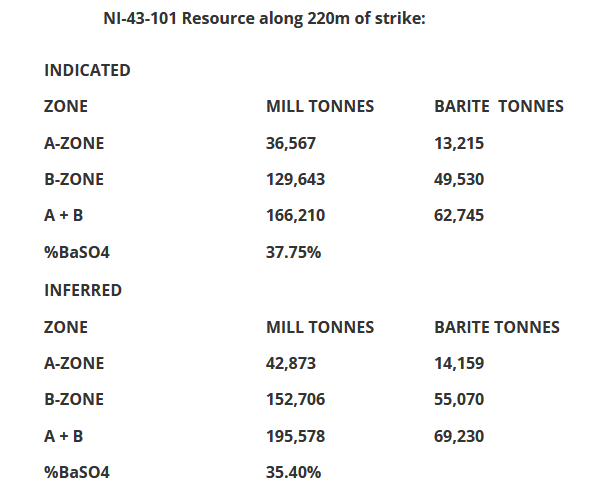

The Voyageur vertical integration story starts with Frances Creek. This is the Company’s 100%-owned barite property, the only known source of high-purity barium sulfate outside of China.

Barite is barium sulphate (BaSO4). Barium sulphate is a natural occurring hard rock mineral that is used in many industrial applications from the mud-flaps on your car to drilling fluids for drilling oil wells. It is used as an additive for paint and gives printer paper that fine extra weight.

However, finding natural high-purity crystal barite that meets pharmaceutical grade is exceptionally rare. Thus, most of the pharmaceutical-grade BaSO4 used in the world must be created synthetically – an expensive process.

Voyageur, itself, has received quotes for synthetic BaSO4 (landed in its home base of Calgary, Alberta) from US$5500 to recently as much as US$17,500 per tonne.

The Company’s Frances Creek barite is one of the few high-grade deposits capable of yielding pharmaceutical-grade barium sulphate. This will make Voyageur the lowest-cost supplier of BaSO4 (outside of China), and by a large margin.

The only natural source of pharmaceutical-grade BaSO4 outside of China

With China’s supply of BaSO4 now effectively at risk (because of the supply-chain issues of the New Economy), Voyageur Pharmaceuticals is sitting on the only natural non-Chinese source of pharmaceutical-grade BaSO4 in the world.

For investors, what is the significance of this?

Primarily, it means a much lower cost for this critical input. This will become easier to see as investors learn more about the BaSO4 supply chain.

BaSO4 is an extremely useful manufacturing input. Lower-grade sources are used as a filler for rubber, plastics and resins. However, for pharmaceutical-grade BaSO4, perhaps the most lucrative application is as a “contrast agent” in the medical imaging CT scan and X-ray contrast media sector.

That’s a mouthful for investors. For those without a healthcare background, it’s perhaps not a term that sheds a lot of light.

CEO Brent Willis understands that. In speaking with The Market Herald, he suggested that when investors hear this term that they think “radiology drugs”.

Ground into an ultra-fine powder, the natural BaSO4 is mixed with other food grade ingredients to create barium contrast media and then administered to patients. It coats the gastrointestinal tract and provides superior contrast in radiology scans such as fluoroscopy and CT scans.

The high-grade barite contained in the Frances Creek (NI 43-101) resource has been shown in chemical testing to yield BaSO4 at an average purity of 98.6%, above the 97.5% threshold necessary to qualify as pharmaceutical grade. This is significant because the only other >98% pure barium on the market is man-made.

Given its importance in healthcare and the extreme scarcity of natural, high-grade barite, both the United States and EU have designated barite as a “critical mineral”.

What’s left for industrial users now that China’s supply of pharmaceutical-grade BaSO4 is now almost unavailable outside of China? Synthetic BaSO4.

Here is where the Voyageur Pharmaceuticals vertical integration story really starts to get interesting.

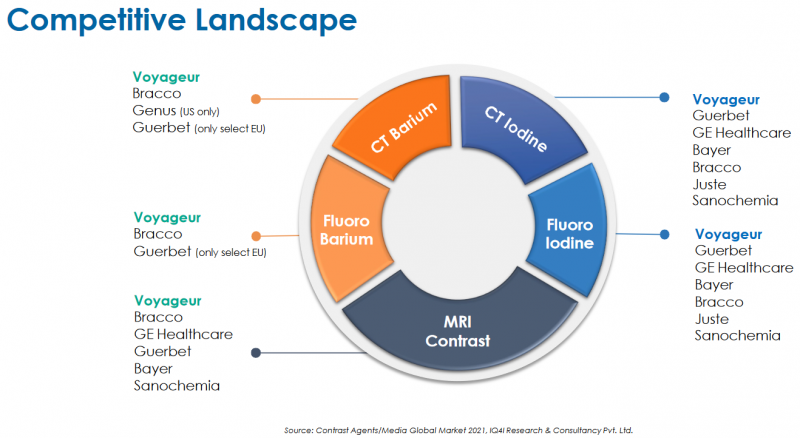

While there are many sources of (very expensive) synthetic BaSO4, because of this barrier to entry, one company (Bracco) has locked up distribution of most of the world’s barium-based radiology drugs.

The low-cost BaSO4 from Frances Creek will allow Voyageur to do more than compete with Bracco as a supplier of barium-based radiology drugs. Voyageur expects to become the lowest-cost supplier in this market once its own supply chain is fully operational.

Moving to production with barium-based radiology drugs

CEO Willis has firsthand experience in the global BaSO4 market. In recent months, Voyageur has invested significant time/energy in seeking to lock-up its own source of synthetic pharmaceutical-grade BaSO4.

This will leave some investors scratching their head.

Why would a company buy (very expensive) synthetic BaSO4 when it is working to become a major supplier of its own much cheaper natural pharmaceutical-grade barium sulphate?

Brent Willis is used to quizzical looks from investors when he mentions Voyageur’s plans here. It’s a strategy that is part of the forward thinking that characterizes Voyageur Pharmaceuticals.

Via the Company’s contract pharmaceutical manufacturer Alberta Veterinarian Laboratories (AVL), Voyageur will start producing some of these barium-based radiology drugs.

This requires licensing for each radiology drug, in each jurisdiction in which Voyageur plans on retailing its products. The Market Herald will go deeper into this somewhat complex topic in an upcoming feature article.

The gist of this is that such licensing is expected to require roughly a year, to gain access to the U.S. and EU markets. To commence this licensing process, Voyageur must have products ready to retail.

Brent Willis pointed out to The Market Herald that Voyageur is now well-advanced in this licensing process. Necessary Health Canada approvals are already in place.

If the Company waited until it had its own manufacturing infrastructure in place to begin this process, then that infrastructure would sit idle – unable to ramp up until licensing was in place. Not good business.

Instead, Voyageur plans to have all of its licensing in place well ahead of the completion of its plant infrastructure.

Cost advantage one: natural vs. synthetic BaSO4

This leads back to the global supply constraints for BaSO4 previously mentioned.

As previously noted, Voyageur has been quoted its synthetic BaSO4 at a cost of US$5500/tonne to US$17,500/tonne, landed in Calgary.

Then there is the natural, pharmaceutical-grade BaSO4 that Voyageur will be producing at Frances Creek.

Voyageur Pharmaceuticals operating costs as reported in the recently published PEA, is CDN$538/tonne (USD$421/tonne, 13-41 times lower than the current cost).

That’s an enormous cost advantage, and it’s why having its own source of natural pharmaceutical-grade barium sulphate is such an important competitive edge for Voyageur.

The Company could make very strong margins just selling the valuable pharmaceutical-grade BaSO4 that Frances Creek will be producing. But Voyageur is setting its sights much higher.

By adding value to its high-grade barite, Voyageur Pharmaceuticals can target an equally lucrative and much larger market: radiology drugs.

That was Brent Willis’ vision as he began building Voyageur from a barite-focused mining company into an emerging, vertically-integrated player in the pharmaceutical industry.

“Voyageur is bringing to market multiple barium products with various concentrations of barium in these products.

Our dry product, which is used in the X-ray markets, will have the greatest margin and we believe we can take a major foothold in this market once the FC project is running.

Our cost of goods is dramatically lower than any competitor. This will allow for rapid market penetration.

The supply of barium synthetic feedstock for contrast is at high risk. European barium manufacturers are having issues manufacturing synthetic barium due to high energy costs and lack of supply of input chemicals. Chinese supply has been decapitated.

Voyageur is poised to take full advantage of this fragile supply chain and become the only domestic supplier of barium sulphate contrast media in North America.”

Cost advantage two: the only North American supplier of radiology drugs

As the global supply chain continues to deteriorate, Willis’ long-term vision for Voyageur Pharmaceuticals looks stronger and stronger: the only domestic supplier of barium sulphate contrast media in North America.

The graphic above shows the current (and future) supply options for radiology drugs. A lot of EU-based multinationals and Voyageur Pharmaceuticals.

This reflects the major barriers to entry into the medical imaging contrast media industry. And it’s a large market.

A 2021 research report pegged this as a US$4.7 billion market, forecast to reach $7 billion by 2028 with a very robust CAGR of 7.7%.

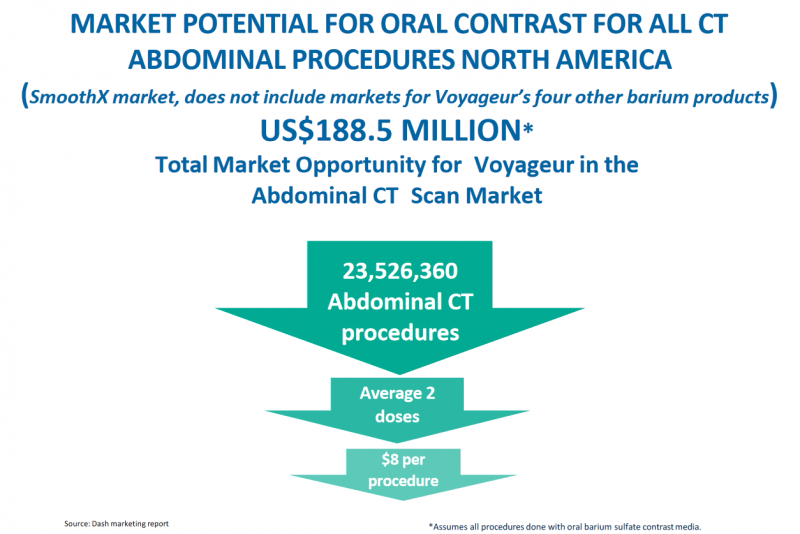

That is an enormous amount of blue sky for an emerging pharmaceuticals microcap that sits with (after the large pullback in biotech stocks) a market cap of only CAD$11 million. Indeed, the Company estimates the North American market potential for just one of its barium-based radiology drugs (“SmoothX”) at US$188.5 million.

Global shipping logjams continue to increase, and shipping costs continue to soar. This means that Voyageur’s geographic advantage as the only (future) North American supplier of radiology drugs starts looking almost as huge as its raw material advantage with its natural BaSO4.

Vertical integration. A major input cost advantage. A strategically advantageous geographic location.

Why are these competitive advantages even more important in the New Economy?

As already noted, in the New Economy governments are broke, staring at vast budget shortfalls. Nowhere do these budget-gaps look worse than in healthcare.

Governments are desperate for healthcare savings, wherever they can find them. Radiology drugs are an integral part of the healthcare system as well as a large-and-growing healthcare expense.

Enter Voyageur Pharmaceuticals.

Positioned for the New Economy

As investors add up the “pluses” for Voyageur, we haven’t even gotten to the largest revenue-generator that the Company is building toward: iodine-based radiology drugs.

This will be further down the road for Voyageur. But as Brent Willis revealed to The Market Herald, the market for iodine-based radiology drugs is ~10 ten times as large as for barium-based contrast agents.

In The Market Herald’s upcoming feature article on Voyageur Pharmaceuticals, we’ll go deeper into its path to production for its barium-based radiology drugs. And we will present the Company’s strategy for its iodine-based radiology drugs.

Hint: “vertical integration” will again be a central theme as Voyageur is working on multiple U.S.-based potential sources of raw iodine. We will also look at a pharmaceuticals market with perhaps even more intense supply pressures than with barium-based radiology drugs.

In the New Economy, cost pressures from soaring inflation and supply shortfalls from collapsing supply chains are now an everyday part of life. It’s a daunting competitive landscape.

For Voyageur Pharmaceuticals, these economic challenges are opportunities to build on its competitive advantages versus the Company’s much larger peers.

For investors, now is the time to target forward-looking, vertically integrated companies that are positioned to thrive in the New Economy.

Voyageur Pharmaceuticals June 2022 corporate presentation

FULL DISCLOSURE: This is a paid article by The Market Herald.